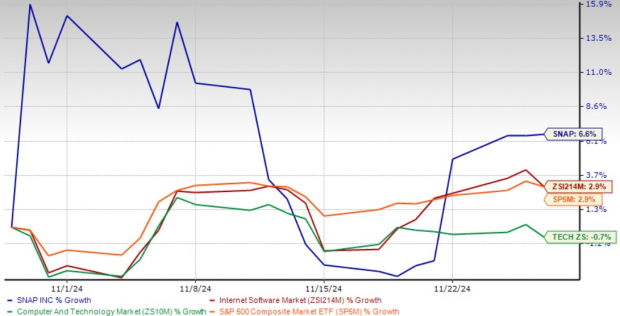

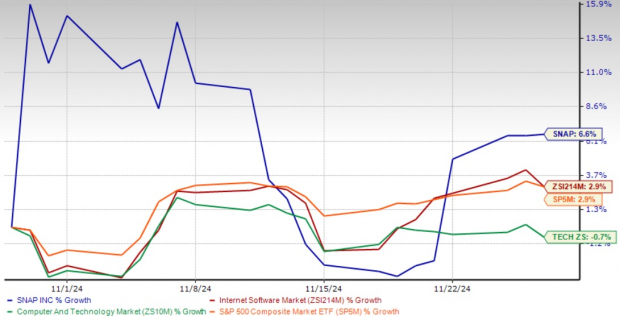

Snap Inc. (SNAP) shares rose significantly, gaining 6.6% following the company’s third-quarter 2024 earnings. Investors are reacting positively to Snap’s new strategies and improving financial results, suggesting solid prospects for both new and current shareholders.

Analyzing Recent Share Price Changes

Image Source: Zacks Investment Research

Strong Financial Results Highlight Growth

In its recent third-quarter report, Snap announced total revenues of $1.37 billion, representing a 15% increase compared to the same quarter last year. The direct-response advertising sector had a standout performance, rising 16% year-over-year. Additionally, the subscription service Snapchat+ helped double the “Other Revenue” category to $123 million. This growth highlights Snap’s effective monetization strategies.

User Engagement and Growth on the Rise

Snap continues to grow its user base, with daily active users (DAU) reaching 443 million, an increase of 37 million from the previous year. Notably, international markets have been a significant contributor, with the Rest of World region alone accounting for 244 million DAUs. Furthermore, users are spending 25% more time engaging with content on the platform compared to last year.

Enhanced Advertising Technology Boosts Potential

Snap’s advertising platform has seen substantial advancements, with the number of active advertisers more than doubling year-over-year during the third quarter. New features, such as First Lens Unlimited and State-specific First Story, along with future offerings like Sponsored Snaps and Promoted Places, enhance Snap’s growth potential in advertising revenue. The platform’s 7-0 Optimization system has shown promising results, with a 24% decrease in cost-per-install and a 27% reduction in cost-per-purchase.

Pioneering Augmented Reality and AI Innovation

As a leader in augmented reality (AR), Snap boasts over 375,000 AR developers who have created more than four million Lenses. The recent launch of the fifth generation of Spectacles and new generative AI features in Lens Studio reflect Snap’s dedication to innovation. The inclusion of AI-generated features, such as collages and video mashups, has further enhanced user engagement. Partnerships with tech giants, such as Microsoft (MSFT), for AI-powered Sponsored Links signal Snap’s commitment to integrating AI across its platform, potentially strengthening its position in the competitive advertising space.

Financial Stability and Strengthening Metrics

Snap’s financial health is robust, reporting an Adjusted EBITDA of $132 million for the third quarter, up from $40 million a year earlier. The company’s Free Cash Flow was $72 million, and it holds a solid balance of $3.2 billion in cash and marketable securities. Furthermore, the announcement of a $500 million share repurchase program illustrates management’s confidence in future growth.

Outlook and Challenges Ahead

Despite positive growth, Snap faces challenges, including reduced advertising spending and fierce competition from major players like Meta Platforms (META) and Alphabet (GOOGL). The company’s ability to capitalize on its AI features in advertising will be vital for ongoing financial success. The changing dynamics of the digital advertising landscape, alongside privacy changes in Apple’s iOS, have influenced ad revenues negatively. Competition with platforms like TikTok may also hinder user growth and engagement, especially among younger audiences.

Broader economic challenges, such as rising interest rates and inflation, have also affected growth-oriented companies like Snap. The company’s current valuation shows a forward 12-month price-to-sales ratio of 3.23, which is above the average for the Zacks Internet – Software industry, indicating that investors expect high growth but also carry increased risk.

Examining Snap’s Price-to-Sales Ratio

Image Source: Zacks Investment Research

Looking forward, Snap predicts fourth-quarter revenues to be between $1.510 billion and $1.560 billion, translating to a year-over-year growth of approximately 11-15%. Despite some immediate challenges, such as the rollout of Simple Snapchat and disruptions in highly monetized markets, the overall trajectory remains optimistic.

The Zacks Consensus Estimate sees a 16.28% increase in revenue, projecting 2024 revenue at $5.36 billion, with earnings expected to grow to 24 cents per share, marking a remarkable 166.67% increase from the previous year.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Final Thoughts

For existing shareholders, Snap’s strong fundamentals and execution indicate maintaining their positions may yield benefits. Their shift towards a more focused operational strategy, alongside leadership in AR and an expanding advertiser base, positions the company for long-term growth.

For those considering an investment, the current pricing presents an appealing entry point. Snap’s combination of user growth, diversified revenue, and improving profit metrics places it favorably in the competitive social media sector. Strategic efforts in AR, advertising enhancements, and user engagement signal continued growth prospects. While awareness of competition and market fluctuations is crucial, Snap’s solid financial standing and clear strategic aims create a positive outlook for future gains.

In light of these developments, investors might view the current positive momentum as an opportunity to establish or hold positions in SNAP stock as it appears well-equipped for enduring successes in the evolving digital media scene. Snap holds a Zacks Rank #2 (Buy). Access the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Discover 5 Stocks to Capitalize on Infrastructure Spending Growth

Trillions of dollars in Federal funding are set for improvements to America’s infrastructure. This investment goes beyond roads and bridges, targeting AI data centers, renewable energy, and more.

In this report, you will uncover five surprising stocks poised to benefit from this burgeoning spending wave.

Download “How to Profit from the Trillion-Dollar Infrastructure Boom” for free today.

Interested in the latest strategies from Zacks Investment Research? Download “5 Stocks Set to Double” for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.