Why Nvidia Remains a Bright Spot for Long-Term Investors

Investing in strong companies for the long haul is a proven method for generating wealth. This strategy allows investors to harness the power of compounding while tapping into ongoing growth trends.

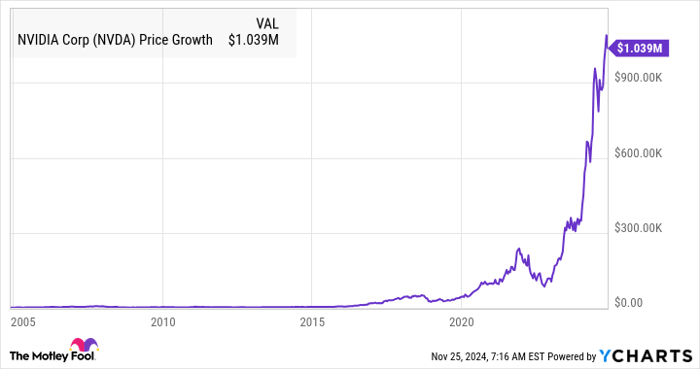

Nvidia (NASDAQ: NVDA) has exemplified this approach, turning astute investors into millionaires. For instance, a mere $1,200 investment in Nvidia two decades ago has skyrocketed to over $1 million in value.

NVDA data by YCharts

Nvidia’s remarkable appreciation over the last 20 years can be attributed to several growth factors, including the rise of PC and smartphone gaming, increased chip utilization in vehicles, the emergence of cloud gaming, and significant demand for high-performance computing in data centers.

Recently, artificial intelligence (AI) has emerged as another crucial growth factor for this semiconductor giant. The exciting news is that the adoption of AI is still in its early stages, suggesting multiple avenues for Nvidia to capitalize on this technology.

Moreover, Nvidia possesses further growth indicators that could drive long-term success. Although its current market cap stands at $3.35 trillion, indicating that it may not replicate its previous exponential growth, the underlying fundamentals show Nvidia still has ample potential to be part of a robust investment portfolio.

Let’s explore the reasons behind Nvidia’s enduring appeal.

The $1 Trillion Data Center Opportunity Fueling Nvidia’s Future

Nvidia recently reported its fiscal 2025 third-quarter results (for the three months ending October 27), revealing record revenue of $35.1 billion. This impressive figure marks a 94% increase from the previous year, largely propelled by a 112% surge in data center revenue, which reached $30.8 billion. Consequently, data center operations now account for nearly 87% of Nvidia’s total revenue.

Nvidia’s GPUs are in high demand for training and deploying AI models; the company commanded a 98% share of this market in 2023. Such dominance is crucial, especially as the AI chip market is projected to expand from $123 billion this year to $311 billion by 2029.

However, CEO Jensen Huang revealed during the recent earnings call that the data center market holds an even larger opportunity beyond AI. He noted the need for “$1 trillion worth of computing systems and data centers globally” that are being upgraded to support machine learning tasks.

This upgrade trend favors GPUs over traditional CPUs, initiating a significant growth opportunity for Nvidia. Analysts anticipate that while sales of general-purpose servers may grow at just 3% annually, accelerated servers will see a robust annual growth rate of 31% from 2023 to 2028.

Another factor driving the adoption of GPU-powered servers is energy efficiency. Nvidia emphasizes that its GPUs can accomplish more in less time than CPUs, which translates to reduced energy consumption. Given that data centers account for approximately 1% to 2% of global electricity use—and this figure is expected to double by the decade’s end—GPU deployment will likely rise significantly, fostering Nvidia’s long-term growth.

Expanding into Enterprise Software: A Complement to Data Center Success

While Nvidia’s data center operations are crucial to its revenue stream, its foray into the enterprise software market is equally promising. Companies are increasingly integrating Nvidia’s AI solutions into their workflows.

Corporations such as Accenture, Deloitte, Salesforce, and SAP are examples of businesses adopting Nvidia’s tools to enhance their operations through generative AI. Consequently, Nvidia expects its enterprise AI revenue to more than double in the current fiscal year, with further growth anticipated due to a solid revenue pipeline.

