Everest Group Faces Tough Times Amid Mixed Q3 Results

Valued at a market cap of around $16.7 billion, Bermuda-based Everest Group, Ltd. (EG) is recognized as a leader in property, casualty, and specialty reinsurance and insurance. The company provides tailored solutions aimed at addressing critical challenges faced by customers and boasts a 50-year history of disciplined underwriting and strong capital and risk management.

Stock Struggles against Market Benchmarks

Despite its strong foundation, shares of Everest Group have slumped 6.2% over the past year, considerably trailing the S&P 500 Index’s ($SPX) robust 31.8% return during the same period. In 2024, the stock’s improvement has also fallen short, rising just 10% compared to the S&P’s impressive 25.8% gain year-to-date.

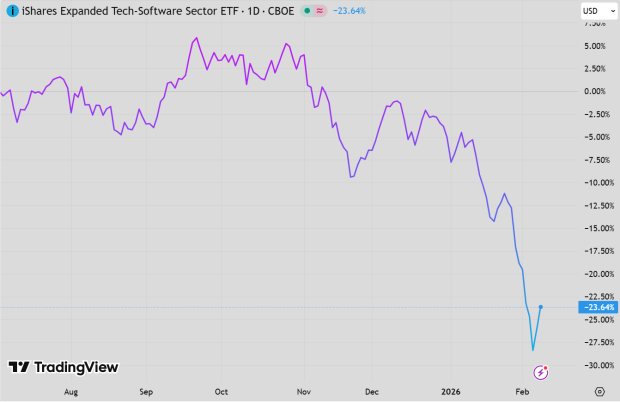

Lackluster Performance Compared to Financial Sector

Further illustrating its underperformance, the iShares U.S. Financials ETF (IYF) has enjoyed a remarkable increase of almost 50% over the past 52 weeks, along with a 39.3% rise year-to-date.

Q3 Earnings Report Highlights Challenges

Everest Group’s Q3 earnings report, released on October 30, provided a mixed outlook. Following the announcement, the stock price dropped sharply by 6.4% in the subsequent trading session. The company reported solid sales growth, with a 13% year-over-year increase to $4.3 billion, although this figure fell short of Wall Street’s expectation of $4.5 billion. Conversely, earnings per share (EPS) rose 3.3% to $14.62, exceeding estimates by 22.6%.

Costs Impact Bottom Line

Despite revenue growth, rising expenses negatively impacted profitability. Net income dropped 24% year-on-year to $509 million, reducing the profit margin from 17% last year to 12%. This financial strain has unsettled investors, overshadowing the company’s impressive revenue figures.

Analysts Project EPS Decline

For the current fiscal year ending in December, analysts predict that EG’s EPS will decline by 12.7% to $57.95. Historically, the company’s performance against these estimates has been mixed, exceeding expectations in three of the last four quarters but missing estimates once.

Wall Street’s Mixed Sentiment

A consensus view among the 14 analysts covering the stock leans toward a “Moderate Buy.” This rating comprises five “Strong Buy,” one “Moderate Buy,” seven “Hold,” and one “Strong Sell” recommendations. Notably, this outlook is less optimistic than a month ago when six analysts recommended a “Strong Buy.”

Price Target Adjustments by Analysts

On November 18, TD Cowen lowered Everest Group’s price target to $419 from $444, while maintaining a “Hold” rating. This new target hints at a potential upside of 7.7% from the current levels. Meanwhile, the average analyst price target stands at $425.92, suggesting a limited upside of 9.5%, though the highest target of $517 indicates a possible rally of up to 32.9%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.