Target Price Insights for Xtrackers S&P 500 ESG ETF and Key Holdings

At ETF Channel, we analyzed the performance of the Xtrackers S&P 500 ESG ETF (Symbol: SNPE) by comparing its trading price against the average analyst 12-month target prices of its holdings. We found the implied target price for SNPE to be $60.77 per unit.

Current Market Position and Analyst Aspirations

Currently, SNPE trades at around $54.86 per unit. This indicates that analysts predict an upside of 10.78% for the ETF based on its underlying stocks. KeyCorp (Symbol: KEY), Iron Mountain Inc (Symbol: IRM), and Corplay Inc (Symbol: CPAY) each show significant potential for growth, with expected increases above their current share prices. For instance, KEY is priced at $17.80 per share, while the average analyst target stands at $19.82, suggesting an 11.37% upside. In a similar vein, IRM’s recent price of $110.09 provides an 11.05% potential gain, targeting $122.25. Lastly, CPAY’s current price of $352.10 has a target of $390.94, reflecting an 11.03% upside.

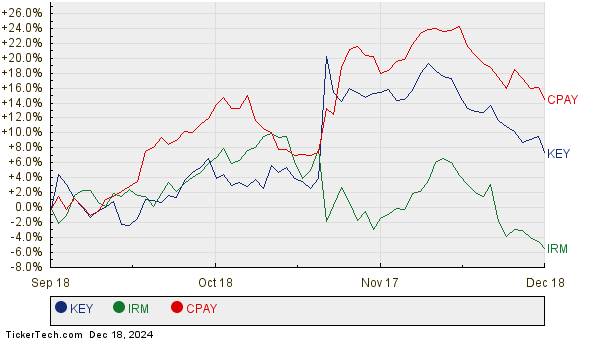

Below is a twelve-month price history chart comparing the performance of KEY, IRM, and CPAY:

Summary of Analyst Targets

Here’s a summary table that outlines the current analyst target prices for the relevant stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Xtrackers S&P 500 ESG ETF | SNPE | $54.86 | $60.77 | 10.78% |

| KeyCorp | KEY | $17.80 | $19.82 | 11.37% |

| Iron Mountain Inc | IRM | $110.09 | $122.25 | 11.05% |

| Corplay Inc | CPAY | $352.10 | $390.94 | 11.03% |

Questions for Investors

Are analysts too optimistic about these price targets, or are they based on sound reasoning? High price targets compared to current trading prices can signal positive future expectations. However, they might also hint at potential price downgrades if recent market trends aren’t considered. Investors need to conduct further research to determine the validity of these projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Monthly Dividend Paying Stocks

• SOI Insider Buying

• Top Ten Hedge Funds Holding PAYX

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.