Nexa Resources S.A. (NEXA) has finalized the sale of the Pukaqaqa Project in the Huancavelica region of Peru. This decision supports NEXA’s strategy to optimize its asset portfolio, aiming to enhance free cash flow and investment returns.

In recent years, NEXA has been assessing its assets following a disciplined approach to capital allocation. In 2022, after evaluating its portfolio, the company opted not to proceed with Pukaqaqa. On September 4, 2024, NEXA announced a deal with Olympic Precious Metals to sell the project for $29.3 million, which will be paid in multiple installments.

Details of the Payment Structure for Pukaqaqa

The Pukaqaqa project is a greenfield site currently in the pre-feasibility study stage and is planned as an open-pit mine for copper and molybdenum, along with potential gold credits.

Nexa Resources is set to receive an initial cash payment of $0.3 million, followed by $1 million within one year and an additional $3 million after four years. Furthermore, contingent payments totaling $25 million are expected in three installments, contingent upon the project’s development milestones.

Nexa’s Growth Strategy and Operational Focus

As a major, low-cost zinc producer, Nexa Resources boasts over 60 years of expertise in mining and smelting across Latin America. The company operates five long-standing mines—three in Peru’s central Andes and two in Brazil—and manages three smelting facilities.

Nexa is committed to investing in existing operations and developing new greenfield projects. The aim is to prolong the life of its current mines and boost production capacity.

Greenfield projects refer to new mining developments in previously unexplored areas. The journey from initial exploration to full-scale mining can span decades and requires significant capital investment. Key phases include pre-feasibility, feasibility studies, construction, commissioning, and reaching full capacity.

In 2022, alongside Pukaqaqa, Nexa decided not to proceed with the Shalipavco greenfield projects. The company holds interests in three other greenfield projects in Peru (Magistral, Hilarión, and Florida Canyon Zinc), one in Namibia, and several prospects in Brazil and Namibia. Currently, Magistral is under review, while Hilarión and Florida Canyon Zinc are in exploration stages. Nexa’s only recently developed greenfield project, Aripuanã, is in the ramp-up stage.

In line with its strategy, Nexa sold the Morro Agudo Complex in Brazil’s Minas Gerais in July 2024 for R$80 million (approximately $16 million). In September, the company announced the sale of the Chapi mine to Quilla Resources Peru S.A.C. This mine has been inactive since 2013 and is under maintenance, with the total payment structure comprising $1 million upfront and $4 million upon starting commercial production.

Nexa Resources remains focused on enhancing the performance of Aripuanã and advancing the Cerro Pasco Integration Project, while also aiming to extend the operational lives of its mines.

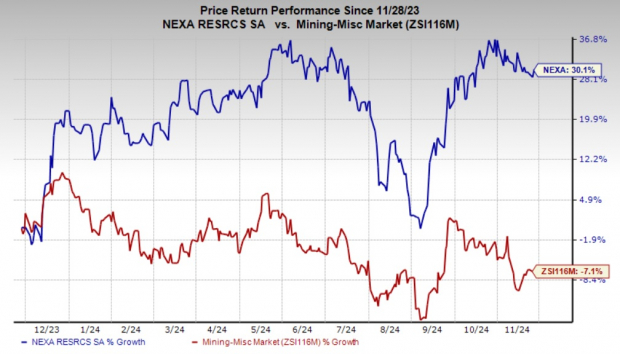

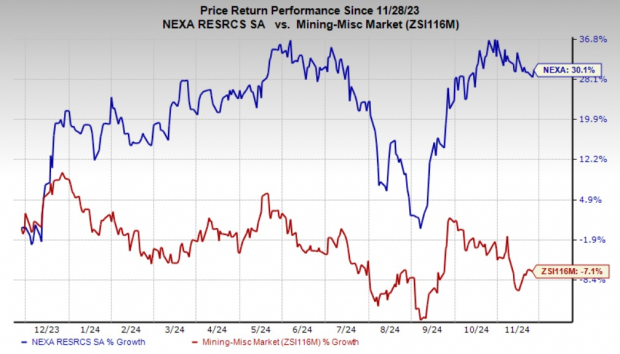

Stock Performance Overview for Nexa Resources

Nexa Resources has seen its shares rise by 30% over the past year, contrasting with a 7.1% decline in the broader mining industry.

Image Source: Zacks Investment Research

NEXA’s Zacks Rank and Comparable Stocks

Currently, Nexa Resources holds a Zacks Rank of #5 (Strong Sell).

In comparison, stocks from the basic materials sector that are performing better include Carpenter Technology Corporation (CRS), Agnico Eagle Mines (AEM), and Fortuna Mining Corp. (FSM). At present, CRS is ranked #1 (Strong Buy), while both AEM and FSM are ranked #2 (Buy). You can view the complete list here.

The Zacks Consensus Estimate for Carpenter Technology’s fiscal 2025 earnings stands at $6.61 per share, reflecting a projected 39.5% year-over-year increase. Analyst consensus estimates have shifted up by 8.5% in the last 60 days, supported by an average trailing four-quarter earnings surprise of 14.1%. Over the last year, CRS shares have soared by 178%.

For Agnico Eagle Mines, the consensus estimate for 2024 earnings is $4.08 per share, suggesting an 83% uptick from the previous year. This estimate has also risen by 8.5% in 60 days, with an average surprise of 19.2%. AEM shares increased by 58% in the past year.

Fortuna Mining’s 2024 earnings forecast sits at 48 cents per share, indicating a remarkable 118% growth year-over-year. Its earnings estimate has moved up 2% in recent months, with an average surprise of 17.9%. FSM has gained 23% within a year.

Top Stock Picks for the Coming Month

Recently disclosed: Experts have selected 7 noteworthy stocks from the current Zacks Rank #1 Strong Buys, deemed “Most Likely for Early Price Pops.”

Over the past 35 years, this exclusive list has outperformed the market, recording an average annual gain of +24.1%. Thus, these 7 stocks could be worth a closer look.

Free Stock Analysis Report for Carpenter Technology Corporation (CRS)

Free Stock Analysis Report for Agnico Eagle Mines Limited (AEM)

Free Stock Analysis Report for Fortuna Mining Corp. (FSM)

Free Stock Analysis Report for Nexa Resources S.A. (NEXA)

Click here to read the original article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.