China Probes Nvidia Over Antitrust Concerns, Despite Limited Immediate Impact

What’s at Stake: China is investigating Nvidia Corporation NVDA for potentially violating its anti-monopoly laws. An analyst suggests the case may not resolve quickly.

The inquiry, first reported by Chinese state media on Monday, investigates Nvidia’s 2020 acquisition of Israeli company Mellanox Technologies. Regulatory authorities are evaluating whether Nvidia’s AI chips bundled with Mellanox’s NVLink technology restrict competition or if the company provides lower-quality products to Chinese customers.

According to Ming-Chi Kuo from TF Securities, the investigation has broader implications amid rising geopolitical tensions between the U.S. and China. He stated, “This case may remain unresolved in the near term,” and referenced past cases like Qualcomm’s QCOM 15-month antitrust probe in China as a possible scenario for Nvidia.

Current Financial Impact: China contributes just 5% of Nvidia’s data center revenue. Though Kuo believes any immediate financial fallout for Nvidia may be limited, he warns of the possibility of future investigations into the company’s operations. “Investors should be prepared for scenarios where Nvidia’s practices, including CUDA, come under scrutiny,” he added.

CUDA, which stands for Compute Unified Device Architecture, is Nvidia’s platform that facilitates general-purpose computing with GPUs, utilizing accessible programming tools and languages like C, C++, and Python.

Stay updated on technology trends with the Benzinga Tech Trends newsletter.

Significance of the Investigation: This antitrust investigation arrives amidst ongoing discussions about tariffs on Chinese imports, reflecting the complex trade dynamics between the U.S. and China. Analysts have downplayed the investigation’s importance. Patrick Moorhead suggested that the inquiry is expected given Nvidia’s dominant position with over 90% market share in its industry. Daniel Newman described the allegations as speculative, while Angela Zhang, a law professor at USC, viewed the antitrust scrutiny as potentially serving China’s strategy against U.S. sanctions.

Nvidia stands as a leader in AI chip production, boasting a market capitalization of $3.399 trillion, making it the second most valuable company globally, trailing only behind Apple Inc.

Last month, Nvidia reported third-quarter revenue of $35.1 billion, marking a remarkable 94% increase from the previous year and exceeding Wall Street’s projection of $33.12 billion.

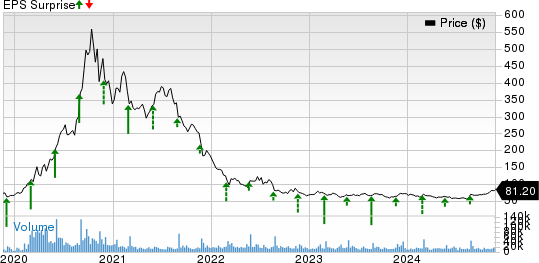

Stock Performance: On Monday, Nvidia’s stock price dipped 2.55%, closing at $138.81, followed by a slight 0.63% decrease in after-hours trading. Nevertheless, the company’s shares have soared by 188.17% year-to-date, substantially outperforming the Nasdaq 100 index, which gained 29.6% during the same period, according to data from Benzinga Pro.

The average price target for Nvidia, as assessed by 40 analysts, is $170.56, with the highest estimate from Rosenblatt at $220 as of November 21. Recent predictions from DA Davidson, Phillip Securities, and Truist Securities average around $154.67, indicating a potential upside of 12.13%.

For more of Benzinga’s Consumer Tech news, follow this link.

Image via Shutterstock

Read Next:

Disclaimer: This content was partially produced with AI tools and reviewed by Benzinga editors.

Market News and Data brought to you by Benzinga APIs