Analyst Insights: Potential Upside for Small Cap Growth ETF

The SPDR S&P 600 Small Cap Growth ETF (Symbol: SLYG) shows promising potential, according to recent analyst estimates. The implied target price for the ETF, based on its underlying holdings, stands at $108.38 per share.

Current Market Position of SLYG

Currently, SLYG trades at approximately $95.32 per unit. This indicates a potential upside of 13.70% when compared to the average analyst targets for its holdings. Notable companies within this ETF that exhibit significant upside to their target prices include Artivion Inc (Symbol: AORT), Payoneer Global Inc (Symbol: PAYO), and SPX Technologies Inc (Symbol: SPXC).

Underlying Stocks and Their Potential Upside

Artivion Inc (AORT) has a recent trading price of $28.90 per share, with an average analyst target significantly higher at $33.17, representing a 14.76% upside. Similarly, Payoneer Global Inc (PAYO) is priced at $10.27 with targets suggesting a rise of 14.14% to $11.72. SPX Technologies Inc (SPXC), meanwhile, has a current price of $153.03 and an analyst target of $174.33, indicating potential growth of 13.92%.

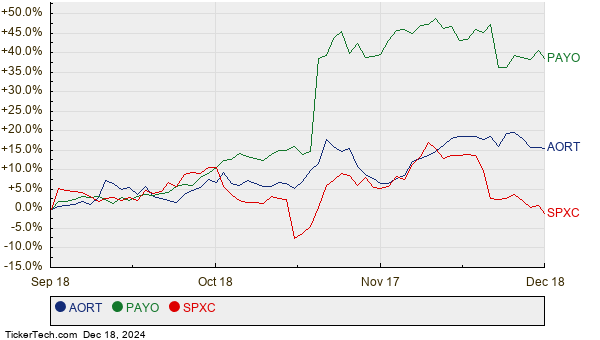

Performance Overview Chart

Below is a twelve-month price history chart for these stocks, illustrating their performance trends:

Summary of Analyst Targets

The following table summarizes the current analyst target prices for the featured stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 600 Small Cap Growth ETF | SLYG | $95.32 | $108.38 | 13.70% |

| Artivion Inc | AORT | $28.90 | $33.17 | 14.76% |

| Payoneer Global Inc | PAYO | $10.27 | $11.72 | 14.14% |

| SPX Technologies Inc | SPXC | $153.03 | $174.33 | 13.92% |

Investors’ Considerations

As we evaluate these target prices, it raises questions about whether analysts’ expectations are realistic or overly optimistic, considering the current market conditions. High target prices relative to trading prices can indicate optimism but might also signal potential downgrades if analysts haven’t adjusted their forecasts based on recent company or industry developments. Investors would do well to conduct further research to assess the validity of these price targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Construction Dividend Stock List

• Top Ten Hedge Funds Holding NIPG

• Funds Holding LI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.