In a recent comparison between energy drink leader Monster Beverage (NASDAQ: MNST) and health-centered competitor Celsius Holdings (NASDAQ: CELH), I found that Monster appeared strong yet overpriced, while Celsius showed promise mixed with risk. Since then, quarterly earnings have come in, prompting a reevaluation of these companies.

Quarterly Results: Monster vs. Celsius – Who Comes Out on Top?

Examining Third Quarter Performance

Let’s analyze the recent earnings reports from both energy drink companies for the third quarter of 2024.

- Celsius Holdings did not meet analysts’ expectations, reporting earnings at breakeven compared to $0.89 per share last year, while revenues slipped by 6.8%. Despite retail sales growth of 15% at Costco (NASDAQ: COST) and a 21% increase on Amazon (NASDAQ: AMZN), reduced inventory from PepsiCo (NASDAQ: PEP) strained their performance.

- Monster Beverage also faced challenges, with revenues up only 1% year-over-year and earnings per share falling from $0.43 to $0.40. These numbers were slightly below Wall Street forecasts. Monster cited “excess inventory levels” of its alcohol-infused drinks, likely indicating a slowdown in sales. Furthermore, ongoing economic issues in Argentina impacted their revenue.

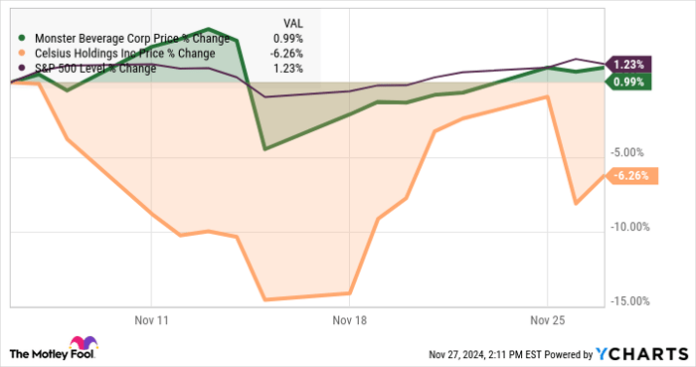

Following the results, Monster’s stock experienced a slight dip, but it rebounded quickly. In contrast, Celsius saw its shares drop 9% after their announcement. Over the next three weeks, Monster’s stock increased slightly, while Celsius continued to decline.

MNST data by YCharts.

Notably, since my analysis in September, Celsius has dropped 17% while Monster and the S&P 500 both grew by about 5%.

Market Reactions and Expectations

Overall, Monster’s results stayed consistent with expectations, despite still appearing overvalued. Meanwhile, Celsius performed poorly compared to forecasts, and its share price suffered significantly.

Currently, Celsius maintains comparable price-to-earnings and price-to-free-cash-flow ratios to Monster. However, Celsius is expected to grow at a faster pace over the next few years. With the inventory issues from PepsiCo behind, Celsius should post more favorable year-over-year numbers starting in 2025.

Investment Perspectives: Monster or Celsius?

Despite the current climate, I find it challenging to recommend investing in Monster, as its shares seem overvalued. In contrast, Celsius now trades at a substantial discount from September valuations, with its health-oriented drinks maintaining solid demand. This scenario initially appears favorable for Celsius.

However, investing in Celsius remains a speculative endeavor, especially given its reliance on fluctuating consumer choices. Monster, conversely, has successfully navigated strong competition in the past. For instance, after a legal conflict led to the bankruptcy of Bang Energy’s parent company, Monster acquired that brand.

The decision isn’t straightforward. In retrospect, I’m pleased I didn’t fully endorse Celsius in September. If you are willing to take a risk, consider purchasing shares now while they are 17% lower and anticipating a recovery in sales.

If speculation doesn’t appeal to you, enjoying your favorite energy drink from the sidelines may be prudent during this uncertain period for energy drink stocks.

Seize a New Investing Opportunity

Have you ever felt like you missed out on top-performing stocks? There’s good news.

Occasionally, our expert team identifies a “Double Down” stock—companies they predict will experience significant growth. If you think you’ve missed these opportunities, now might be the best time to invest:

- Nvidia: If you had invested $1,000 during our recommendation in 2009, it would now be worth $350,915!*

- Apple: A $1,000 investment from 2008 would be valued at $44,492!*

- Netflix: Those who invested $1,000 back in 2004 would have approximately $473,142!*

We are currently issuing “Double Down” alerts for three fantastic companies, and this could be a rare chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Celsius, Costco Wholesale, and Monster Beverage. See the full disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.