Analysts Predict Positive Future for SPDR NYSE Technology ETF

We analyzed the SPDR NYSE Technology ETF (Symbol: XNTK) to see how its holdings compare to analysts’ forecasts. The ETF’s weighted average target price is projected at $236.25 per unit, suggesting potential growth.

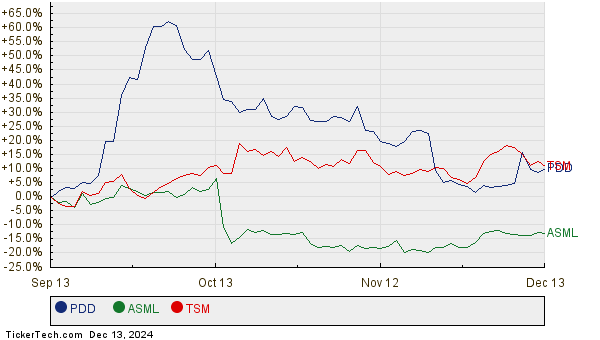

Currently trading at approximately $210.66 per unit, the ETF has an anticipated upside of 12.15%. This means analysts predict an increase based on their average target prices for the underlying stocks. Notably, three key holdings show promising upside potential: PDD Holdings Inc (Symbol: PDD), ASML Holding NV (Symbol: ASML), and Taiwan Semiconductor Manufacturing Co., Ltd. (Symbol: TSM). At a recent price of $104.66 per share, PDD has a significant upside of 62.49%, with an average target of $170.07 per share. ASML, priced at $713.10, has a potential increase of 25.85% towards a target of $897.44. Meanwhile, TSM’s recent price of $191.46 suggests an expected rise of 18.11% towards a target of $226.14. Below, you can see a twelve-month performance comparison for these stocks:

Together, PDD, ASML, and TSM constitute 7.80% of the SPDR NYSE Technology ETF. The table below summarizes the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR NYSE Technology ETF | XNTK | $210.66 | $236.25 | 12.15% |

| PDD Holdings Inc | PDD | $104.66 | $170.07 | 62.49% |

| ASML Holding NV | ASML | $713.10 | $897.44 | 25.85% |

| Taiwan Semiconductor Manufacturing Co., Ltd. | TSM | $191.46 | $226.14 | 18.11% |

The question remains: Are these analysts being realistic with their targets or are they too optimistic? Investors should consider whether there are valid reasons behind these estimations or if they have fallen behind recent market developments. While a high target price can indicate strong future expectations, it may also signal an opportunity for downward revisions if the projections do not align with current realities.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Semiconductors Dividend Stocks

• STX YTD Return

• Funds Holding BTAI

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.