Broadcom’s Remarkable Surge: A Potential Growth Stock to Watch

Nvidia (NASDAQ: NVDA) has driven the semiconductor industry to new heights throughout 2023 and into 2024, showcasing the rapid growth within the artificial intelligence (AI) sector. It constantly competes with Apple and Microsoft for the title of the world’s most valuable company. Yet, it’s not alone; other chip stocks, particularly Broadcom, have also reported impressive gains.

Broadcom’s Standout Performance

Following the release of its fiscal 2024 fourth-quarter earnings (which concluded on November 3) on December 12, Broadcom (NASDAQ: AVGO) experienced a significant jump, rising 24.4% on December 13 and reaching a market cap of $1.05 trillion. In fact, the stock has more than doubled in value this year and increased over 600% in the past five years. By comparison, Nvidia’s stock gained only 1% in the last six months, while Broadcom soared approximately 44% as of December 16.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Understanding Broadcom

Broadcom specializes in global connectivity, offering both hardware and software solutions that cater to cloud infrastructure, data centers, networking, and more. The company produces advanced Ethernet switching equipment, anticipating increased demand from major cloud providers like Amazon Web Services, as well as application-specific integrated circuits (ASICs). Broadcom holds a leading position in the ASIC market, which could see rising demand as companies seek alternatives to Nvidia’s GPUs.

Exceptional Financial Results

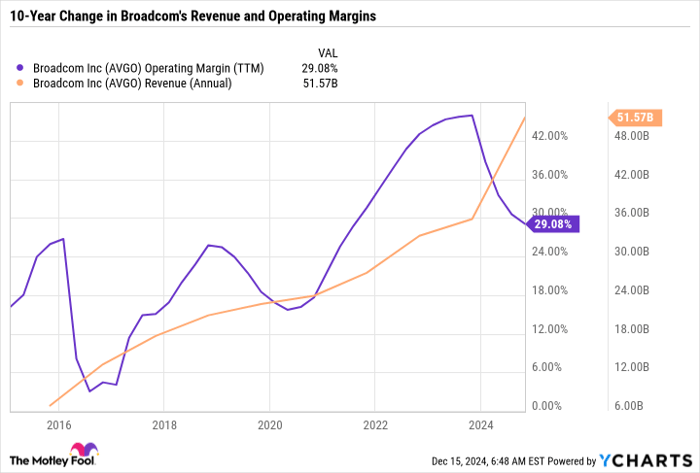

The rise of cloud computing and AI has transformed Broadcom from a value-focused firm to a high-growth company, significantly boosting its market cap. Over the past decade, the company’s revenue has increased nearly eightfold and grew by 44% in fiscal 2024 compared to fiscal 2023. Although recent adjustments related to the VMware acquisition caused some margin narrowing, the company is heavily investing in innovation.

AVGO Operating Margin (TTM) data by YCharts.

Looking ahead, management forecasts strong momentum into fiscal 2025, expecting first-quarter revenue to reach $14.6 billion and adjusted EBITDA at $9.64 billion. If achieved, that would mark a year-over-year revenue increase of 22% and a 35% rise in adjusted EBITDA.

The Impact of VMware Acquisition

Broadcom completed its acquisition of VMware in early fiscal 2024, enhancing its presence in the software and cloud markets. Leaders within Broadcom noted that the integration of VMware is ahead of schedule and supports both sales and earnings growth. CEO Hock Tan highlighted remarkable AI revenue growth—up 220% from $3.8 billion in fiscal 2023 to $12.2 billion in fiscal 2024—representing 41% of total semiconductor revenue.

This surge in AI revenue contributed to a record semiconductor revenue of $30.1 billion for the year.

AI is becoming the largest revenue segment for Broadcom, with a positive outlook. However, it was management’s three-year forecast that led to a significant market cap increase of over $200 billion in a single session.

Looking Ahead

Previously, Broadcom’s value was mainly assessed through its earnings and growing dividend, which rose by 11%. With the company experiencing rapid transformations, it is now entering a phase of valuation expansion, where investors may focus more on expected future earnings rather than past performance.

Analysts expect significant earnings growth in the coming year. Currently, Broadcom trades at a forward price-to-earnings ratio of 36, which is fairly reasonable given that its stock doubled over the past year and increased more than sevenfold in the last five years. However, investors should remain cautious as projections can diverge from results, especially within the volatile semiconductor market.

Weighing Investment Risks

Broadcom was once seen primarily as a network connectivity company ready to capitalize on AI demand. Now, it has shifted its focus, claiming that the AI semiconductor market will dominate its revenue. This shift resembles Nvidia’s evolution, with its data center business now constituting 85% of its total revenue.

If you believe in Broadcom’s vision for capitalizing on hyperscaler investments in AI, it could be a solid investment. Should the company meet its growth targets, today’s share price may be considered a bargain in hindsight.

Conversely, potential market downturns or overly optimistic forecasts could negatively impact the stock. Management has also indicated that investment growth from hyperscalers is expected to be inconsistent, which could lead to significant price fluctuations.

A Chance to Consider New Opportunities

Have you ever felt like you missed out on some of the most successful stock purchases? Now might be the time to reevaluate.

On rare occasions, our team of experts issues a “Double Down” stock recommendation for companies they project will see significant gains. If you’re concerned about missing your opportunity to invest, don’t wait too long. The figures illustrate the potential impact:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $342,278!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $47,543!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $496,731!*

Presently, we’re identifying three outstanding “Double Down” stocks, and this could be a limited opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.