Strong Retail Sales in November Signal Holiday Cheer for Consumers

November’s retail sales growth has given retailers a reason to cheer as the holiday shopping season reaches its peak. The Commerce Department reported a 0.7% increase in sales, following October’s upwardly revised reading of 0.5%. Retail sales, which reached an impressive $724.6 billion, highlight the underlying economic strength and showcase robust consumer spending on motor vehicles and online merchandise.

A resilient labor market, steady wage gains, and solid household finances fueled this consumer spending activity. Despite Cyber Monday shifting into December due to a late Thanksgiving, November’s performance reflects strong consumer participation and marks a promising beginning to this year’s shopping season. Compared to last year, retail sales rose by 3.8%.

Early signs from the holiday shopping season suggest a positive outlook for the retail sector, thanks to easing inflation and improved purchasing power. The recent interest rate cut by the Federal Reserve has also helped boost consumer confidence. As spending increases, retailers like Abercrombie & Fitch Co. ANF, Deckers Outdoor Corporation DECK, The Gap, Inc. GAP, and Amazon.com, Inc. AMZN are poised to take advantage of holiday demand.

Insights on Retail Sales Performance

Sales at motor vehicle and parts dealers saw a month-on-month increase of 2.6%. Similarly, both furniture and home furnishing stores, as well as electronics and appliance outlets, experienced a 0.3% rise. Building material, garden equipment, and supplies dealers posted a 0.4% increase.

Sales at sporting goods, hobbies, musical instruments, and bookstores rose by 0.9%, while receipts at gasoline stations increased by 0.1%. Online retailers reported a notable 1.8% jump, although sales at health and personal care stores remained flat.

In contrast, sales at food and beverage stores fell by 0.2%, and miscellaneous stores saw a more significant decline of 3.5%. Clothing and clothing accessory stores also experienced a dip of 0.2%. General merchandise stores reported a slight decrease of 0.1%, while food services and drinking places witnessed a 0.4% drop.

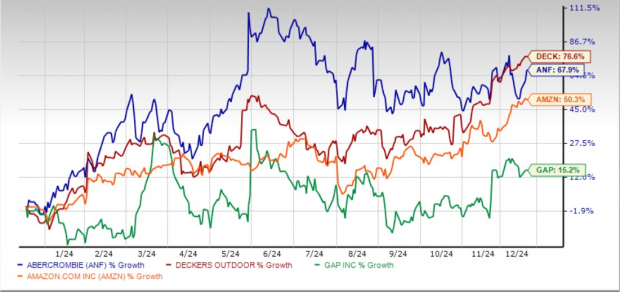

Stock Performance of Key Retailers: ANF, DECK, GAP & AMZN

Image Source: Zacks Investment Research

Key Retail Stocks to Watch

Abercrombie & Fitch: Expanding Brand Presence

Abercrombie & Fitch is emerging as a strong investment choice. The company successfully integrates digital and physical retail channels to enhance the shopping experience and increase customer satisfaction. Strategic marketing campaigns in essential markets have strengthened brand visibility and customer acquisition. Innovative product lines are being introduced to cater to specific customer needs.

As a global omnichannel specialty retailer, Abercrombie & Fitch has a trailing four-quarter earnings surprise of 14.8%, on average. The Zacks Consensus Estimate for its current financial-year sales and earnings per share (EPS) indicates growth of 14.9% and 69%, respectively, compared to the prior year. The company holds a Zacks Rank #1 (Strong Buy).

Deckers: Success with HOKA and UGG

Deckers continues to thrive by enhancing its brand presence and focusing on direct-to-consumer channels. Their commitment to product innovation and expanding into international markets, especially in the Asia-Pacific region, positions DECK for sustained growth. By prioritizing premium products from flagship brands like HOKA and UGG, Deckers executes a successful strategy in a competitive market.

Current estimates predict a 13.6% growth in sales and a 12.8% increase in EPS for Deckers, compared to last year’s figures. This company also carries a Zacks Rank #1, with an average trailing four-quarter earnings surprise of 41.1%.

Gap: Innovating to Meet Consumer Needs

Gap is well-positioned for growth by taking a multifaceted approach to strengthen its brand and encourage customer loyalty. By emphasizing product innovation and using consumer insights, the company is aligning its products with evolving preferences. Their investments in technology and digital channels aim to create a more convenient and personalized shopping experience, supporting profitability through disciplined inventory and expense management.

The Zacks Consensus Estimate for Gap’s current financial-year sales and EPS predicts growth of 0.8% and 41.3%, respectively. The company holds a trailing four-quarter earnings surprise of 101.2% and is also ranked Zacks Rank #1.

Amazon: Dominating with Efficient Logistics

Amazon remains an attractive option with its robust e-commerce platform known for vast product selection and efficient delivery services. Prime membership plays a significant role in driving revenue and fostering customer loyalty by offering exclusive services, including expedited shipping.

Current estimates suggest that Amazon’s financial-year sales and EPS will grow by 10.9% and 79%, respectively, compared to last year. AMZN shares a Zacks Rank #2 (Buy) and has a trailing four-quarter earnings surprise of 25.9%.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be remarkable.

From 2012 (when our Director of Research Sheraz Mian took charge) through November 2024, the Zacks Top 10 Stocks gained +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Now, Sheraz is reviewing 4,400 companies to select the best 10 stocks to buy and hold for 2025. Don’t miss the opportunity to invest in these stocks when they’re announced on January 2.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to access this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Deckers Outdoor Corporation (DECK): Free Stock Analysis Report

The Gap, Inc. (GAP): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.