Exploring Investment Options in the Nasdaq: The Nasdaq Composite and Nasdaq-100

When discussing investments in the Nasdaq, people often refer to two key options: the Nasdaq Composite and the Nasdaq-100. The Nasdaq Composite encompasses a wide array of over 2,500 companies on the Nasdaq (NASDAQ: NDAQ) stock exchange, while the Nasdaq-100 focuses specifically on the largest non-financial stocks within that index.

Choosing between the two isn’t straightforward, as each has its advantages. The Composite offers more diversity, while the Nasdaq-100 zeroes in on the biggest players.

Why Consider an ETF like Invesco QQQ Trust?

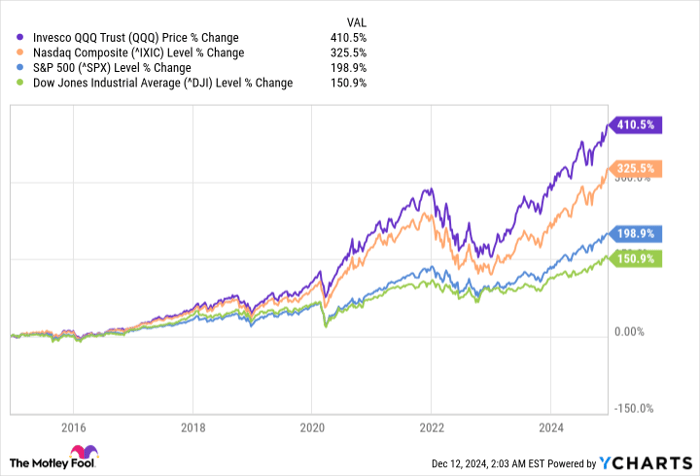

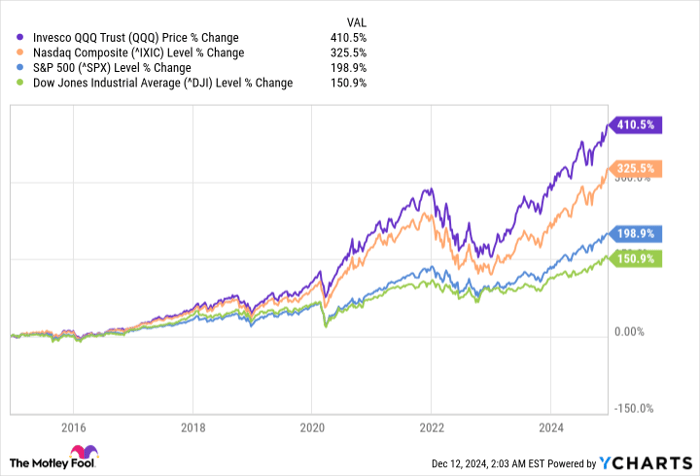

Looking toward the future, one attractive investment option for many is a Nasdaq-100 exchange-traded fund (ETF), particularly the Invesco QQQ Trust (NASDAQ: QQQ). This fund has gained popularity among investors, boasting impressive long-term returns.

Data by YCharts.

Top Holdings Driving Growth Opportunities

The Invesco QQQ Trust is weighted by market capitalization, meaning larger companies have a bigger impact on the fund’s performance. This leads to several megacap tech stocks being the primary contributors. Here are the ETF’s top 10 holdings:

| Company | Percentage of the ETF |

|---|---|

| Apple | 8.96% |

| Nvidia | 7.88% |

| Microsoft | 7.83% |

| Amazon | 5.62% |

| Meta Platforms | 5.12% |

| Broadcom | 4.89% |

| Tesla | 4.61% |

| Costco Wholesale | 2.70% |

| Alphabet (Class A) | 2.58% |

| Alphabet (Class C) | 2.48% |

Data source: Invesco. Percentages as of Dec. 10.

Although these 10 companies represent more than 52% of the ETF, their robust growth prospects make them appealing. They are tied to significant trends like artificial intelligence (AI), cloud computing, and electric vehicles (EV), all showing strong momentum.

AI is poised to reshape various industries. Companies in the ETF lead advancements in fields such as graphics processing, machine learning, and semiconductors. In cloud computing, the leaders are Amazon, Microsoft, and Alphabet, holding market shares of 31%, 20%, and 11%, respectively, indicating substantial growth potential as adoption expands.

The global EV market, valued at just over $500 billion in 2023, is projected to grow to nearly $1.9 trillion by 2032—an impressive compound annual growth rate of almost 14%. While Tesla is the only EV manufacturer in the top 10, it relies on various suppliers for necessary hardware and software.

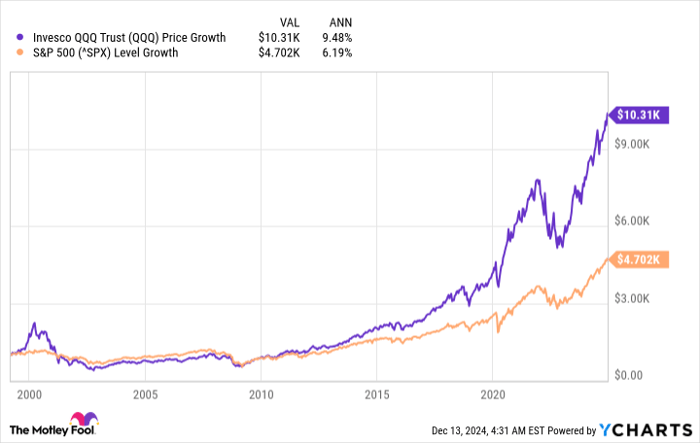

Proven Track Record of the Invesco QQQ Trust

Since launching in March 1999, the Invesco QQQ Trust has delivered a remarkable return of over 930% (as of Dec. 12) with an average annual return of about 9.5%. This performance has consistently outpaced the S&P 500. An investment of $1,000 at inception would now be worth more than $10,300.

Data by YCharts.

Historical performance provides no guarantees for future results; however, it is reassuring to see the ETF withstand significant market downturns such as the dot-com crash, the Great Recession, and the COVID-19 pandemic.

Additionally, the energy of your investment is kept to a minimum. With an expense ratio of just 0.2%, you would pay $2 for every $1,000 invested each year. While there are cheaper options available, such as some S&P 500 ETFs at just 0.03%, QQQ remains a reasonable choice offering proven value and growth opportunities.

Is Now the Right Time to Invest $1,000 in Invesco QQQ Trust?

Before making any investment decisions regarding Invesco QQQ Trust, it’s important to think carefully:

The Motley Fool Stock Advisor analyst team recently pinpointed what they believe are the 10 best stocks to invest in right now, and the Invesco QQQ Trust was not included. These top selections may yield significant returns in the future.

For instance, when Nvidia was recommended on April 15, 2005, an investment of $1,000 would have grown to $822,755!*

Stock Advisor offers investors a detailed strategy for success, including portfolio-building advice, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

Explore the 10 stocks »

*Stock Advisor returns as of December 9, 2024

Note: John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is part of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a board member, alongside Randi Zuckerberg, a former Facebook market development director and sister to Meta CEO Mark Zuckerberg. Stefon Walters holds positions in Apple and Microsoft. The Motley Fool has stakes in several major companies, including Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, and Tesla. They recommend Broadcom and Nasdaq, alongside options trading strategies involving Microsoft. The Motley Fool maintains a strict disclosure policy.

The views expressed here reflect those of the author and do not necessarily represent those of Nasdaq, Inc.