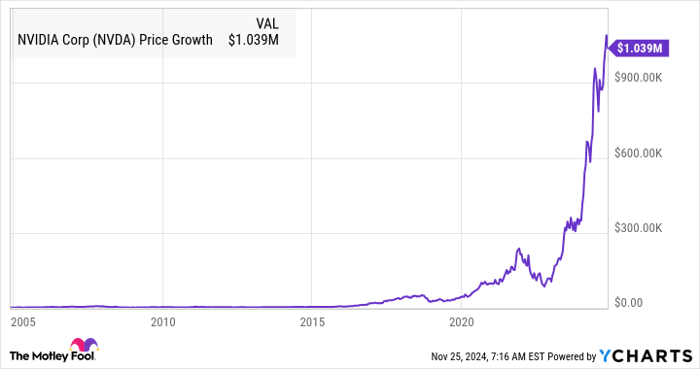

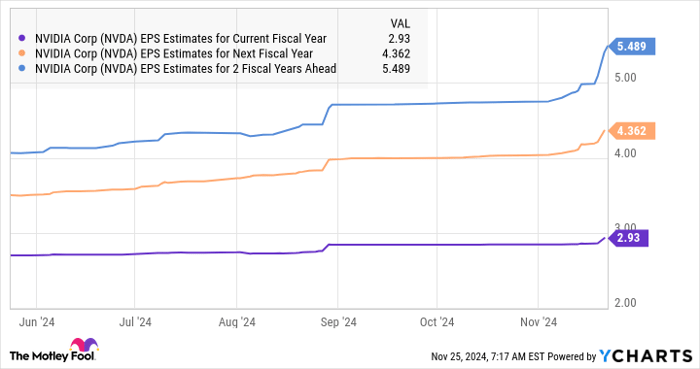

The overall enterprise AI market is forecast to grow at an annual rate nearing 38% through 2030, generating around $155 billion in revenue. This backdrop strongly supports the likelihood of Nvidia gaining a larger market share. Indeed, analysts are optimistic, having recently raised their revenue forecasts for Nvidia in the current and upcoming fiscal years.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

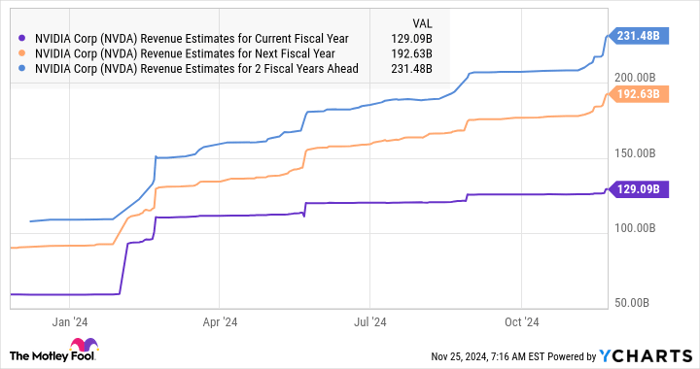

This strong growth is expected to positively impact Nvidia’s bottom line as well.

NVDA EPS Estimates for Current Fiscal Year data by YCharts

Nvidia seems well-positioned to sustain this substantial growth beyond the next three years. With both a $1 trillion opportunity in accelerated computing and the lucrative enterprise AI sector, Nvidia appears set for a prosperous future, potentially enhancing its stock value.

This makes Nvidia an attractive option for investors who aim to build a million-dollar portfolio, especially since the stock is currently trading at 33 times forward earnings—only slightly higher than the tech-heavy Nasdaq-100 index at 31 times estimated earnings.

A Wise Move? Should You Invest $1,000 in Nvidia?

Before making an investment in Nvidia, keep this in mind:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to consider… and Nvidia was not included. The chosen stocks have potential for significant returns moving forward.

Take note of Nvidia’s listing on April 15, 2005. If you invested $1,000 at that recommendation, you would have turned it into approximately $839,060!*

Stock Advisor offers a clear path for investors, providing strategies for portfolio building, regular insights from analysts, and two new stock suggestions each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

Check out the 10 stocks »

*Stock Advisor returns as of November 25, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has positions in Accenture Plc, Nvidia, and Salesforce, along with recommendations for options concerning these companies. They follow a strict disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.