Intel Stock: Anticipating a Turnaround in 2025 Amid Market Turbulence

Next year is set to be crucial for Intel stock (NASDAQ:INTC). With a more attractive range of CPU products and a recovery in demand, Intel could see its core CPU sales climb. Additionally, the company’s foundry business is approaching a pivotal moment with the potential launch of its groundbreaking 18A process. Furthermore, the return of Donald Trump to the presidency may bolster Intel’s U.S. manufacturing base, placing the company in a strong position due to favorable policies. Below, we outline expectations for Intel in 2025. For further insights, consider our analysis discussing potential scenarios for Intel stock, including a rise to $60 or a drop to $10.

The fluctuations of INTC stock over the past four years have been notable, with annual returns showing far more volatility compared to the S&P 500. The stock posted a return of 6% in 2021, experienced a significant drop of -47% in 2022, and rebounded with an impressive 95% increase in 2023. Conversely, the Trefis High Quality (HQ) Portfolio, featuring a collection of 30 meticulously selected stocks, demonstrated far less volatility and has outperformed the S&P 500 every year in this time frame. What accounts for this difference? The HQ Portfolio consistently provided better returns with decreased risk, resulting in a more stable investment experience. What factors might contribute to a recovery in Intel stock?

Potential Revival in CPU Demand

Intel has lost significant market share in the CPU sector in recent years, largely due to gains made by rival AMD and a broader shift towards AI accelerators, which has negatively impacted demand for its GPUs. Nevertheless, Intel’s upcoming product lineup shows promise. The Lunar Lake chip, targeted at laptops and ultra-compact devices, alongside the Arrow Lake chip for desktops, will be produced by TSMC utilizing its advanced 3nm process. This advancement offers Intel a better chance to compete with AMD in the near future.

The anticipated recovery of the PC market, combined with improved product offerings, is expected to elevate Intel’s revenues in 2024. After nearly two years of hefty investments in AI chip technologies, companies may soon ramp up CPU spending, particularly in general-purpose workloads and server updates. Intel’s latest server chips, such as the Sierra Forest and Granite Rapids, are poised to strongly compete with AMD, thanks to the application of the new “Intel 3” 3nm process. Moreover, Intel’s revenue guidance for Q4 was encouraging, with projections estimating sales between $13.3 billion and $14.3 billion, indicative of positive trends on the horizon.

Progress with the 18A Process Node

Intel is heavily investing in its 18A process, touted as its most advanced technology to revitalize its foundry business. This process introduces chips with advanced technologies like RibbonFET gate-all-around transistors and PowerVia backside power delivery, expected to enhance performance and power efficiency. The company has secured significant contracts leveraging this technology, including a partnership with the U.S. Department of Defense for the RAMP-C program, aimed at advancing semiconductor technology domestically. Furthermore, other notable clients, including Amazon and Microsoft, plan to design custom chips, including AI accelerators.

In early August, Intel announced several milestones achieved with the 18A chips, confirming successful operation and functionality. As external clients prepare to transition their initial 18A designs for production in 2025, Intel anticipates beginning enterprise-scale production thereafter. If capitalized on effectively, this transition could dramatically improve the narrative surrounding the stock, validating the substantial investments made in Intel’s foundry operations over recent years.

Support from U.S. Manufacturing Policies

President-elect Donald Trump’s focus on enhancing U.S. manufacturing could benefit Intel, considering its significant domestic manufacturing presence. There’s potential for Intel to gain substantial regulatory support geared towards increasing domestic chip production. For instance, the new administration might implement tariffs that would elevate costs for foreign fabrication companies switching to U.S. markets. A robust emphasis on domestic production, whether through tariffs or other strategies, could lead to increased business for Intel. Additionally, the foundry division responsible for producing chips for third-party customers may witness stronger demand due to companies preferring U.S. suppliers to mitigate the impact of potential duties.

Given the importance of semiconductors for national security—an issue Trump has underscored—Intel’s domestic manufacturing capabilities could be seen as essential to preserving U.S. technological independence. Intel is uniquely positioned as the only American semiconductor company that designs and fabricates leading-edge chips in the country, potentially enhancing its prospects for government contracts, especially as Trump previously increased military spending during his term.

Emerging Opportunities in AI Accelerators

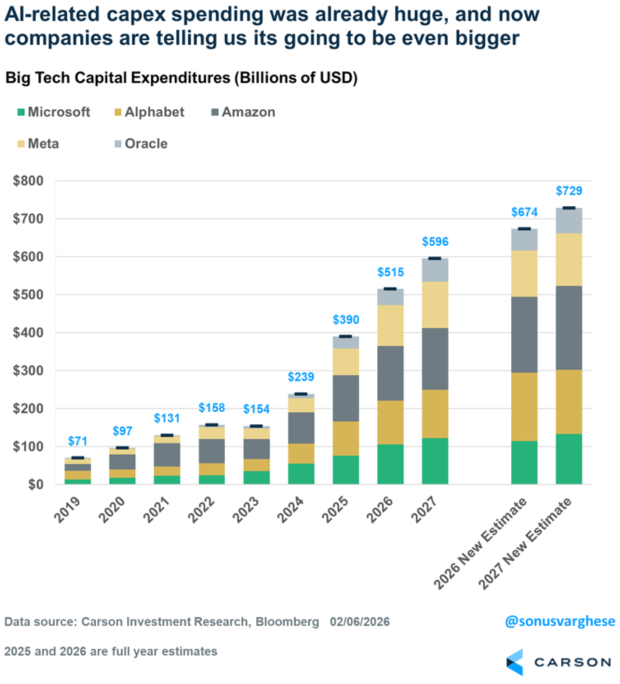

While Nvidia currently dominates the AI processor market, Intel is making strides to establish its foothold with its Gaudi 2 and the forthcoming Gaudi 3 AI accelerators. This presents an opportunity for Intel to reclaim some market share. The AI industry as a whole may begin shifting its focus from model training to inferencing, which produces outputs from trained models. Inferencing requires less computational power, suggesting that processors from both Intel and AMD could effectively manage these tasks.

Cost considerations are also becoming crucial for AI chip customers. The economics surrounding AI remain challenging, with significant investments in GPU chips yielding minimal returns, and it’s likely that companies will become more cautious with their AI expenditures starting in 2025. Although Gaudi sales have been underwhelming, Intel’s newest Gaudi 3 accelerator is priced at about half that of Nvidia’s offerings, potentially offering a more appealing price-to-performance ratio. This strategic shift towards inferencing may influence recommendations such as Selling Nvidia, Buying AMD Stock.

Currently, Intel shares trade at roughly $24, which equates to 25 times the consensus earnings for 2025. This valuation appears reasonable based on the factors discussed, and Intel is projected to return to growth with an anticipated revenue growth rate of around 6% in the coming year. Our assessment places Intel stock at a value of around $27 per share, slightly above its current market price. For a detailed analysis, refer to our insights on Intel valuation.

| Returns | Dec 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| INTC Return | 0% | -52% | 67% |

| S&P 500 Return | 0% | 26% | 169% |

| Trefis Reinforced Value Portfolio | 1% | 25% | 831% |

[1] Returns as of 12/3/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.