“`html

U.S. Stocks Surge: Small Caps Shine in 2023 Rally

U.S. stock markets have been witnessing an impressive rally since the beginning of 2023 barring some minor hurdles. Wall Street’s bull run has got an added boost this year, to the surprise of a large section of financial pundits, who indiscriminately warned of overvaluation.

Year to date, the three major stock indexes—the Dow, the S&P 500, and the Nasdaq Composite—have advanced 18.6%, 26.5%, and 29.1%, respectively. Most surprising is that the small-cap-centric Russell 2000 index has appreciated 20.5% this year, recovering from a severe downturn in the previous two years.

Here, we recommend five small-cap stocks with a favorable Zacks Rank and solid upside potential for the short term: Talkspace Inc. (TALK), Rayonier Advanced Materials Inc. (RYAM), Castle Biosciences Inc. (CSTL), Private Bancorp of America Inc. (PBAM), and Research Solutions Inc. (RSSS).

Impact of Tariffs on Small Businesses

Since the onset of the COVID-19 pandemic in March 2020, small businesses have struggled significantly. Concerns for this sector included diminished demand caused by social distancing, which slowed U.S. consumer spending, and disruptions in global supply chains.

The implementation of tariffs by Donald Trump aimed to bolster U.S. industries by encouraging companies to repatriate jobs. Small businesses, which lack geographical diversification and depend on local consumers, stand to benefit. Higher costs on cheaper imported goods, especially from China, will create a more even playing field for domestic small businesses.

Rate Cuts: A Relief for Small Businesses

Post-pandemic, small businesses faced the challenge of climbing inflation and high-interest rates. Operating on thin profit margins, these companies often struggle to absorb increasing input costs, impacting their financial health. A gradual decrease in benchmark interest rates will provide much-needed support for their survival.

Russell 2000 Sets a Milestone

On November 26, the Russell 2000 index reached an all-time high of 2,439.02 before closing at 2,424.31, marking its first new high since November 8, 2021. The following day, it hit a new peak of 2,449.86, closing at 2,426.19. These developments could significantly benefit small businesses in the short term.

Five Small-Cap Stocks to Consider

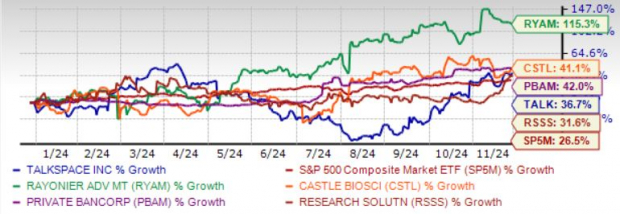

These five stocks exhibit strong growth potential for 2025 and have seen positive earnings estimate revisions recently. Each of our selections carries a Zacks Rank of #1 (Strong Buy). The chart below illustrates the price performance of these five picks year-to-date.

Image Source: Zacks Investment Research

1. Talkspace Inc.

Talkspace operates as a virtual behavioral healthcare company in the United States. TALK provides psychotherapy and psychiatry services through its platform to individuals, enterprises, health plans, and employee assistance programs. The company offers text, audio, and video-based therapy from licensed therapists.

TALK also provides the Talkspace Employee Assistance Program (EAP) and Talkspace Behavioral Health plan (BH), allowing members to access online therapy through their employers. Its services are available via platforms like the Apple App Store and Google Play App Store.

Promising Short-Term Growth for TALK

Talkspace anticipates a revenue growth rate of 23.4% and earnings growth exceeding 100% for 2025. The Zacks Consensus Estimate for 2025 earnings has improved by 29% in the past week.

The average short-term price target from brokerage firms suggests a 30.8% increase from its last closing price of $3.47, indicating a maximum upside of 44.1% and a downside of 13.5%.

2. Rayonier Advanced Materials Inc.

Rayonier Advanced Materials is a global supplier of cellulose specialties products, which are natural polymers for the chemical industry. RYAM provides products used in various industrial and consumer applications, including textiles, cosmetics, and pharmaceuticals, from production facilities primarily in Jesup, GA, and Fernandina Beach, FL.

Strong Short-Term Outlook for RYAM Stock

Rayonier Advanced Materials expects revenue and earnings growth rates of 6% and more than 100%, respectively, for 2025. The Zacks Consensus Estimate for 2025 earnings has improved by 26.1% over the last month.

The average short-term price target has risen by 41.7% from its last closing price of $8.72, indicating a potential peak value of $13-12 with no downside risk.

3. Castle Biosciences Inc.

Castle Biosciences is a commercial-stage dermatological cancer company that offers clinically actionable genomic information to healthcare providers. CSTL specializes in testing solutions for diagnosing and treating dermatologic cancers, Barrett’s esophagus, uveal melanoma, and mental health conditions.

Significant Short-Term Upside for CSTL

Castle Biosciences has projected revenue and earnings growth rates of 48.9% and 96.3%, respectively, for the remainder of 2024. The Zacks Consensus Estimate for 2024 earnings has more than doubled in the last month.

“““html

Promising Upside for Stocks of Private Bancorp and Research Solutions

Recent analysis reveals promising increases in stock prices for several companies in the financial and research sectors. Analysts show notable optimism for Private Bancorp of America Inc. and Research Solutions Inc.

Positive Price Projections for Private Bancorp of America Inc.

Private Bancorp of America offers a range of banking services to individuals and businesses in California. Their offerings include checking and savings accounts, money market accounts, certificates of deposit, individual retirement accounts, as well as personal and unsecured lines of credit. They also provide convenient services like online banking and direct deposits.

Short-Term Stock Gains Expected for PBAM

Private Bancorp is projected to see a revenue growth rate of 11.1% and an earnings growth rate of 5.6% for the year 2025. Over the past month, the Zacks Consensus Estimate for 2025 earnings has risen by 1%.

Brokerage firms have set an average short-term price target for PBAM that indicates a potential upside of 28.8% from its last closing price of $49.70. Current targets range from $60 to $71, suggesting a maximum upside of 42.9% without any downside risks.

Research Solutions Inc.: A Rapidly Growing Company

Research Solutions specializes in providing research information services and software, mainly focusing on life sciences and other research-dependent sectors. Their offerings include document delivery, reprints, and management services related to published materials.

Research Solutions forecasts a revenue growth rate of 10.1% and a staggering earnings growth rate of over 100% for the current fiscal year ending June 2025. The Zacks Consensus Estimate for 2025 earnings has surged by more than 100% in just 30 days.

The average price target set by analysts for RSSS indicates a significant increase of 47.6% from the last closing price of $3.42. Targets range from $6 to $4.35, which represents a maximum potential upside of 75.4% with no downside risk.

Infrastructure Boom: Investment Opportunities Await

As the federal government allocates trillions of dollars for infrastructure improvements, investments will span across roads, bridges, AI data centers, and renewable energy sources. This investment wave presents opportunities in the market.

Inside this report, you will find five surprising stocks that could benefit from the anticipated surge in spending on infrastructure. Download the free report titled “How to Profit from the Trillion-Dollar Infrastructure Boom” today.

For the latest insights from Zacks Investment Research, you can also download “5 Stocks Set to Double” for free.

Stock Analysis Reports are available for:

- Rayonier Advanced Materials Inc. (RYAM)

- Research Solutions Inc. (RSSS)

- Castle Biosciences, Inc. (CSTL)

- Private Bancorp of America, Inc. (PBAM)

- Talkspace, Inc. (TALK)

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`