Hormel Foods (NYSE: HRL) stands out as a Dividend King, currently featuring an attractive 3.6% dividend yield. While the company faces several challenges at the moment, savvy long-term dividend investors may find a compelling opportunity here. Below are four key reasons to consider adding Hormel to your investment portfolio.

1. Leadership with Investor Interests at Heart

Companies should prioritize their investors’ long-term interests, which is not always the case. Many firms cater mainly to large institutional shareholders, often neglecting small investors. Fortunately, at Hormel, that dynamic differs.

Image source: Getty Images.

The Hormel Foundation holds approximately 46.8% of Hormel’s stock. This foundation was established by the founding family to ensure the company remains independent and contributes positively to the local community. This control structure guarantees that Hormel, as a food manufacturer, is committed to providing sustainable and increasing dividends. As the largest shareholder, the Hormel Foundation’s interests align with those of conservative long-term dividend investors, ensuring a focus on stability and growth.

2. A Proven History of Success

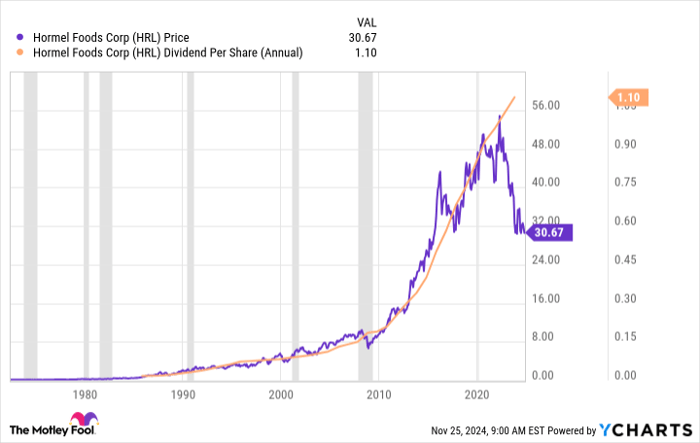

Hormel is committed to long-term goals, and its impressive track record backs this up. As a Dividend King, the company has raised its dividend for 58 consecutive years, a feat that reflects a well-run business model. The involvement of The Hormel Foundation emphasizes this commitment, with ongoing efforts to deliver reliable dividend growth.

HRL data by YCharts

Even the most successful companies encounter difficult periods. Hormel has faced its share of challenges over the years, including the inflationary pressures of the 1970s, the Dot-com bust, the Great Recession, and the recent COVID-19 pandemic. Despite these hurdles, it has managed to adapt and push through, demonstrating resilience even during tough times. While the pandemic continues to present challenges, Hormel’s long history suggests it will overcome current obstacles.

4. Current Headwinds Are Manageable

Why are investors worried about Hormel today, especially when the stock’s yield is historically high? There are several factors at play: difficulty passing rising input costs to consumers, challenges from avian flu, and slow pandemic recovery in China. Additionally, Hormel’s recent acquisition of the Planters brand occurred just as the nut snacking segment began to lose momentum.

Though these concerns are valid, they are not fatal to the company. Each issue can be resolved or addressed over time. Currently, the financial results are weak, which raises concerns, but Hormel is actively working on solutions.

Efforts to cut costs, which were delayed during the pandemic, are now back on track. The company is also focusing on innovation to boost demand across the U.S., China, and particularly for the Planters brand. Given Hormel’s historical strengths in innovation, there’s confidence it can reignite consumer interest.

The challenge lies in timing; solutions will take time to materialize, while Wall Street expects quick results. This creates an opportunity for long-term dividend investors willing to wait for stability and growth in the future.

Evolution with a Consistent Goal

Hormel’s business model has evolved over the past decade, shifting from primarily a meat producer to a diversified branded products company. Nevertheless, the goal remains unchanged: to achieve steady, long-term growth that supports reliable dividend growth. This transformation may cause some investors to reassess the stock’s value, potentially creating opportunities for those focused on long-term gains.

Should the stock be undervalued due to this revaluation, investors could benefit from an attractive yield. Furthermore, should Wall Street underestimate Hormel’s future growth potential, investors may enjoy both a healthy dividend and capital appreciation as performance improves.

Seize the Opportunity for Future Gains

If you’ve ever felt you missed out on successful investments, now might be your chance.

Occasionally, our expert analysts recommend what we term a “Double Down” stock, signaling companies with high potential for growth. If you feel you’ve missed the boat, the present could be the prime moment to invest as opportunities don’t last forever. Consider this:

- Nvidia: An investment of $1,000 back in 2009 would be worth $358,460!*

- Apple: If you invested $1,000 in 2008, you’d now have $44,946!

- Netflix: A $1,000 investment in 2004 would have grown to $478,249!

Right now, we are issuing “Double Down” alerts for three outstanding companies. Don’t miss this chance!

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Reuben Gregg Brewer has positions in Hormel Foods. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.