Warren Buffett’s Growth Picks: An Insight into Berkshire Hathaway’s Portfolio

Warren Buffett is celebrated for his value investment strategy, a principle evident in Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) recent quarter trades. The company has recently acquired stakes in Domino’s Pizza and Pool Corp., both of which are solid value investments.

Buffett’s Classic Investment Approach

Both Domino’s Pizza and Pool Corp. are well-established brands leading their respective industries. They may target different customer bases, but both have strong economic performance and resilience against broader market pressures. While Buffett favors value investments, his portfolio is occasionally boosted by growth stocks.

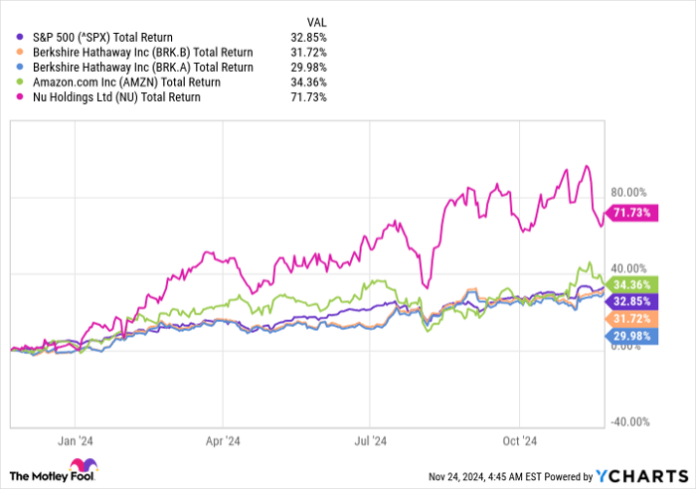

Currently, there are two stocks in Berkshire Hathaway’s portfolio that stand out as growth stocks, outperforming both Berkshire Hathaway and the S&P 500 over the past year. Let’s explore these two stocks and consider if they might be worth your investment.

1. Amazon: Dominating E-Commerce and Cloud Services

Berkshire Hathaway started investing in Amazon (NASDAQ: AMZN) in 2019, when the company was already well-known for creating wealth. Although the exact purchase date isn’t clear, Amazon has gained 126% in value over the past five years, aligning with Berkshire’s investment timeline.

At the time, few predicted that a global pandemic was on the horizon, one that would fundamentally change global commerce. What was clear was Amazon’s position as the leading e-commerce platform in the U.S. and its significant presence in the cloud computing sector.

Both of these fields continue to expand rapidly, and Amazon’s innovative culture suggests it will maintain its competitive edge. Today, the company is also capitalizing on advancements in artificial intelligence (AI).

Though Buffett isn’t a fan of AI, claiming he lacks the understanding to fully grasp its potential, he values Amazon’s stronghold in markets critical to the economy.

Currently, Amazon’s price-to-earnings (P/E) ratio stands at 42, near its historical low. This suggests it may be a solid investment. Enthusiasm around AI may attract more investors, but Buffett’s endorsement signifies stability beyond just AI prospects.

2. Nu Holdings: The Digital Banking Powerhouse

Another notable growth stock within Berkshire Hathaway’s portfolio is Nu Holdings (NYSE: NU). Nu is a financial technology leader in Latin America, offering banking and financial services through a mobile app. Based in Brazil, it also operates in Mexico and Colombia.

Since going public in 2021, Nu has experienced remarkable growth. Berkshire Hathaway became an early investor when it injected $500 million just prior to the IPO—an atypical move for the company known for outright acquisitions and sizable stakes in quintessential firms.

CEO David Velez highlighted that Nu’s financing stemmed from sustainable growth. Even before its IPO and before reporting profits, it was clear that this digital bank was on a solid path, serving 40 million customers, which has since surged to 109.7 million.

Today, Nu is consistently profitable, reporting positive earnings per share every quarter since Q3 2022. Despite not fitting the classic Buffett mold, this banking venture plays a vital role in the economic landscape it inhabits, boasting a robust lending operation funded by customer deposits.

Both Nu and Amazon have outpaced the S&P 500 and Berkshire Hathaway itself in performance over the past year.

^SPX data by YCharts

Although Nu demonstrates exceptional growth, both stocks diverge from traditional Buffett investments by thriving on innovation and substantial growth potential—far from the usual slower-growth stocks Buffett favors. For those searching for growth opportunities, Amazon and Nu are worthy considerations.

Seize Your Chance at Investment Opportunities

Have you ever felt like you missed out on investing in successful stocks? This might be your moment.

Your chance to invest could come from analyst recommendations known as “Double Down” stocks—companies predicted to experience significant growth. If you believe you’ve missed the best investment opportunities, now may be the time to act:

- Nvidia: A $1,000 investment back in 2009 would now be worth $350,915!*

- Apple: A $1,000 investment from 2008 would have grown to $44,492!*

- Netflix: A $1,000 investment from 2004 would be valued at $473,142!*

Currently, alerts for three more exceptional “Double Down” stocks are being issued, offering a rare chance to capitalize on potentially lucrative investments.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in Nu Holdings. The Motley Fool has positions in and recommends Amazon, Berkshire Hathaway, and Domino’s Pizza. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.