Micron Technology: Analyzing Current Valuation and Market Dynamics

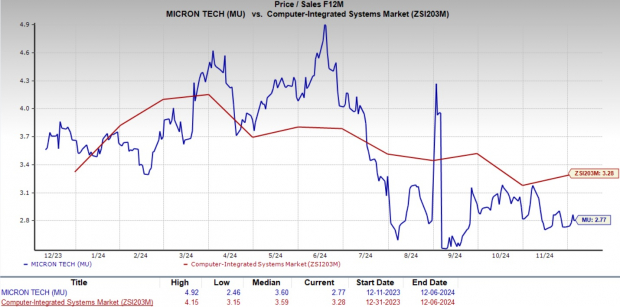

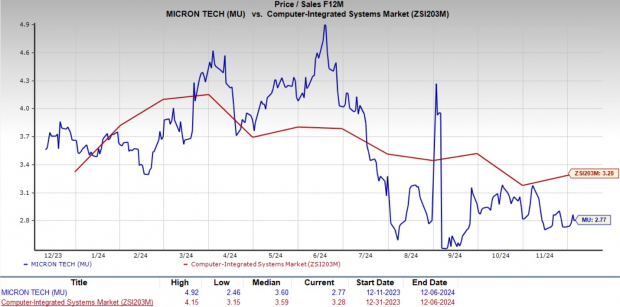

Micron Technology, Inc.’s MU valuation indicates that the stock is currently priced lower than the industry standard. The MU stock trades at a forward 12-month price-to-earnings (P/E) ratio of 10.41, well below the Zacks Computer – Integrated Systems industry average of 20.21. Additionally, its forward 12-month price-to-sales (P/S) ratio of 2.77 is noticeably less than the industry average of 3.28.

Image Source: Zacks Investment Research

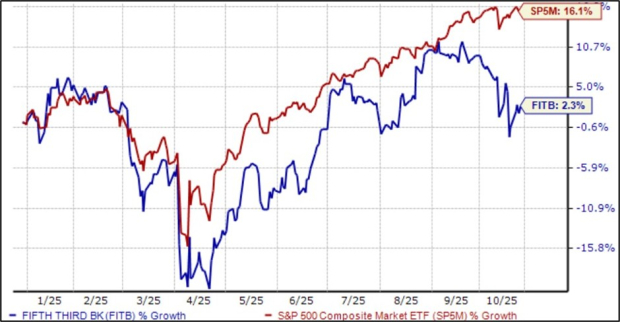

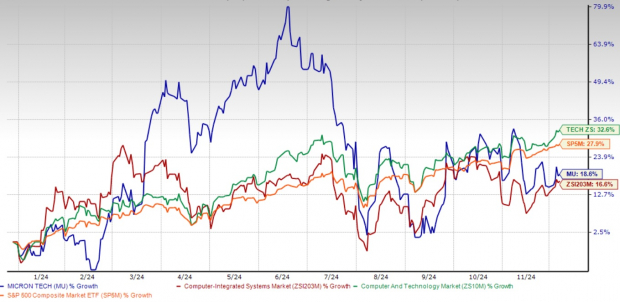

In 2024, Micron’s stock has experienced considerable fluctuations, climbing 18.6% year-to-date. While this figure surpasses the industry average, it trails behind the Zacks Computer and Technology sector and the S&P 500 index, prompting a reevaluation of its valuation and future performance. Although trading at a low valuation compared to its peers, Micron is currently facing short-term challenges, suggesting that maintaining its stock is the prudent option for investors.

Year-to-Date Price Performance Overview

Image Source: Zacks Investment Research

Favorable Industry Trends Support Micron’s Long-Term Success

Micron’s involvement in high-demand sectors such as artificial intelligence (AI), automotive, and industrial IoT positions it advantageously within the semiconductor industry. The rapid growth of AI applications has led to increased demand for advanced memory solutions like DRAM and NAND. Micron’s focus on next-generation DRAM and 3D NAND technologies helps it remain competitive in this evolving market.

