MetLife Teams Up with Workday to Transform Employee Benefits

MetLife, Inc. (MET) has partnered with Workday, Inc. (WDAY) to introduce the new Workday Wellness program. This strategic collaboration combines MetLife’s significant presence as the largest U.S. Group Benefits carrier with Workday’s cutting-edge AI tools designed to improve employer benefit offerings.

Enhancing Employee Benefits

This partnership stands to benefit MetLife by integrating its insurance products with Workday’s analytics-driven platform. The Workday Wellness program allows employers to assess their employees’ benefit preferences and usage. This analysis helps employers tailor benefits more effectively, which could lead to increased premiums for MetLife in the future.

Boosting Customer Engagement

By addressing the changing demands from both employers and employees, MetLife aims to strengthen its product appeal. This data-driven strategy is expected to enhance customer engagement, reinforcing MetLife’s reputation as a comprehensive group benefits provider.

Simplifying Complex Benefits Administration

This partnership simplifies the often complicated administrative tasks associated with employee benefits. By ensuring seamless integration with Workday’s system, MetLife enhances the client experience, possibly attracting new clients and improving retention rates. Over the next three years, MetLife anticipates a rise in adjusted PFOs within its Group Benefits segment, projected between 4-6%.

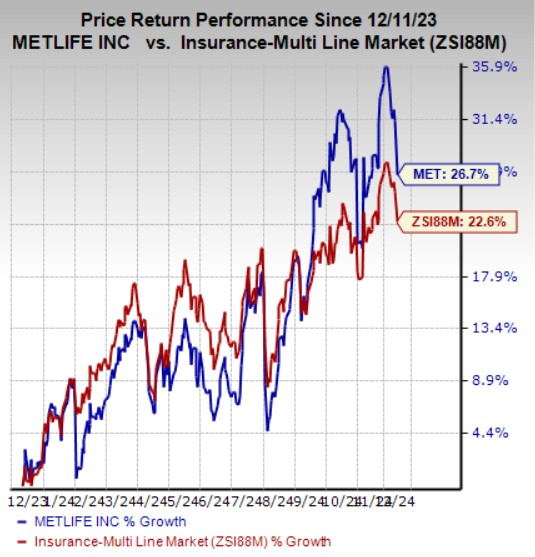

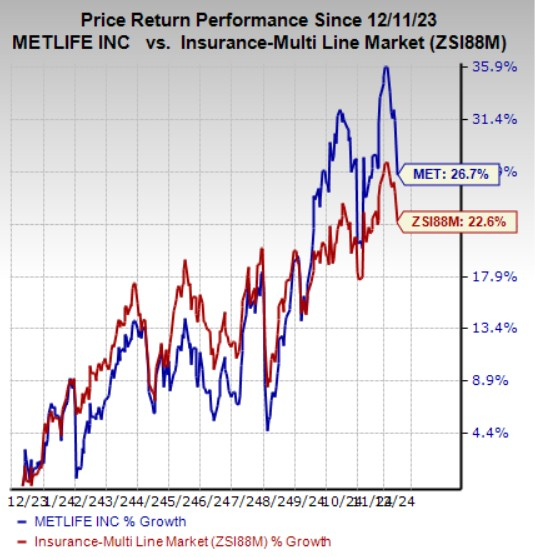

MET’s Price Performance

In the last year, MetLife’s share price has climbed by 26.7%, outperforming the broader industry, which saw a growth of 22.6%.

Image Source: Zacks Investment Research

Current Zacks Rating for MET

Currently, MetLife holds a Zacks Rank of #4 (Sell).

Other Stocks to Watch

Investors may want to consider better-ranked stocks in the Finance sector such as BrightSphere Investment Group Inc. (BSIG) and First Savings Financial Group, Inc. (FSFG), both of which carry a Zacks Rank of #1 (Strong Buy). For a full list of today’s top Zacks #1 Rank stocks, click here.

BrightSphere Investment Overview

BrightSphere Investment’s earnings have exceeded expectations in each of the last four quarters, averaging a surprise of 20.07%. The Zacks Consensus Estimate predicts a growth of 45.5% in BSIG’s earnings for 2024, along with a revenue increase of 16.6% compared to the same period last year. Recently, the earnings forecast for BSIG has increased by 12.1% over the past two months.

First Savings Financial Insights

First Savings Financial has outperformed estimates in three of the last four quarters, with an average surprise of 11.60%. The Zacks Consensus Estimate indicates a 55.9% improvement in FSFG’s earnings for 2024, alongside an 8.5% growth in revenue from the previous year. The earnings forecast for FSFG has risen by 20.5% in the past two months.

Discover the Top 10 Stocks for 2025

Stay ahead by learning about our top 10 stock picks for 2025.

Historically, these selections have performed exceptionally well. Between 2012 and November 2024, the Zacks Top 10 Stocks delivered a remarkable gain of +2,112.6%, significantly outpacing the S&P 500’s +475.6% return. Our research director, Sheraz Mian, is currently sifting through 4,400 companies to uncover the top 10 stocks to buy and hold for 2025. Don’t miss out; the list will be revealed on January 2.

Be First to New Top 10 Stocks >>

MetLife, Inc. (MET) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

First Savings Financial Group, Inc. (FSFG) : Free Stock Analysis Report

BrightSphere Investment Group Inc. (BSIG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.