Investing in Alphabet: Weighing Opportunities Against Legal Challenges

Understanding why an investment may falter is just as crucial as recognizing its potential for success. This insight is especially important for investors eyeing Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), which is sending mixed signals to its stakeholders.

On one side, Alphabet’s advertising revenue remains strong, while its cloud computing and artificial intelligence (AI) sectors are rapidly growing. The stock currently trades at an attractive valuation. Conversely, the Department of Justice (DOJ) intends to dismantle Alphabet’s operations, targeting its Google Chrome browser over monopoly concerns. Investors must now consider which scenario poses the greater risk.

Legal Hawk: The DOJ Targets Alphabet

The DOJ has intensified its scrutiny of Alphabet, recently winning a ruling that finds Google—an Alphabet subsidiary—in violation of antitrust laws. The DOJ is advocating for the sale of Google Chrome, although a final verdict is still pending and could take years to reach.

Alphabet retains the option to appeal to the Supreme Court, which could delay resolution even further. This ongoing legal issue may continue to overshadow the company, but it’s likely that Alphabet is already strategizing contingency plans in case the ruling does not go in its favor.

A historical reference is Microsoft’s antitrust case from the early 2000s. In April 2000, a judge found Microsoft guilty of monopolistic practices, ordering a breakup just two months later. However, an appeals court overturned that decision the following year, and it took years for a resolution to be finalized.

Considering this protracted process, Alphabet faces a significant timeline before the lawsuit concludes. Therefore, investors might want to avoid hasty reactions regarding their positions at this stage.

Given this context, the current “red flag” appears to be more of a distraction than a defining signal for the future.

Promising Growth: Google Cloud and AI on the Rise

For those examining Alphabet’s financial health, its solid performance should warrant greater optimism. In Q3, the company experienced a 15% year-over-year revenue increase, with earnings per share (EPS) jumping from $1.55 to $2.12—a robust 37% growth driven by its cloud computing segment.

Google Cloud’s popularity stems from its advanced AI tools, which provide clients with powerful options like leading GPUs and in-house TPUs (tensor processing units). TPUs can significantly outperform traditional GPUs, making them advantageous in AI development, thus lowering operational costs and time for businesses.

In Q3, Google Cloud’s revenue surged by 35% year over year, improving from 29% in Q2 and 28% in Q1. This expanding segment could greatly influence Alphabet’s overall performance as it scales up.

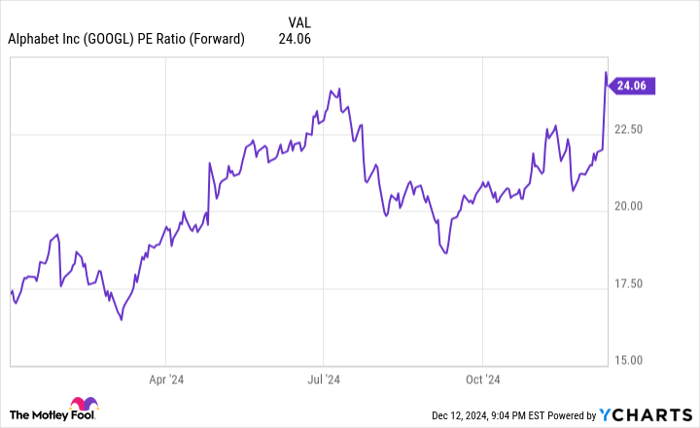

Interestingly, the ongoing DOJ investigation has created an opportunity for investors to acquire Alphabet shares at a reasonable price. Currently priced at approximately 24 times forward earnings, this valuation is notably lower than many comparable tech stocks.

GOOGL PE Ratio (Forward) data by YCharts

Alphabet stands out as the most attractively priced stock within the “Magnificent Seven” group, suggesting it is doing just as well—if not better—than many of its peers.

Based on this analysis, the bullish outlook considerably outweighs the bearish concerns. Investors have a promising opportunity to buy Alphabet shares, especially with a strong 2025 anticipated fueled by its AI efforts, despite the DOJ challenge still on the horizon.

A Second Chance at a Potentially Lucrative Investment

If you’ve ever felt you missed the boat on buying strong stocks, this might be your moment.

Our expert analysts occasionally issue “Double Down” recommendations for companies poised for significant growth. If you’re worried that you’ve missed your chance to invest, now is an optimal time to act before it’s too late. The numbers back it up:

- Nvidia: an investment of $1,000 when we recommended it back in 2009 would now be worth $348,112!*

- Apple: a $1,000 investment in 2008 would now stand at $46,992!*

- Netflix: invested $1,000 in 2004? That’s now $495,539!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and opportunities like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.