Notably, Micron is diversifying its focus. By reducing its dependence on consumer electronics—an area prone to demand fluctuations—and emphasizing more stable sectors like automotive and data centers, Micron is better equipped to handle revenue volatility. This strategy also contributes to its resilience in an often cyclical industry.

Innovations and Collaborations Fuel Demand for Micron Products

The innovative products offered by Micron bolster its competitive position. Its cutting-edge GDDR7 graphics memory is undergoing tests from major companies like Advanced Micro Devices (AMD) and Cadence Design Systems (CDNS), underscoring its significance in gaming and advanced computational applications.

Furthermore, Micron’s HBM3E chips are set to enhance NVIDIA’s (NVDA) next-generation AI chip, the H200. This partnership highlights Micron’s integral role in the AI ecosystem, with its HBM supply fully booked for 2024 and strong orders already established for 2025, ensuring stable revenue prospects moving forward.

Micron’s Financial Resurgence and Future Outlook

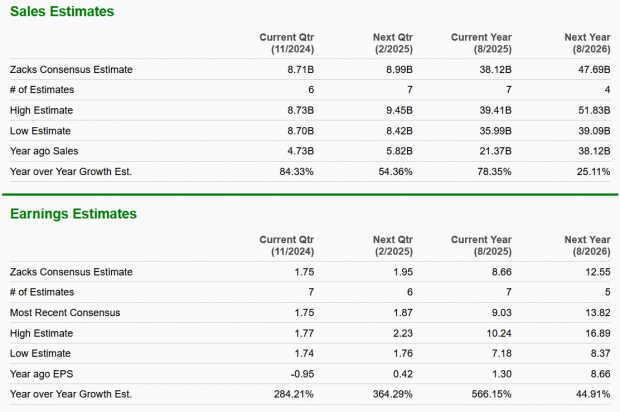

Micron has shown a remarkable recovery following the downturn experienced in late 2022 and early 2023. The company has consistently exceeded earnings expectations over the past four quarters, with an impressive average surprise of 72.7%. This track record reflects Micron’s capability to navigate challenges in the marketplace effectively.

Growth prospects for Micron in fiscal 2025 and 2026 look promising, bolstered by its hefty investments in memory technology and collaborations with key technology firms. The Zacks Consensus Estimate indicates ongoing confidence in Micron’s earnings path, fueled by strong demand in AI, data centers, and other fast-growing sectors.

Image Source: Zacks Investment Research

Potential Risks for Micron to Monitor

Despite Micron’s strong position, it faces near-term risks that might slow down its growth. A key concern is the possibility of oversupply in the high-bandwidth memory (HBM) sector. As these chips become increasingly essential to Micron’s revenue stream, any mismatch between supply and demand could lead to lower average selling prices (ASPs). This situation could negatively affect profit margins, particularly amid rising competition.

Additionally, Micron’s reliance on AI-driven demand presents another vulnerability. Although the ongoing AI boom presents vast growth opportunities, any decline in adoption rates or shifts in technology could lessen the demand for its memory solutions.

Conclusion: Hold Micron Stock for the Time Being

Micron is strategically positioned to flourish in the continually evolving semiconductor market, due to its leadership in advanced memory technologies and key partnerships. Its impressive financial rebound and commitment to innovation reinforce its long-term growth prospects. However, the uncertainties surrounding near-term challenges, like the potential for HBM oversupply and market fluctuations, suggest a cautious stance.

For the time being, holding onto Micron stock seems to be the most sensible course of action. As market conditions stabilize, Micron’s attractiveness as an investment may increase, making it a stock to watch closely. Currently, MU holds a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Today: Capitalizing on the Future of Energy

The demand for electricity is soaring. Meanwhile, efforts are underway to decrease reliance on fossil fuels like oil and natural gas. Nuclear energy presents a viable alternative.

Leaders from the US and 21 other nations have recently pledged to TRIPLE global nuclear energy capacities. This push could create significant profits for companies related to nuclear energy—especially for investors who act early.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, delves into the key companies and technologies driving this trend, identifying three standout stocks poised to benefit the most. Download Atomic Opportunity: Nuclear Energy’s Comeback today at no cost.

For the latest recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double for free.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.