“`html

Riding the Wave: How to Make the Most of the Current Market Boom

Plus… here’s why you should stick around for the thrilling conclusion of this “movie”…

Editor’s Note: Eric Fry here. I’ve been sharing insights about my friend and InvestorPlace colleague, Luke Lango’s newly developed, easy-to-use market-beating system, Auspex.

Luke and his team dedicated much of the past year to developing this tool, and I must admit… the results have been noteworthy. A comprehensive back test revealed it outperformed the market by over 10X across 5-, 10-, 15-, and 20-year periods.

Today, I’ve invited Luke to explain how you can use Auspex to take advantage of the current economic boom while avoiding potential pitfalls.

He’ll share more about this powerful tool during the Auspex Anomaly Event on Wednesday, December 11 at 1 p.m. Eastern Time. Click here to join us.

Now, let’s hear from Luke…

Since Donald Trump secured the recent U.S. presidential election, I’ve adopted a six-word mantra:

Embrace the boom… beware the bust.

Since Election Day, the S&P 500 has increased by around 9%, the Russell 2000 index for small-cap stocks has climbed about 6.5%, the tech-heavy Nasdaq-100 has risen about 6%, and Bitcoin (BTC-USD) has surged about 42% – hitting its all-time high of over $100,000 earlier last week.

Trump is set to reshape the U.S. economy with a range of pro-growth policies, from deregulation to tax reform. These promises are energizing investors, indicating that the market could keep rising in the early days of his administration.

Embrace that boom.

However, there are warning signs for the Trump administration and a shaky global landscape.

A widespread 20% tariff could severely disrupt U.S. companies that produce goods overseas.

Moreover, Trump’s choice of Robert F. Kennedy Jr. to lead the Department of Health and Human Services (HHS) adds significant uncertainty to the biopharma sector.

The international scene remains unpredictable and volatile.

Beware those potential busts.

Acting on these warnings can be challenging.

That’s why my team and I developed a system called “Auspex.” This tool goes beyond mere talk; it’s a strategy that transforms the embrace the boom… beware the bust mentality into a concrete plan.

It requires approximately 10 minutes of effort each month, focusing on around 10 stocks at a time.

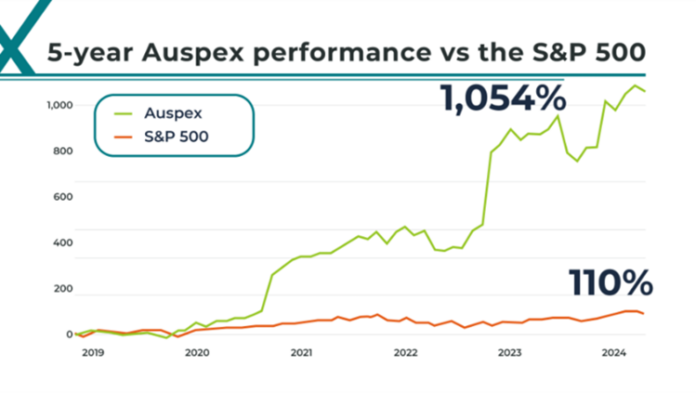

Our historical analysis indicates that from September 2019 to September 2024, this system, if rebalanced monthly, could yield a whopping 1,054% return!

In comparison, the S&P 500 only gained 109% during the same five-year stretch, marking an impressive outperformance of the market by nearly 9X.

This strategy has beaten the market every month since we began live-testing it with a select group of my members in July.

Learn more about why our “Auspex” system is one of the smartest investment strategies available and register for my upcoming broadcast this Wednesday by clicking here.

Before we dive deeper, let’s explore how long this Trump-era boom could last…

And why now is the ideal time for investors to jump in, before the anticipated downturn (hint: the final 30 minutes of a movie tend to be the best).

Lastly, I’ll show how my new Auspex system can help safeguard your investments during potential downturns while still achieving market-beating performance.

The Boom We’re Embracing Now

The U.S. stock market has been thriving for the past two years, largely due to the AI Revolution and recent rate cuts from the Federal Reserve.

During the AI Revolution, big tech companies like Meta Platforms Inc. (META), Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN), and Alphabet Inc. (GOOGL) are all investing generously to build infrastructures for next-gen AI. They are spending billions to construct new AI data centers and develop innovative applications.

This significant investment has fostered a major economic boom.

Following the most intense rate-hiking cycle in nearly 50 years, the Federal Reserve began lowering rates in September, providing relief to consumers and businesses alike. This relief has further fueled the AI boom and…

This combination has propelled stock prices upward.

Since reaching its lowest point in October 2022 – just over two years ago – the S&P 500 has surged 70%. It’s on track for a second consecutive year of over 20% gains.

The S&P rose 24% in 2023 and has already increased by 27% in 2024. If these trends continue, this will be only the fourth time since the Great Depression that the S&P 500 has experienced back-to-back years of over 20% growth.

We are indeed in a stock market boom.

And we believe this boom is about to become even more pronounced.

With Donald Trump’s recent victory and Republicans regaining control of Congress, we can expect a wave of deregulation,

“`

The Economic Boom: A Temporary High in the Market

Pro-business policies and tax cuts are anticipated to impact the economy positively in the coming years. However, such conditions raise a crucial reminder: all market booms come to an end, and typically, this shift leads to significant downturns.

History Repeats: Understanding Market Busts

The stock market has experienced consecutive years of over 20% gains recently. This remarkable performance has only been witnessed three times in history: in 1935/36, 1954/55, and 1995/96.

After the robust years of 1935 and ’36, the market crashed nearly 40% in 1937. This swift downturn followed shortly after an impressive boom.

The years 1954 and ’55 were also marked by gains, yet 1956 saw the market flatten, followed by a 15% decline in 1957, demonstrating how quickly prosperity can turn into adversity.

In the wake of the 1995/96 boom, a strong rise continued through 1997 to 1999, yet the market faced a staggering 50% crash from 2000 to 2002. Each time, bullish trends eventually led to a significant bust.

Each boom poses the inevitability of a bust; the true question lies in its timing.

So, should investors sell their stocks to avoid the impending collapse? The answer is a resounding no.

Maximizing Gains: The Final Chapter of the Boom

Typically, the last portions of films, shows, or sports games are where the excitement peaks. Likewise, the concluding years of a stock market boom often yield significant profits.

Take the Dot-Com Boom of the 1990s as an example. The Nasdaq Composite index recorded incredible growth, with increases of 40% in 1995, around 20% in ’96 and ’97, and another 40% surge in ’98.

Remarkably, the best performance came in 1999, with a staggering 90% gain in that final year before the downturn began in 2000.

This history suggests that the most rewarding moments can come just before a market’s inevitable decline. Therefore, leaving the party too early could mean missing out on substantial returns, but staying too long can be equally dangerous.

So, what should investors do? Embrace the boom while being cautious about the bust.

Ride the wave of increasing stock prices, remaining vigilant for signs of trouble that might signal a downturn.

While identifying these signs can be challenging, strategies like the Auspex investment tool can facilitate navigating market fluctuations. This innovative investment screen helps subscribers achieve gains in 30-day bursts, allowing for more controlled exposure to market risks.

Preparation is key. The tool offers the potential for profitability with minimal time commitment—just 10 minutes a month focused on about ten stocks.

Mark your calendars for Wednesday, Dec. 11 at 1 p.m. EST. A special broadcast revealing this tool will provide valuable insight—an event that promises to be informative.

Reserve your spot today!

Sincerely,

Luke Lango

Editor, Hypergrowth Investing