“`html

Oil-Dri of America: A Hidden Gem in the Sorbent Market

Many publicly traded companies operate with seemingly ordinary business models but yield extraordinary returns. One such example is Oil-Dri of America (NYSE: ODC), a leading maker and seller of sorbent minerals and related products.

Despite a business description that may not seem exciting, Oil-Dri’s stock has tripled in the past two years. Since 2000, the company’s performance has nearly tripled the returns of the S&P 500 index, marking it as a 16-bagger.

While past returns are impressive, Oil-Dri’s future prospects could be even stronger. Here’s an overview of this lesser-known quality dividend stock and why it could continue its market outperformance for years to come.

Understanding Oil-Dri’s Business

Recognized on Forbes’ lists of “America’s Most Successful Small Companies” for two consecutive years, Oil-Dri is finally gaining market recognition. Mining clay since 1963, the company operates facilities in six states and boasts clay reserves that are expected to last another 40 years.

Oil-Dri’s operations support multiple markets:

- Pet care (55% of sales): Oil-Dri offers patented lightweight scoopable litter under brand names like Cat’s Pride, Jonny Cat, and KatKit. After acquiring Ultra Pet in 2024, Oil-Dri ventured into the crystal litter market, which is gaining popularity among cat owners.

- Fluids purification (21% of sales): The company supplies clay products that help process various oils, including vegetable oils and biodiesel, while also offering adsorbents to remove metals from the renewable diesel sector.

- Industrial and sports (10% of sales): Oil-Dri’s granular clay absorbents control spills in garages and mechanics’ shops. Additionally, its products are used for drainage on sports fields and to enhance baseball diamond surfaces.

- Agriculture and horticulture (8% of sales): Oil-Dri’s Agsorb and Verge products assist in nurturing and protecting crops.

- Animal health (6% of sales): Amlan International, a subsidiary, produces natural feed additives that promote animal health and safety from toxins.

Although Oil-Dri faces competition in these sectors, its vertically integrated approach offers a significant edge. Many of its products are essential purchases for customers, leading to stable and consistent sales for this industrial firm.

Image source: Getty Images.

Future Growth and Innovative Strategies

Oil-Dri’s future looks promising due to strong growth opportunities and remarkable profitability improvements.

The acquisition of Ultra Pet for $46 million in May 2024 allowed the company to enter the thriving crystal litter market, which has expanded significantly since 2018. Oil-Dri has already established a solid footing with a 31% market share in branded clay litter and a 79% share in private-label products, and aims to replicate this success in crystal litter through Ultra Pet.

Additionally, the U.S. renewable diesel production increased dramatically from 800 million gallons in 2020 to an expected 6 billion gallons in 2025. This surge in demand makes Oil-Dri’s fluid purification products even more vital. The company is adding new plants to meet this growing demand, poised for further growth.

Encouragingly, this growth is taking place without sacrificing profitability. The company’s focus on optimizing its sales mix, referred to as its “Moneyball” approach, aims to enhance value across its product range. As Chief Financial Officer Susan Kreh noted during the first-quarter earnings call, they are concentrating on high-value products while trimming unprofitable offerings.

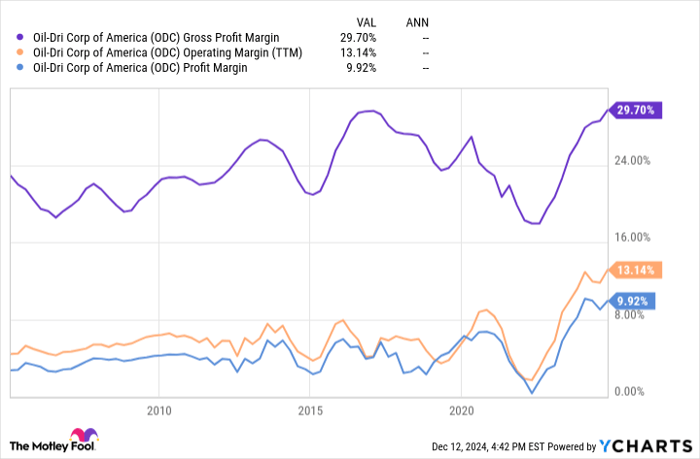

This strategic focus has led to record margins unseen in over two decades.

ODC Gross Profit Margin data by YCharts

Such improving profitability enables a 1.4% dividend yield, accounting for only 18% of net income. This suggests that Oil-Dri could potentially triple its dividend and still retain half of its profits. Although the management has historically preferred a conservative approach to dividend increases, the recent 7% rise indicates potential for future growth as profitability grows.

Currently trading at just 14 times earnings and experiencing 10% annual sales growth over the past five years, with a remarkable 15% spike in the last quarter, Oil-Dri may be undervalued if it can maintain long-term profitability.

Seize the Opportunity for Growth

Have you ever felt you missed an opportunity with successful stocks? Now might be your chance.

Occasionally, our expert analysts put forth a strong recommendation for companies poised for significant growth. If you’ve been hesitant to invest, this could be your moment before the opportunity slips away. Below are a few highlights:

- Nvidia: A $1,000 investment in 2009 would be worth $348,112 today!*

- Apple: If you invested $1,000 in 2008, you’d have $46,992!*

- Netflix: A $1,000 investment in 2004 would have grown to $495,539!*

At present, we are recommending “Double Down” alerts for three outstanding companies, and opportunities like this may not come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`