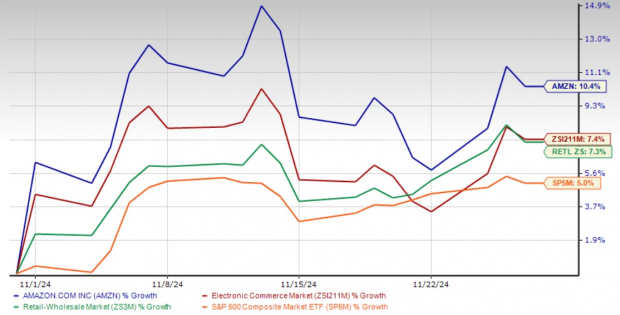

Amazon AMZN is making waves in the financial world, with its stock rising 10.4% since revealing its Q3 2024 earnings. This powerful performance across various business segments suggests investors may find it worthwhile to consider adding AMZN to their portfolios.

Stock Performance Overview

Image Source: Zacks Investment Research

Strong Financial Outcomes

Amazon achieved impressive results this quarter, reporting earnings per share of $1.43. This reflects a significant 52.1% increase year over year. Total revenues soared to $158.9 billion, which is an 11% rise from 2023, while operating income hit a record $17.4 billion, up 56% from last year. These results highlight Amazon’s successful execution and focus on profitability.

Leadership in AWS and AI

Amazon Web Services (AWS) remains a key driver of growth, reporting a 19.1% year-on-year revenue increase to $27.5 billion, leading to an impressive annualized run rate of $110 billion. The company is also advancing in artificial intelligence, with AWS growing at a triple-digit pace. Utilizing new foundation models through Amazon Bedrock and forming partnerships with companies like Anthropic, Meta Platforms META, and Mistral, Amazon is pushing the boundaries of AI innovation.

However, it’s important to note that Amazon’s strong market position faces stiff competition from cloud rivals such as Microsoft MSFT and Alphabet’s GOOGL Google, both enhancing their cloud services with generative AI capabilities.

E-commerce Resilience and Innovation

In e-commerce, Amazon’s North America segment reported a revenue increase of 9%, reaching $95.5 billion. The International segment grew even faster at 12%, totaling $35.9 billion. Amazon has improved its operational efficiency, which is demonstrated by over 40 million customers receiving same-day delivery in the last quarter. Key events, like the Prime Big Deal Days, along with new Prime benefits, showcase Amazon’s commitment to enhancing customer satisfaction.

Advertising Revenue Surge

Amazon’s advertising segment continues to thrive, generating $14.3 billion in revenue, marking an 18.8% year-over-year growth. The company has entered the broadcast season for Prime Video advertising and is implementing AI-driven creative tools, highlighting its innovative strategies in a high-margin business area.

Future Growth Strategy

Looking ahead, Amazon’s planned $75 billion capital expenditure for 2024 illustrates its confidence in future growth. The planned expansion of Amazon Pharmacy to reach nearly half of the U.S. by 2025 and significant investments in AI infrastructure indicate the company’s commitment to sustained growth.

Why Invest in Amazon?

Investors should consider Amazon as a strong investment opportunity, bolstered by operational efficiencies and consistent margin improvements across key sectors. With powerful positions in AI, cloud services, and diverse ventures in e-commerce and advertising, Amazon presents multiple avenues for growth. The company’s financial health is illustrated by a 57% increase in operating cash flow to $112.7 billion and an increase in free cash flow to $47.7 billion, supporting future expansion initiatives. This makes it attractive for growth-focused investors.

While Amazon’s forward 12-month Price-to-Sales (P/S) ratio stands at 3.09X—above the Zacks Internet – Commerce industry average of 1.8X—such a premium valuation is justified by strong market positioning and growth potential. Compared to its historical median of 2.8X, this valuation reflects investor confidence in Amazon’s diverse revenue streams and robust ecosystem.

P/S Ratio Indicates Higher Valuation

Image Source: Zacks Investment Research

Outlook for Q4

For the fourth quarter of 2024, Amazon forecasts net sales between $181.5 billion and $188.5 billion, indicating a growth rate of 7-11%. Operating income is projected to fall between $16 billion and $20 billion, reflecting continued profitability.

The Zacks Consensus Estimate for net sales stands at $187.07 billion, representing a 10.06% increase from the same period last year.

Fourth-quarter earnings estimates are pegged at $1.49 per share, which would mean a remarkable 47.52% increase year over year. This estimate has increased by 8.8% in just the past month.

Image Source: Zacks Investment Research

Final Recommendation

With its strong financial results, leadership in AI and cloud computing, operational advancements, and positive future outlook, Amazon’s recent stock surge seems reasonable. This may be just the start of a longer-term growth trend. Investors seeking stability and growth in technology, e-commerce, and AI sectors might find Amazon appealing, especially those with a long-term perspective. Currently, AMZN has a Zacks Rank #2 (Buy), indicating a favorable outlook.

Explore the Future of Energy

The demand for electricity is on the rise as we work to lessen our reliance on fossil fuels. Leaders from the US and 21 other nations recently pledged to triple the world’s nuclear energy capacity. This transition presents massive profit potential for nuclear-related stocks—especially for early investors.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, examines the key players and technologies driving this trend, including three standout stocks with high potential.

Download our report, Atomic Opportunity: Nuclear Energy’s Comeback, for free today.

For the latest recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.