Berkshire Hathaway’s Big Cash Reserves Signal Caution Amid Market Euphoria

The investing world always keeps a keen eye on Warren Buffett. Recent developments in his investment strategy may require some keen observation to grasp fully, yet his message remains crystal clear.

As a public enterprise, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) discloses its performance through quarterly updates and also files a form 13F that outlines its trades every quarter.

In the third quarter, Berkshire Hathaway announced it held a record $325 billion in cash. This marks its highest level ever. Additionally, it appears to be a net seller of stocks, a trend that has persisted over several quarters.

Buffett’s investing philosophy is straightforward: buy low, sell high, and he’s straightforward about it. He prioritizes finding great value in stocks before making purchases.

Investor sentiment suggests the market is currently inflated. The S&P 500 has risen 26% this year and is trading at unprecedented highs. Valuations are elevated, and a market correction could be on the horizon.

While it’s uncertain if a downturn will happen tomorrow, the historical nature of the market indicates it will eventually occur. There are cycles of bull and bear markets, along with dips and corrections, and even crashes.

Although no one can accurately predict the timing of these events, it is vital for investors to be prepared. Here are three strategies that can help:

1. Maintain Cash Reserves

Having cash readily available outside of investments is crucial. Everyone should establish an emergency fund for unexpected situations.

In addition, regular funds for potential investments are wise. A steady investment strategy may seem mundane, but it is effective. Regardless of the amount—whether it’s $50 per month or more—consistent contributions, over time, can lead to significant growth.

If market prices seem overly inflated, being selective with investments and keeping cash on hand for future opportunities can be beneficial.

2. Be Wary of Inflated Prices

The adage “what goes up must come down” often applies to unreasonable valuations. Not every high valuation is problematic; some companies justifiably deserve higher valuations due to rapid growth. However, when valuations begin to seem irrational and money continues to pour in, it’s time to reevaluate.

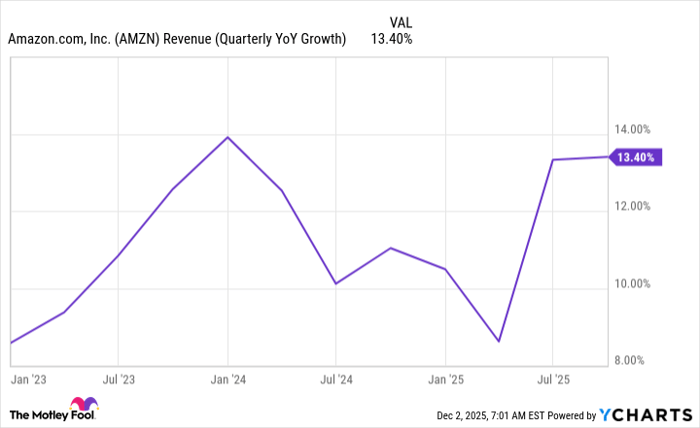

Image source: The Motley Fool.

One of Buffett’s notable quotes, “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful,” resonates today more than ever. However, his commentary reveals a troubling trend:

As this is written, little fear is visible in Wall Street. Instead, euphoria prevails — and why not? What could be more exhilarating than to participate in a bull market in which the rewards to owners of businesses become gloriously uncoupled from the plodding performances of the businesses themselves? Unfortunately, however, stocks can’t outperform businesses indefinitely.

Despite this wisdom, history shows that investors often overlook such advice, leading to repeated cycles of soaring markets followed by crashes. Currently, Buffett’s strategy reflects his own advice by steering clear of stocks that appear disconnected from their underlying company performance.

That said, there are still bargains to be found. In the third quarter, Berkshire Hathaway initiated new positions in Domino’s Pizza and Pool Corporation.

3. Stay Invested for the Long Run

A significant cause of market crashes stems from what Buffett terms “fear.” Investors often succumb to panic-selling, leading to rapid declines. However, seasoned investors recognize that downturns, corrections, and crashes are integral to the market.

For instance, if an investor sold at the start of the last bear market, they would have missed considerable gains afterward: the S&P 500 has risen 67% since that period, while Nvidia’s stock has skyrocketed over 1,000%, despite experiencing a decline of half its value in 2022.

Essentially, the right mindset is key: invest in companies you trust and allow time and the market to foster growth.

Is Now a Good Time to Invest $1,000 in Berkshire Hathaway?

Before making any investments in Berkshire Hathaway, consider the following:

The Motley Fool Stock Advisor analyst team has pinpointed what they believe are the 10 best stocks to buy currently—Berkshire Hathaway is not among them. The selected stocks have the potential for significant returns in the future.

For instance, consider Nvidia when it was recommended on April 15, 2005… an investment of $1,000 at that time would now be worth $847,211!*

Stock Advisor offers investors a clear path to success, providing guidance on portfolio building, analyst updates, and two new stock recommendations each month. The Stock Advisor service has substantially outperformed the S&P 500 since 2002.*

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Berkshire Hathaway and Domino’s Pizza. The Motley Fool’s disclosure policy is available online.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.