TreeHouse Foods Faces Tough Times Amidst Declining Sales

TreeHouse Foods (THS) is a major player in the private-label packaged foods and beverages sector in North America. The company supplies products to retail grocery chains and foodservice distributors, focusing on affordable, high-quality alternatives to national brands.

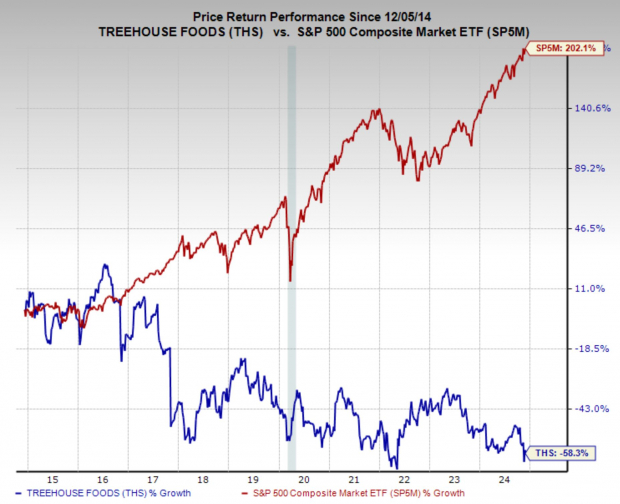

Over the last decade, however, TreeHouse Foods has seen its stock value plummet by more than 50%. Annual sales dropped from a peak of $6 billion in 2016 to just $3.3 billion today, significantly impacting investor confidence.

Current challenges are compounded by a disappointing Zacks Rank. Analysts have been lowering their earnings estimates, suggesting that investors should be cautious about TreeHouse stock until there’s a substantial improvement in its business and earnings outlook.

Image Source: Zacks Investment Research

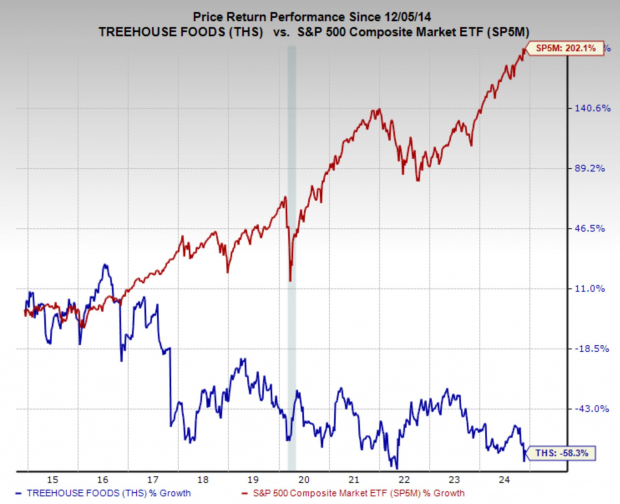

Declining Earnings Estimates for TreeHouse Foods

This year, analysts expect TreeHouse to face a 4.3% drop in sales. The company holds a Zacks Rank #5 (Strong Sell), reflecting significantly lowered earnings projections. Estimates for the current quarter are down by 27.6%, while expectations for FY24 have decreased by 12.2% and FY25 by 18.2%.

Image Source: Zacks Investment Research

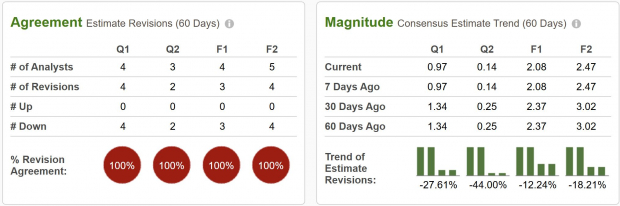

Valuing TreeHouse Foods Stock

Currently, TreeHouse is trading at a one-year forward earnings multiple of 16.7x. This valuation is below the market average and slightly under its five-year median of 17.8x. Although it’s not at a premium, it may still seem excessive given the company’s challenging growth prospects.

Image Source: Zacks Investment Research

Should You Consider Avoiding THS Shares?

TreeHouse Foods is enduring significant challenges, with no immediate relief in sight. The competitive landscape in the food industry is tough, characterized by razor-thin profit margins.

Given the lack of visible improvement in growth or business fundamentals, it may be wise for investors to steer clear of TreeHouse stock and explore better opportunities.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy remains a vital sector, contributing trillions of dollars to the economy and hosting some of the world’s most profitable companies.

With cutting-edge technologies emerging, clean energy sources are positioned to replace traditional fossil fuels. As investments flood into solar power and hydrogen initiatives, it’s possible that new leaders in this sector could provide exciting stock options for investors.

Download “Nuclear to Solar: 5 Stocks Powering the Future” for Zacks’ top clean energy picks, available for free today.

Want to receive more recommendations from Zacks Investment Research? You can download “5 Stocks Set to Double” for free.

TreeHouse Foods, Inc. (THS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.