The story of Super Micro Computer (NASDAQ: SMCI) is one of the most compelling narratives within the artificial intelligence (AI) sector today.

Earlier this year, Supermicro’s shares surged more than 300%. Yet, starting in August, a dramatic sell-off began, indicating a rough patch for investors.

Where should you invest $1,000 right now? Our analysts have highlighted the 10 best stocks to consider. See the 10 stocks »

In recent months, Supermicro has faced numerous challenges. However, there are signs that a recovery may be on the horizon.

Let’s examine the current situation at Supermicro, the reasons behind its stock decline, and the potential for a rebound that could benefit investors.

Recent Challenges: A Timeline of Events

Supermicro has encountered several significant setbacks in a short period. Here’s a timeline detailing the key events impacting its stock performance:

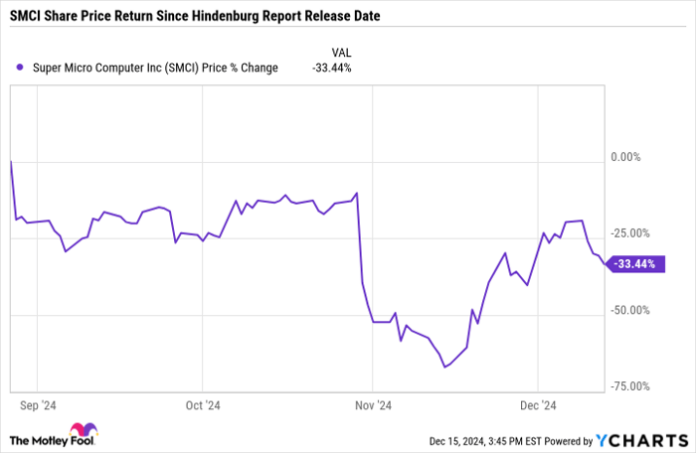

- August: Hindenburg Research released a report accusing Supermicro of accounting malpractice. This news led to a dramatic 19% drop in shares within one trading day. Shortly thereafter, Supermicro notified investors about a delay in filing its 10K annual report.

- September: Following Hindenburg’s claims, The Wall Street Journal revealed a Department of Justice (DOJ) investigation into Supermicro’s accounting practices. Consequently, Supermicro received a warning from Nasdaq about potential delisting due to compliance issues.

- October: On October 30, it was disclosed that Ernst & Young LLP, a leading accounting firm, had resigned as Supermicro’s auditor.

- November: Mid-November brought reports that Nvidia was shifting some of its Blackwell orders away from Supermicro. Supermicro produces architectural servers designed for Nvidia’s graphics processing units (GPUs), making this news particularly impactful given the anticipated success of Nvidia’s Blackwell series.

SMCI data by YCharts.

Could a Turnaround Be Near for Supermicro?

While these allegations of accounting issues are serious, it’s essential for investors to remain cautious rather than panicked. Research firms like Hindenburg have a vested interest in driving stock prices down. Despite these challenges, Supermicro is taking steps to recover.

In late November, Supermicro appointed a new auditor, BDO USA, P.C., and submitted a compliance plan to Nasdaq to avoid delisting. In early December, Nasdaq allowed Supermicro to remain listed until February 25, 2025, granted they meet filing requirements.

Recent announcements indicate that a Special Committee formed by Supermicro concluded that Ernst & Young’s resignation was not justified based on their internal review.

Taken together, these developments suggest that Supermicro could be laying the groundwork for a recovery.

Image source: Getty Images.

Is Investing in Supermicro Stock a Good Idea Now?

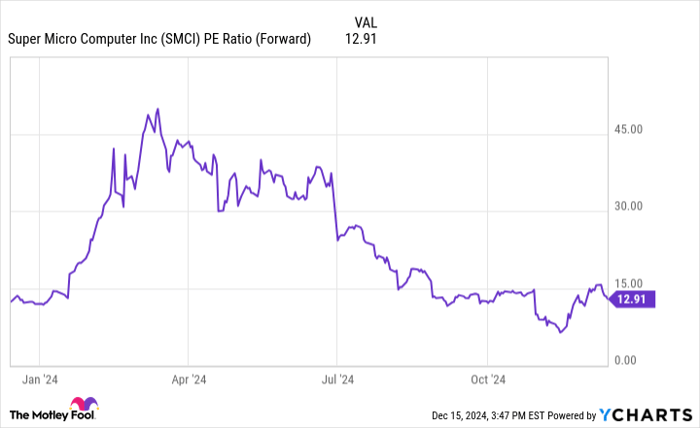

According to the chart below, Supermicro’s forward price-to-earnings (P/E) ratio stands at 12.9, significantly lower than earlier this year. This might appear as an attractive valuation, but caution is advised.

Rushing to invest could reflect a mindset that leads to losses.

SMCI PE Ratio (Forward) data by YCharts.

The situation at Supermicro is fluid; any update — positive or negative — could significantly impact stock performance. Given the uncertainties, investing in Supermicro may feel more like gambling rather than a calculated financial choice.

Should You Invest $1,000 in Super Micro Computer Now?

Before making a decision to invest in Super Micro Computer, consider this:

The Motley Fool Stock Advisor team has recently highlighted 10 best stocks to buy, which do not include Super Micro Computer. These stocks are positioned for potential significant returns in the near future.

For instance, when Nvidia was recommended on April 15, 2005, a $1,000 investment at that time would have grown to about $799,099 today!

Stock Advisor provides investors with a straightforward strategy for success, including portfolio-building guidance, regular updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.*

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

Adam Spatacco is invested in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.