Analysts Expect Gains for First Trust Value Line Dividend Index Fund ETF

Analysts have high hopes for the First Trust Value Line Dividend Index Fund ETF, with a promising upside predicted based on its underlying holdings.

The implied analyst target price for the First Trust Value Line Dividend Index Fund ETF (Symbol: FVD) is set at $49.27 per unit, as derived from the performance of its underlying stocks. Currently, FVD is trading at around $44.69 per unit, suggesting analysts anticipate a potential increase of 10.24% in the ETF’s value when considering the average targets of these holdings.

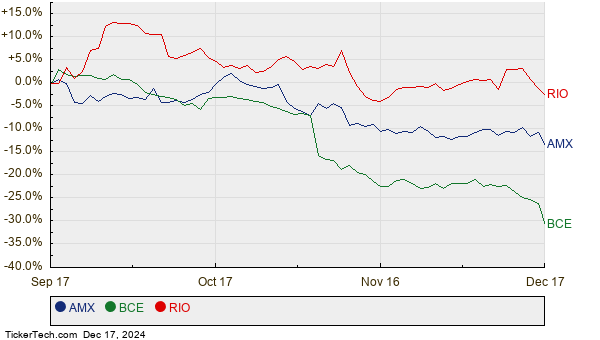

Among FVD’s underlying stocks, three stand out for their notable upside relative to their analyst target prices: America Movil SAB de CV (Symbol: AMX), BCE Inc (Symbol: BCE), and Rio Tinto plc (Symbol: RIO). AMX’s recent trading price is $14.51/share; analysts have set a target price of $20.82/share, indicating an upside of 43.51%. BCE’s recent price stands at $23.86, with an average target of $32.22/share, which translates to a 35.05% potential increase. Lastly, RIO is currently trading at $61.26, against an expected target price of $81.58/share, indicating a 33.16% upside. Below is a chart illustrating the twelve-month stock performance of AMX, BCE, and RIO:

A summary of the current analyst target prices is shown in the table below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Value Line Dividend Index Fund ETF | FVD | $44.69 | $49.27 | 10.24% |

| America Movil SAB de CV | AMX | $14.51 | $20.82 | 43.51% |

| BCE Inc | BCE | $23.86 | $32.22 | 35.05% |

| Rio Tinto plc | RIO | $61.26 | $81.58 | 33.16% |

These insights raise important questions: Are analysts being too optimistic with their predictions, or do they have valid reasons based on recent developments in these companies and their industries? A higher target price can signal confidence, but it may also lead to potential downgrades if those targets are not met. Investors are encouraged to conduct further research to gain clarity on these issues.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• WDC market cap history

• IXJ Split History

• Funds Holding RIT

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.