Snowflake’s Stock Faces Challenges Despite Recent Gains

Snowflake (NYSE: SNOW) is struggling this year, with its stock down 11% in 2024. This performance falls short compared to major market indices. However, following outstanding figures for its third quarter of fiscal year 2025 (ending October 31), the stock surged more than 30% in one trading day. While some might interpret this as a missed opportunity, there are indicators that suggest this could signal a longer-term trend. The question arises: is now the right time to buy?

Snowflake Boosts Its AI Capabilities Amidst Market Growth

Snowflake’s focus remains on data management. Its data cloud product provides essential infrastructure for handling data collection, storage, and processing. This service is crucial now, given the increasing reliance on data for training artificial intelligence (AI) models.

To strengthen its position in AI, Snowflake has teamed up with Anthropic to integrate its Claude model into the Snowflake platform via Amazon Web Services (AWS). This partnership is vital as more companies explore the potential advantages of AI. With over 10,000 clients already, Snowflake is well-positioned to benefit from increased revenue from its existing customer base thanks to this collaboration.

In Q3 FY 2025, Snowflake reported a 29% year-over-year increase in product revenue, reaching $900 million. This impressive figure does not account for the potential growth from the Anthropic partnership. A particularly noteworthy statistic is the rise in Snowflake’s Remaining Performance Obligations (RPO), which jumped by 55% to $5.7 billion. This suggests a higher-than-expected growth rate moving forward.

This encouraging news drove up Snowflake’s stock price. However, some concerns linger that may give investors pause.

Concerns Over Profitability and Growth

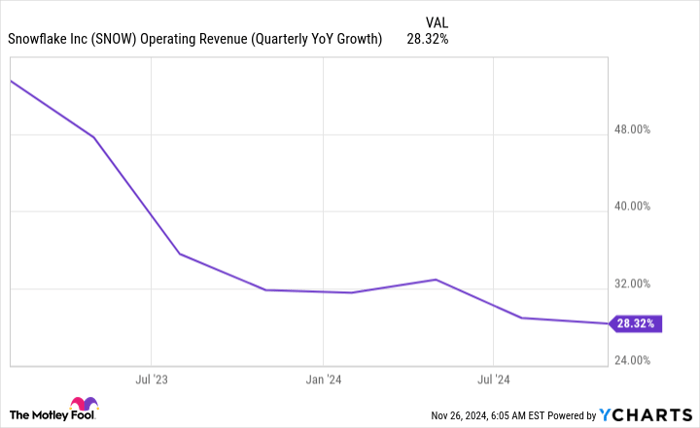

Despite the positive RPO figures, Snowflake’s growth appears to be slowing. The company anticipates product revenue growth of just 23% in Q4, indicating a trend toward maturing business dynamics.

SNOW Operating Revenue (Quarterly YoY Growth) data by YCharts

One critical issue is that Snowflake has recorded an operating loss of $366 million, which translates to a daunting 39% loss margin. Despite slowing growth, this loss margin has not improved over the past few years.

SNOW Operating Margin (Quarterly) data by YCharts

This trend presents a worrying scenario, as the company may struggle to achieve profitability without significant operational cuts. The current management’s apparent disregard for profitability raises concerns for shareholders, impacting the overall investment outlook for Snowflake.

As a current shareholder, I may consider using this recent increase as a chance to sell or reduce my stake. Many high-growth software companies are now posting solid profits, and it’s reasonable to expect Snowflake to follow suit eventually.

Should You Invest $1,000 in Snowflake Now?

Before deciding to invest in Snowflake, take note of this:

The Motley Fool Stock Advisor recently highlighted the 10 best stocks for investors at this time—and Snowflake was not featured on that list. The chosen stocks offer the potential for significant returns in the coming years.

For example, when Nvidia was selected on April 15, 2005, if you had invested $1,000 at that moment, you would have seen it grow to $847,211!*

Stock Advisor offers a straightforward guide for investors, covering topics like portfolio building, timely updates from analysts, and two fresh stock picks every month. Since 2002, the Stock Advisor service has quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a board member of The Motley Fool. Keithen Drury has investments in Amazon and Snowflake. The Motley Fool holds positions in and recommends Amazon and Snowflake, following its disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.