Palantir Technologies: Riding a Wave of AI Growth Despite Potential Risks

Performance and market dynamics around Palantir Technologies Inc PLTR have captured investor interest this year, with the stock soaring nearly 350% since January. However, as the equity sector often faces adjustments, caution is warranted.

The Bullish Case for Palantir

Supporters of Palantir present numerous reasons to remain optimistic. The field of artificial intelligence has gained significant traction, with a report from Cognizant Impact forecasting that generative AI could inject $1 trillion into the U.S. economy over the next decade.

Strategic Partnerships Boosting Growth

Palantir continues to secure important alliances, recently partnering with Red Cat Holdings, Inc. RCAT. This collaboration aims to enhance the capabilities of autonomous warfare drones through Palantir’s AI technology, creating a buzz in the market.

Technical Indicators: A Mixed Bag

From a technical standpoint, PLTR stock is currently trading significantly above its key moving averages. Traders often prefer to follow prevailing trends unless a strong counter-indication arises.

Signs of Potential Weakness

Nevertheless, signs of overheating may be emerging. Some indicators suggest the stock is overbought, while Wall Street analysts maintain a bearish outlook, assigning an overall rating of 2.2, indicating a tendency to sell. Additionally, recent insider selling could signal possible volatility ahead.

Direxion ETFs: New Opportunities Amid Uncertainty

For investors navigating the mixed signals, the launch of Palantir-focused exchange-traded funds (ETFs) by Direxion offers fresh opportunities. These funds aim to harness the sentiment surrounding Palantir’s stock.

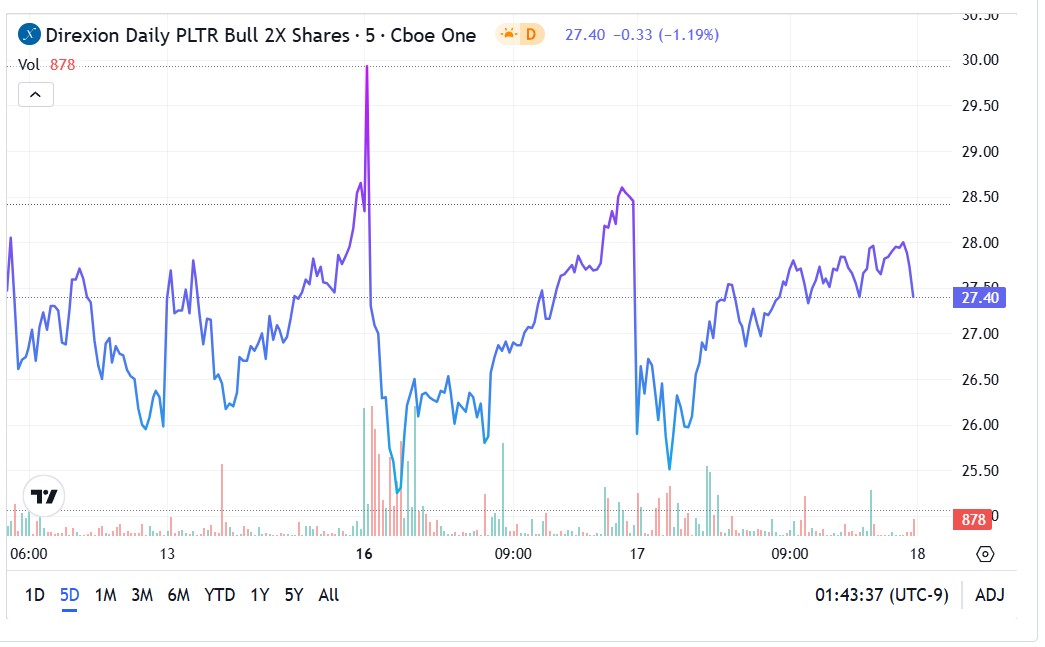

Bullish investors might consider the Direxion Daily PLTR Bull 2X Shares PLTU, which targets daily returns of 200% of PLTR’s performance. Conversely, those who hold a bearish view may explore the Direxion Daily PLTR Bear 1X Shares PLTD, designed to yield daily returns that are the complete inverse of PLTR’s performance.

Advantages and Considerations of Direxion ETFs

Investors choose these Direxion ETFs for their simplicity compared to traditional options trading. However, it’s critical to remember that these funds should only be held for a single day to avoid value decay due to daily compounding effects.

Market Trends for PLTU and PLTD

Since its launch on December 11, 2024, the PLTU ETF has limited pricing data, but its trend indicates potential support at around $26. To maintain bullish momentum, it will be crucial for this level to hold.

- Shortly after launch, PLTU settled into a trading channel, facing resistance at $29 and support at $26.

- Should support fail around $26, a drop to the $25 level might follow.

Current Landscape for PLTD

The PLTD ETF also debuted on December 11, without extensive pricing data, yet it currently reflects a trend of skepticism.

- After an energetic start, PLTD has formed a consolidation pattern with resistance at $24.50 and support at $23.30.

- It’s crucial for PLTD to break past the $24 level to maintain its market structure.

Featured photo by Jensen Art Co on Pixabay.

Market News and Data brought to you by Benzinga APIs