Ball Corporation Faces Decline Amidst Ongoing Industry Challenges

Financial Overview of the Aluminum Packaging Leader

With a market cap of $17.4 billion, Ball Corporation (BALL) provides aluminum packaging products across various sectors, including beverages, personal care, and household items. The company, based in Westminster, Colorado, also manufactures extruded aluminum aerosol containers, reclosable aluminum bottles, aluminum cups, and aluminum slugs.

Typically, companies valued over $10 billion are categorized as “large-cap stocks,” and BALL fits this classification. In addition to packaging, BALL supplies aerospace and other technologies to the U.S. government, establishing itself as a leading provider in recyclable aluminum packaging known for its commitment to sustainability.

Recent Stock Performance: A Significant Decline

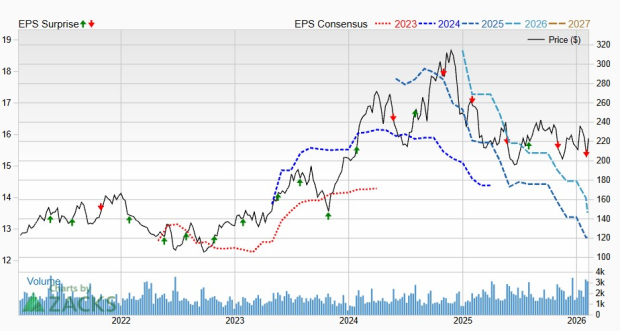

Despite its solid position in the market, BALL has seen its stock drop by 18.3% from its 52-week peak of $71.32, reached on April 30. In the last three months, shares of BALL fell 11.8%, notably underperforming the Nasdaq Composite’s ($NASX) 12.7% increase during the same period.

In the past year, BALL’s stock has decreased by 1.2%, a stark contrast to the NASX’s impressive 35.2% returns. Year-to-date, BALL’s shares are up nearly 1.3%, but that pales in comparison to NASX’s gains of 32.7%.

To emphasize its downward trend, BALL has been trading below both its 200-day and 50-day moving averages since late October.

Challenges Identified in Recent Earnings Report

Over the past year, BALL’s struggles can be largely attributed to declining organic revenue and cash flow margins. Following a mixed Q3 earnings report on October 31, the company’s shares dropped 7.7%. Revenue decreased by 13.7% year-over-year to $3.08 billion, missing expectations by 1.6%. Conversely, BALL’s adjusted earnings per share improved by 10% compared to the previous year, surpassing Wall Street estimates by 6%.

While the company reported increased volumes in the EMEA region, this was countered by lower volumes in North, Central, and South America. Each segment, despite the volume drops, showed year-over-year profit growth mainly due to improved gross and operating margins.

Comparative Performance Against Rival Companies

When compared to its competitor, Crown Holdings, Inc. (CCK), which has seen a decline of 2.8% over the past year and 4.6% year-to-date, BALL has outperformed in some metrics.

Analysts Show Moderate Optimism for Future

Although BALL’s recent performance has raised concerns, analysts maintain a moderately optimistic outlook. The stock currently holds a consensus rating of “Moderate Buy” from 14 analysts, with a mean price target of $71.77, suggesting a potential 23.2% increase from current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.