Agree Realty: A Promising Investment in the REIT Market

Understanding Net Lease REITs

Agree Realty, a net lease real estate investment trust (REIT), offers a dividend yield of 4.1%. This yield slightly exceeds the average of 3.7% for the REIT sector but falls short of the 5.6% offered by leading competitor Realty Income. With high-value seven-figure portfolios in mind, is Agree Realty still a worthwhile investment? Perhaps.

A net lease means that tenants are responsible for most property-related operating expenses. Typically, these assets are leased to a single tenant, which brings a high level of risk—either a property is fully leased or completely vacant. Investors can reduce risk through diversification, and Agree Realty holds over 2,200 properties in its portfolio, providing significant protection.

Image source: Getty Images.

Agree Realty targets retail assets, which tend to be similar in characteristics, allowing for easier transactions. The retail net lease market in the U.S. is estimated at around $1.5 trillion, creating ample opportunities for Agree in a competitive landscape. Their strategy focuses on partnering with robust tenants.

Another method to lower risk involves stringent monitoring of lessees and proactive management. Agree Realty has actively marketed to improve the quality of its tenant base, selling off properties leased to Walgreens Boots Alliance while acquiring sites from stronger retailers like Tractor Supply and TJX Companies. After a tough lesson in 2011 when bookseller Borders went bankrupt and forced a dividend cut, Agree has adopted a more prudent approach with respect to troubled tenants. At that time, the REIT was significantly smaller than it is now.

Agree’s sound balance sheet, underpinned by an investment-grade credit rating, enables it to secure debt at favorable rates and positions the company to weather financial challenges, safeguarding its decade-long history of annual dividend increases.

The Investment Case for Agree Realty

Overall, Agree Realty demonstrates a robust net lease business model with considerable growth potential. Comparatively, Realty Income owns more than 15,400 properties, highlighting the relative size and scalability of Agree’s operations. This smaller scale affords Agree the flexibility to drive growth without needing to allocate massive investments.

Evidence of this growth is reflected in its dividend history. Over the past decade, Agree’s dividend has risen at a compound annual growth rate of approximately 6%, contrasted with Realty Income’s growth rate of about 3%. While this difference may seem modest in absolute terms, it effectively means Agree’s dividends have doubled the growth rate of its larger competitor—a significant divergence.

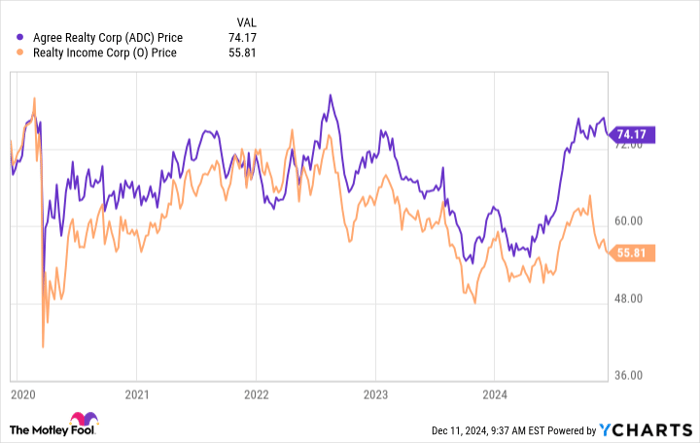

ADC data by YCharts

It’s no surprise that Agree’s share price has rebounded close to pre-pandemic levels, while Realty Income’s stock remains below early 2020 figures. Despite this potential for growth, investors should note the current premium price Agree commands, reflected in its lower dividend yield. Agree Realty may not be the optimal choice for those seeking maximum current income; rather, it fits the profile of a growth and income stock. Its growth potential may offer better odds for wealth accumulation compared to Realty Income.

Agree Realty: A Solid Addition to a Diverse Portfolio

For individuals aiming to build long-term wealth, incorporating Agree Realty into a diversified portfolio makes sense. Although it won’t yield overnight riches, it shows faster growth than several competitors, justifying a premium for those who prioritize growth over immediate income. If you’re interested in diversifying with a steadily growing net lease REIT, Agree Realty is worth considering.

Is Now the Time to Invest $1,000 in Agree Realty?

Before making a purchase, it’s wise to assess your options:

The Motley Fool Stock Advisor team has identified ten stocks they believe are excellent investments right now—and Agree Realty isn’t one of them. Their picks could potentially deliver significant returns in the future.

For context, consider when Nvidia was recommended on April 15, 2005; if you had invested $1,000 then, you’d have $822,755 today!

Stock Advisor provides valuable resources for investors, including portfolio-building guidance, analyst updates, and two new stock picks each month. The service has outperformed the S&P 500 by more than quadrupling its returns since 2002.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

Reuben Gregg Brewer holds positions in Realty Income. The Motley Fool has positions in and recommends Realty Income, TJX Companies, Tractor Supply, and Vanguard Real Estate ETF. Read our disclosure policy for more details.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.