Analysts See Strong Potential in Invesco S&P Ultra Dividend Revenue ETF

At ETF Channel, we have analyzed the Invesco S&P Ultra Dividend Revenue ETF (Symbol: RDIV) by comparing its underlying holdings’ trading prices against the average analyst target prices for the next 12 months. Our findings reveal an implied analyst target price of $54.90 per unit for RDIV.

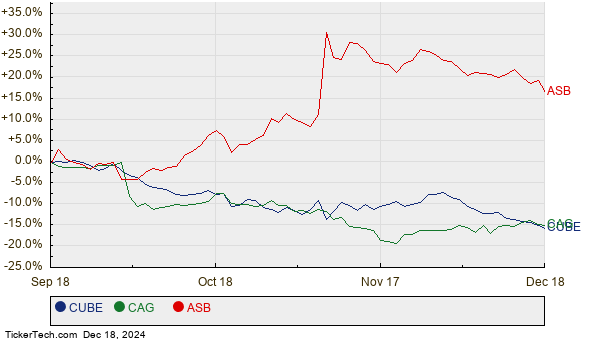

Currently trading at about $49.69 per unit, RDIV shows potential for upside, with analysts suggesting a 10.49% increase. Among its underlying holdings, three stocks stand out for their promising growth projections: CubeSmart (Symbol: CUBE), Conagra Brands Inc (Symbol: CAG), and Associated Banc-Corp (Symbol: ASB). CUBE is currently priced at $45.54 per share, but analysts target it at $50.71, indicating an 11.36% upside. Conagra Brands, trading at $27.88, has a target price of $30.93, presenting a potential 10.95% gain. Similarly, ASB’s recent price of $25.10 is expected to climb to $27.78, which equates to a 10.67% increase.

Below is a chart reflecting the twelve-month price history for CUBE, CAG, and ASB:

Here’s a summary table of the current analyst target prices mentioned:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P Ultra Dividend Revenue ETF | RDIV | $49.69 | $54.90 | 10.49% |

| CubeSmart | CUBE | $45.54 | $50.71 | 11.36% |

| Conagra Brands Inc | CAG | $27.88 | $30.93 | 10.95% |

| Associated Banc-Corp | ASB | $25.10 | $27.78 | 10.67% |

The crucial question remains: Are these analyst targets realistic, or are they overly optimistic? Investors need to consider whether these predictions are backed by solid company and industry insights, or if they are remnants of past performance. A high target compared to current stock prices may indicate future potential, but it also runs the risk of downgrades if the estimates miss the mark. Thorough research is essential for investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• OUNZ YTD Return

• CWBR Split History

• AIKI market cap history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.