Zoom Video Surpasses Q3 Expectations with Strong Earnings and Positive Guidance

As the Thanksgiving holiday approaches, Zoom Video ZM stands out in a quieter trading week for tech stocks.

Although this week doesn’t feature many major earnings reports, Zoom’s recent Q3 results, released on Monday, have caught attention with figures that exceeded expectations. The company has maintained a notable record of beating earnings forecasts, and its revenue guidance for the upcoming quarter appears promising.

Strong Q3 Earnings Report

In Q3, Zoom reported an earnings per share (EPS) of $1.38, surpassing the Zacks estimate of $1.31 and showing a 7% increase from last year’s $1.29. CEO Eric Yuan credited the company’s AI features for the success, as sales rose to $1.17 billion—up 3% year-over-year and slightly higher than the anticipated $1.16 billion.

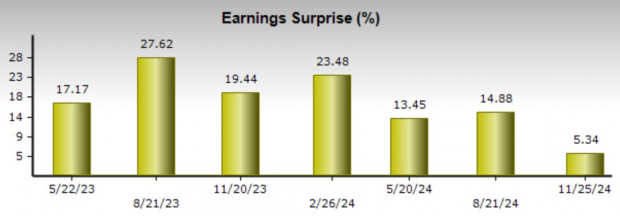

Remarkably, Zoom has exceeded the Zacks EPS consensus in every quarter since its 2019 IPO, boasting an average EPS surprise of 14.29% in its last four reports.

Image Source: Zacks Investment Research

Promising Future Guidance

Looking ahead, Zoom provided favorable guidance for Q4, noting record-breaking performance in its Contact Center with a deal of over 20,000 seats in the EMEA region. Additionally, the Workvivo platform achieved its largest agreement with a Fortune 10 company. The revenue guidance for fiscal year 2025 is projected at $4.65-$4.66 billion, exceeding the Zacks consensus of $4.64 billion, representing a 2% growth.

Image Source: Zacks Investment Research

Stock Performance and Valuation Insights

Year-to-date, Zoom’s stock has appreciated by 19%, although this rate lags behind broader market indices, which have risen by 33%. Nevertheless, it’s worth noting that the Zacks Internet-Services Industry is performing well, ranking in the top 14% among 250 sectors, with companies like Twilio TWLO and Fortinet FTNT shining brightly.

Image Source: Zacks Investment Research

In terms of valuation, Zoom is trading at a sensible forward earnings multiple of 15.6X, significantly lower than the S&P 500’s 25.4X. Moreover, it trades at a discount compared to the industry average of 32.6X, while Twilio and Fortinet stand at 28.6X and 44.2X, respectively.

Image Source: Zacks Investment Research

Conclusion

Following a successful Q3 performance and positive outlook, Zoom Video holds a Zacks Rank #2 (Buy). With likely earnings estimates on the rise in the coming weeks due to its attractive valuation and strong performance history, there could be more growth ahead for investors.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 elite stocks from a list of 220 Zacks Rank #1 Strong Buys. They are predicted to be “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market by more than 2X, boasting an average gain of +24.1% per year. Make sure to pay close attention to these 7 hand-picked stocks.

Zoom Video Communications, Inc. (ZM): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

Twilio Inc. (TWLO): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.