Autodesk Thrives with Strong Q3 Earnings and Steady Revenue Growth

Autodesk (ADSK) reported third-quarter fiscal 2025 non-GAAP earnings of $2.17 per share, surpassing the Zacks Consensus Estimate by 2.84% and showing a 4.83% improvement from the prior year.

Check out the latest EPS estimates and surprises on Zacks Earnings Calendar.

The company’s total revenue reached $1.57 billion, beating expectations by 0.45% and increasing by 11% compared to the same period last year. This growth stemmed from strong performance across its product lines as well as robust renewal rates in both architecture, engineering, and construction (AEC) and manufacturing sectors.

During the third quarter, Autodesk introduced a new transaction model in Western Europe.

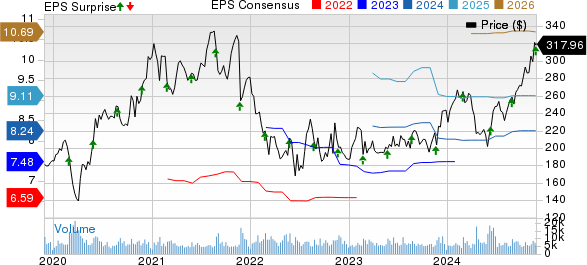

Analyzing Autodesk’s Stock Performance and Earnings Surprises

Autodesk, Inc. price-consensus-eps-surprise-chart | Autodesk, Inc. Quote

Financial Highlights for Autodesk (ADSK)

In this quarter, Autodesk’s subscription revenue—accounting for 92.8% of its total revenue—rose by 10.88% year over year to $1.45 billion. Meanwhile, maintenance revenues, comprising 0.57% of overall sales, dropped 25% to $9 million. Other revenues, which constituted 6.62% of total revenue, increased 18.18% to $104 million.

Furthermore, recurring revenues were a significant contributor, making up 97% of the company’s third-quarter revenue.

The net revenue retention rate remained steady within the target range of 100-110% when adjusted for currency fluctuations.

On a regional basis, revenue from the Americas (44.9% of total revenues) grew by 10.16% from last year to $705 million. Meanwhile, EMEA (36.94% of revenues) saw a 12.4% rise to $580 million, and the Asia-Pacific region (18.15% of revenues) experienced a 10.47% growth, reaching $285 million.

Billings also showed strength, totaling $1.54 billion, marking a substantial 28% year-over-year increase.

Revenue Breakdown by Product Category

Autodesk offers four main product families: Architecture, Engineering and Construction (AEC), AutoCAD and AutoCAD LT, Manufacturing (MFG), and Media and Entertainment (M&E).

This quarter, AEC (47.83% of total revenues) saw revenues increase 11.26% year over year to $751 million.

AutoCAD and AutoCAD LT (25.35% of total revenues) brought in $398 million, a growth of 6.9%. Revenues from MFG (19.55% of total revenues) rose 14.13% to $307 million. Lastly, M&E (5.29% of total revenues) posted a 13.7% increase, totaling $83 million.

Operating Performance Metrics

Autodesk’s non-GAAP operating income stood at $573 million, reflecting a 4.7% year-over-year increase. However, the non-GAAP operating margin decreased by 3 percentage points to 36%.

Balance Sheet and Cash Flow Summary

As of October 31, 2024, Autodesk held cash and cash equivalents (including marketable securities) of $1.71 billion compared to $1.87 billion as of July 31, 2024.

Deferred revenues saw a 9% decline to $3.66 billion, while unbilled deferred revenues increased by $1.24 billion year-over-year to $2.45 billion.

The company reported a 17% increase in remaining performance obligations (RPO), which totaled $6.11 billion. Current RPO also grew by 14%, reaching $4.01 billion.

Operating cash flow increased significantly to $209 million, a rise of $191 million year-over-year, while free cash flow climbed to $199 million, up $186 million compared to the same period last year.

Outlook for Fiscal 2025

For the full fiscal year 2025, Autodesk expects revenues in the range of $6.11 billion to $6.13 billion, indicating approximately 11% growth. Billings are anticipated between $5.9 billion and $5.98 billion, suggesting an annual increase of 14-15%.

Projected non-GAAP earnings per share are estimated to be between $8.29 and $8.35, with a non-GAAP operating margin forecasted between 35.5% and 36% year-over-year. Free cash flow is expected to be around $1.47 billion to $1.5 billion.

For the fourth quarter of fiscal 2025, Autodesk forecasts revenue between $1.623 billion and $1.638 billion, with non-GAAP earnings anticipated to be in the range of $2.1-$2.16 per share.

Market Position and Competitors

Currently, Autodesk holds a Zacks Rank #3 (Hold). Shares of ADSK have increased by 18.7% year-to-date. Other notable stocks from the broader Computer and Technology sector include Fortinet (FTNT), Meta Platforms (META), and Reddit Inc (RDDT). Fortinet currently boasts a Zacks Rank #1 (Strong Buy), while both Meta Platforms and Reddit Inc. hold a Zacks Rank #2 (Buy).

Fortinet shares have shown a remarkable year-to-date gain of 64.7%. The long-term earnings estimate for Fortinet stands at $18.3 per share.

Meta Platforms shares have increased by 62.1% this year, with a long-term earnings estimate of $20.1 per share. Reddit Inc. has delivered an impressive year-to-date return of 170.6%, with a long-term earnings estimate set at $36 per share.

Discover the Top Stocks for Short-Term Gains

Experts have selected 7 standout stocks from the current list of 220 Zacks Rank #1 Strong Buys, identifying them as “Most Likely for Early Price Pops.”

Since 1988, the complete list has more than doubled the market’s performance, averaging a gain of +24.1% per year. Don’t miss your chance to review these recommended stocks.

Curious about the latest stock recommendations from Zacks Investment Research? You can download “5 Stocks Set to Double” for free now.

Autodesk, Inc. (ADSK): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

Reddit Inc. (RDDT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.