Keybanc Adjusts Rating for ServiceNow Amid Growing Institutional Interest

Fintel reports that on December 13, 2024, Keybanc downgraded their outlook for ServiceNow (WBAG:SNOW) from Overweight to Sector Weight.

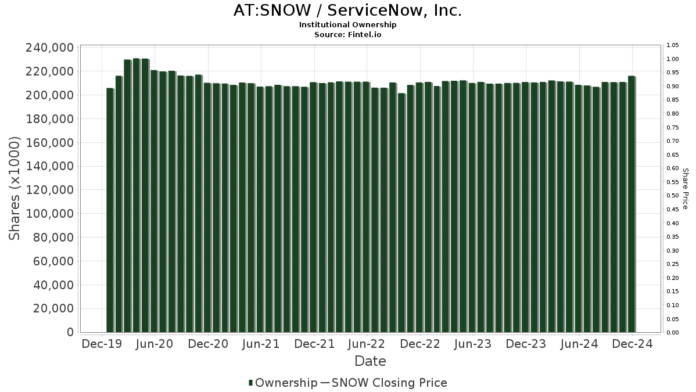

Fund Sentiment Shows Increased Engagement

Currently, 3,213 funds or institutions hold positions in ServiceNow, reflecting an increase of 95 owners or 3.05% from the previous quarter. The average portfolio weight dedicated to SNOW across all funds is 0.43%, which has risen by 33.82%. Institutions have raised their total shares owned in the last three months by 1.23%, bringing the total to 216,140K shares.

Price T Rowe Associates possesses 7,446K shares, equating to 3.61% ownership of ServiceNow. This marks a decrease of 3.57% from their previous holding of 7,712K shares, yet they increased their portfolio allocation in SNOW by 5.61% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares now holds 6,530K shares, representing 3.17% ownership. Previously, they had 6,480K shares, demonstrating a small increase of 0.77%, paired with a 7.61% growth in portfolio allocation in the last quarter.

JPMorgan Chase owns 6,436K shares, accounting for 3.12% ownership. This reflects a notable increase of 16.21% from their earlier count of 5,392K shares, although they reduced their portfolio allocation in SNOW significantly by 91.52% recently.

VFINX – Vanguard 500 Index Fund Investor Shares has 5,395K shares, representing 2.61% ownership. They recorded an increase of 2.47% from their prior holding of 5,262K shares and upped their allocation in SNOW by 7.28% this past quarter.

Geode Capital Management reports 4,212K shares, making up 2.04% of ownership. This is an increase of 1.86% from their previous count of 4,134K shares, although they reduced their portfolio allocation by 44.06% in the last quarter.

Fintel is a comprehensive platform for investing research, catering to individual investors, traders, financial advisors, and smaller hedge funds. Our extensive data includes fundamentals, analyst reports, ownership information, fund sentiment, options activity, insider trading insights, and more. Additionally, our exclusive stock recommendations are driven by robust, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.