Palo Alto Networks Shows Strong Growth; Is It Time to Invest?

Palo Alto Networks (NASDAQ: PANW) has seen its stock rise impressively by 30% this year. This rebound is notable, especially after a disappointing start that included a sharp decline in February following the release of its quarterly results.

At that time, the cybersecurity company faced heavy selling pressure when it lowered its full-year guidance. Nonetheless, recent months have shown a recovery, bolstered by the latest quarterly results that suggest the potential for further gains for investors.

Palo Alto released its fiscal 2025 first-quarter results (for the three months ended Oct. 31) on Nov. 20. The results exceeded analysts’ expectations, prompting the company to raise its guidance for the entire year. Furthermore, management announced a 2-for-1 forward stock split, set to take effect on Dec. 12.

Let’s delve into Palo Alto’s quarterly performance and consider whether it’s a good time for investors to purchase the stock.

Positive Trends in Palo Alto’s Financial Metrics

Palo Alto’s fiscal Q1 revenue increased by 14% year-over-year, reaching $2.14 billion, while non-GAAP net income rose by 13%, amounting to $1.56 per share. Analysts had anticipated earnings of $1.48 per share and revenue of $2.12 billion.

The company’s market-beating performance continues with an updated earnings forecast. Palo Alto now projects annual earnings between $6.26 and $6.39 per share, an increase from the previous estimate of $6.18 to $6.31 per share. Additionally, the company expects revenue to rise by 14% for fiscal 2025, surpassing the earlier prediction of 13.5%. The full-year revenue range is now set between $9.12 billion and $9.17 billion, slightly above analysts’ estimates of $9.13 billion.

The encouraging earnings report and elevated guidance result from robust demand for its cybersecurity platform. According to management, customers have been signing larger contracts.

For instance, accounts spending over $1 million on Palo Alto’s services increased by 13% year-over-year, reaching 305. Notably, accounts spending more than $5 million saw an even larger increase of 30%. Palo Alto attributes this growth in contract size to the rising adoption of integrated cybersecurity platforms.

Palo Alto’s CEO, Nikesh Arora, explained in the earnings call that the company’s approach leverages AI technology to process relevant security data efficiently and automate workflows. Additionally, Palo Alto has been enhancing its product offerings to address AI-generated security needs, noting it currently supports over 750 AI-specific applications, a number that is expected to rise.

Impressively, Palo Alto’s AI-focused products generated $250 million in annual recurring revenue in the first quarter of fiscal 2025, equating to an annual run rate of $1 billion. The adoption of AI in the cybersecurity sector is anticipated to grow at approximately 21% annually from 2024 to 2032, potentially reaching $121 billion in revenue by the end of that period.

Palo Alto appears well-positioned to capture this burgeoning market, as evidenced by its remaining performance obligations (RPO), which reflect the total value of future contracts. RPO increased by 20% in fiscal Q1 to $12.6 billion.

This more rapid growth in RPO than in actual revenue suggests a promising trajectory for the company. Looking ahead, Palo Alto projects its RPO could rise by 19% to 20% by the end of fiscal 2025, reaching between $15.2 billion and $15.3 billion, outpacing its top-line growth expectations.

Evaluating Palo Alto’s Stock After Recent Gains

Since hitting a 52-week low on Feb. 21, Palo Alto Networks stock has surged by 46%. It currently trades at 50 times trailing earnings, which is steep compared to the Nasdaq-100 index’s trailing P/E ratio of 33. On the other hand, analysts anticipate improvement in Palo Alto’s bottom-line growth.

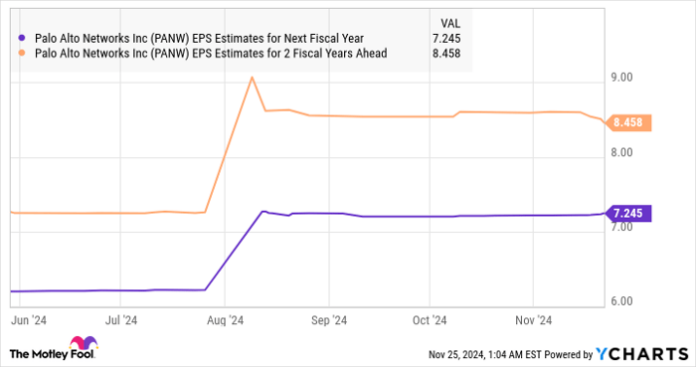

Expectations are set for a 12% increase, with earnings projected at $6.35 per share this year. The accompanying chart indicates the potential for even faster growth in the upcoming years.

PANW EPS Estimates for Next Fiscal Year data by YCharts.

Investors should note that stronger earnings growth could be on the horizon, driven by a robust revenue pipeline and increasingly larger deals that may enhance margins and reduce acquisition costs. Growth investors may still find the potential improvement in Palo Alto’s growth rate justifies its current stock valuation.

Should You Invest $1,000 in Palo Alto Networks Now?

Before purchasing stock in Palo Alto Networks, consider the following:

The Motley Fool Stock Advisor analyst team has highlighted what they believe to be the 10 best stocks for investors to buy right now, and Palo Alto Networks is not included in that list. The stocks selected are anticipated to yield significant returns in the future.

For perspective, consider when Nvidia made this list on April 15, 2005… an investment of $1,000 at that time would now be worth $839,060!*

Stock Advisor provides a straightforward investment strategy, with ongoing analyst updates and two new stock recommendations each month. Since its launch in 2002, the Stock Advisor service has significantly outperformed the S&P 500, achieving over four times its returns.

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool recommends Palo Alto Networks. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.