Urban Outfitters Stock Soars After Strong Earnings Report

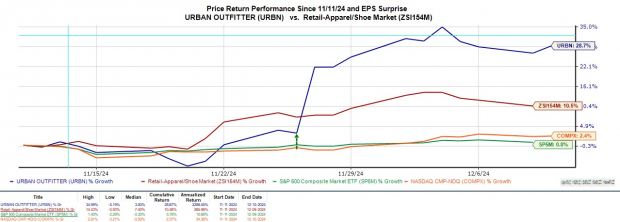

Urban Outfitters URBN has drawn attention as its third quarter earnings exceeded expectations in late November.

Since then, the stock has surged 25%, bolstered by a trend of optimistic earnings revisions. This positive momentum has resulted in URBN earning a Zacks Rank #1 (Strong Buy) designation and being named the Bull of the Day.

Image Source: Zacks Investment Research

Strong Growth Across Retail Brands

The boost in Urban Outfitters stock follows record sales and profits for the third quarter. All four of its retail brands, in addition to its main name, reported record revenue in Q3, showcasing the company’s growing appeal.

Nuuly, a subscription rental service, particularly excelled, showing double-digit revenue growth and a 51% spike in average active subscribers.

Solid Q3 Earnings Performance

Urban Outfitters reported Q3 sales of $1.36 billion, a 6% year-over-year increase, surpassing Zacks estimates of $1.33 billion. Notably, net income climbed 24% to $103 million, equating to $1.10 per share, which exceeded the Zacks EPS Consensus of $0.85 by 29%. The company has beaten earnings expectations in three of its last four quarterly reports, averaging a surprise of 22.82%.

Image Source: Zacks Investment Research

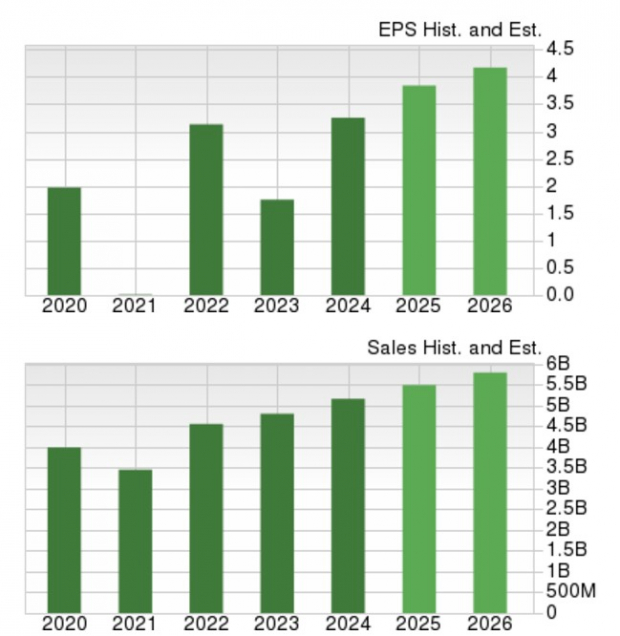

Promising Future Projections

Looking ahead, Urban Outfitters is expected to see total sales grow over 5% in the current fiscal year and FY26, with projections reaching close to $6 billion. Additionally, FY25 EPS forecasts suggest an 18% increase to $3.84 from $3.25 in FY24, with a further 8% growth anticipated for FY26.

Image Source: Zacks Investment Research

Positive EPS Revisions Indicate Growth

In the past 30 days, estimates for FY25 and FY26 EPS have risen over 6%, reflecting increased interest in Urban Outfitters stock.

Image Source: Zacks Investment Research

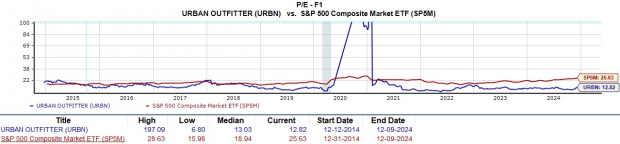

Valuation Appears Attractive

Currently, Urban Outfitters stock trades at a forward earnings multiple of 12.8X, which is attractive compared to the S&P 500 and the Retail-Apparel and Shoes Industry average of 17X. Well-known competitors include Abercrombie & Fitch ANF and The Gap GAP.

Notably, URBN is near its decade-long median of 13X forward earnings, significantly below its peak of 197X during this period.

Image Source: Zacks Investment Research

Conclusion on Urban Outfitters Stock

With over a 40% increase year-to-date and nearing 52-week highs, Urban Outfitters stock could experience further growth. In addition to its strong buy rating, URBN has achieved an overall “A” VGM Zacks Style Scores grade, reflecting its value, growth, and momentum.

Explore Zacks’ Expert Picks for Just $1

We’re serious.

In an unexpected move several years ago, we offered members 30 days of full access to our picks for just $1, no further commitment required.

Many have taken up this offer while others were skeptical. Our goal is to familiarize you with services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which have closed 228 positions with significant gains in 2023 alone.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GAP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.