Mid-Cap ETF Sees Potential Gains, Analysts Predict Upside

In our latest analysis of ETFs at ETF Channel, we’ve examined how the iShares Morningstar Mid-Cap ETF (Symbol: IMCB) stacks up against analyst expectations. We calculated a weighted average implied target price of $87.58 per unit for IMCB, based on its underlying holdings.

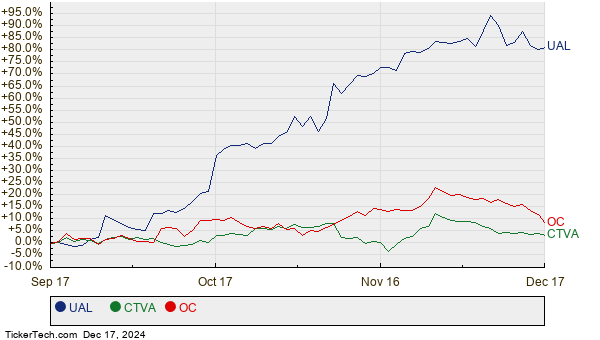

Currently trading at approximately $79.54 per unit, IMCB presents analysts with a promising upside of 10.11%. Notably, among the ETF’s holdings, three companies—United Airlines Holdings Inc (Symbol: UAL), Corteva Inc (Symbol: CTVA), and Owens Corning (Symbol: OC)—are expected to experience significant growth toward their target prices. For instance, UAL’s recent trading price of $95.48 is well below the average target of $109.81, reflecting a substantial potential increase of 15.01%. Similarly, CTVA is positioned for a 12.16% gain, moving from its current price of $58.95 to a target of $66.12. Analysts anticipate OC to hit a target price of $207.00, which represents an 11.73% increase from its latest price of $185.26. The accompanying chart illustrates the 12-month price history of these stocks:

Here’s a quick summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Morningstar Mid-Cap ETF | IMCB | $79.54 | $87.58 | 10.11% |

| United Airlines Holdings Inc | UAL | $95.48 | $109.81 | 15.01% |

| Corteva Inc | CTVA | $58.95 | $66.12 | 12.16% |

| Owens Corning | OC | $185.26 | $207.00 | 11.73% |

Investors must consider whether these analyst target prices are warranted or overly ambitious. The nature of a high target can indicate confidence in a stock’s future performance, but it may also hint at possible downgrades if the predictions no longer align with industry trends. These considerations underscore the need for thorough research as investors assess the upcoming year.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Utilities Stocks Hedge Funds Are Selling

• B. Riley Financial Past Earnings

• PAYX shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.