Analysts Predict Solid Upside for iShares MSCI USA Min Vol Factor ETF

Recent analysis reveals promising growth potential for the iShares MSCI USA Min Vol Factor ETF (Symbol: USMV), indicating a significant upside based on its underlying holdings.

The implied analyst target price for USMV stands at $101.21 per unit, compared to its recent trading price of $92.40. This difference suggests that analysts expect an upside of approximately 9.53%. Among the ETF’s underlying holdings, Fiserv Inc (Symbol: FI), Chubb Ltd (Symbol: CB), and Roper Technologies Inc (Symbol: ROP) stand out, each showing substantial potential based on their respective analyst target prices. Specifically, FI currently trades at $201.54/share, with a target price of $222.00/share, reflecting a 10.15% upside. Similarly, CB has a recent price of $274.60, with an analyst target of $301.22, indicating a 9.69% potential increase. ROP shows a recent price of $549.47, while analysts predict it could reach $602.42, which is a 9.64% rise.

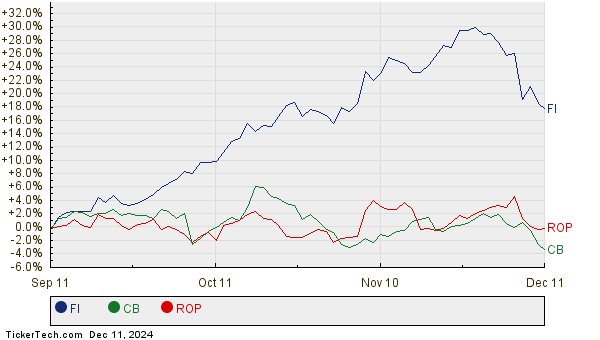

Below is a twelve-month price history chart comparing the stock performance of FI, CB, and ROP:

Here’s a summary table of the key analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares MSCI USA Min Vol Factor ETF | USMV | $92.40 | $101.21 | 9.53% |

| Fiserv Inc | FI | $201.54 | $222.00 | 10.15% |

| Chubb Ltd | CB | $274.60 | $301.22 | 9.69% |

| Roper Technologies Inc | ROP | $549.47 | $602.42 | 9.64% |

As investors consider these outlooks, questions arise about whether analysts are justified in their targets or if they may be overly optimistic. High price targets relative to current trading prices can underscore enthusiasm about a stock’s future. However, they can also lead to potential downgrades if the targets fail to align with recent market trends. Investors should conduct thorough research before making any decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Best High Dividend Stocks

• ARQQ Average Annual Return

• NMK Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.