Buffett’s Berkshire Hathaway: A Cautious Outlook for Future Investors

Warren Buffett is considered one of the greatest investors ever. His company, Berkshire Hathaway (NYSE: BRK.B) (NYSE: BRK.A), has made numerous millionaires over the years, including Buffett and his late partner, Charlie Munger, who became billionaires. But can Berkshire’s stock continue to create wealth for investors in the future? Although I believe the company will perform well over time, I would recommend waiting before purchasing stock in Berkshire Hathaway. Here’s why I would refrain from buying right now.

Understanding Current Valuations

Warren Buffett is known for being a value investor, seeking to acquire quality companies when their market value is lower than their true worth. While this strategy has been effective for him, it seems harder to find appealing investments lately, including in his own company.

In the last few months, Buffett has significantly sold off stocks without making many new investments. In the last quarter, Berkshire Hathaway sold $36.1 billion of stocks while only purchasing $1.5 billion. He has also reduced his stakes in major holdings like Apple and Bank of America, while only adding small positions in Domino’s Pizza and Pool Corp.

With an operating profit of $10.1 billion, Berkshire Hathaway now holds $325.2 billion in cash and short-term investments, a notable increase from $167.6 billion at the end of last year. Despite this cash reserve, Buffett did not buy back any of Berkshire’s stock during the quarter. This marks the first time since 2018 that the company has not engaged in share buybacks.

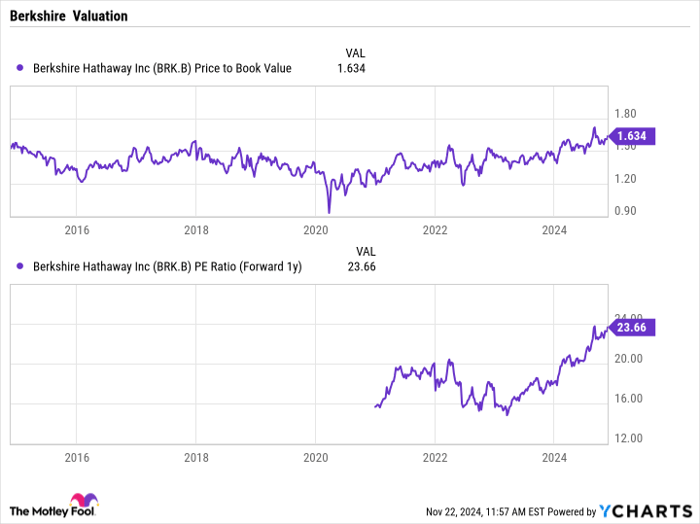

Buffett had previously stated that he preferred to buy back shares only when the stock traded below a specific book value. However, he later reconsidered this view, suggesting P/B and P/E ratios aren’t the best ways to assess a company’s true value. Current valuation metrics indicate that the stock is trading at historical highs.

BRK.B Price to Book Value data by YCharts.

Berkshire Hathaway is currently valued at about 1.6 times its book value and boasts a forward P/E ratio of 23 for the next year according to analysts. Both of these figures suggest the stock may be overvalued, which Buffett seems to agree with by refraining from stock buybacks, as well as not finding attractive alternative investments.

Image source: Getty Images.

Berkshire’s Leadership Transition

Buffett revolutionized the insurance industry by favoring equity investments with his company’s float, which is the money that’s available for investment until claims are paid. This strategy has yielded outstanding long-term returns for Berkshire and its shareholders.

While the structure Buffett established will last beyond his tenure, his unique presence is irreplaceable. Although there is a capable team managing the day-to-day operations, Buffett’s reputation and experience attract companies to consider selling themselves to Berkshire.

At 94 years old, Buffett is nearing the end of his time with Berkshire Hathaway. Although he has speculated that Berkshire’s stock might rise after his departure due to potential restructuring, investor sentiment may lead many to cash out once he’s no longer at the helm. This echoes how Apple thrived after the passing of its iconic CEO, Steve Jobs, suggesting that strong leadership can leave a lasting impact, yet stocks can still perform well over time.

Considering the current high valuations, Buffett’s cash reserves, and his age, I would exercise caution before investing in Berkshire Hathaway stock at this time.

Is Now the Right Time to Invest $1,000 in Berkshire Hathaway?

Before purchasing stock in Berkshire Hathaway, think about this:

The Motley Fool Stock Advisor team has recently identified their top 10 best stocks for investors right now, and Berkshire Hathaway did not make the list. The selected stocks have the potential for outstanding returns in the coming years.

For example, if you invested $1,000 in Nvidia when it was recommended on April 15, 2005, your investment would now be worth $869,885!

Stock Advisor offers a straightforward plan for investors, including portfolio-building guidance, regular analyst updates, and two new stock picks each month. Since 2002, this service has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

Bank of America is an advertising partner of Motley Fool Money. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Domino’s Pizza. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.