Walmart Stock Soars Amid Strategic Tech Investments

Walmart WMT stock has made a remarkable comeback, rising approximately 78.7% this year. After lagging behind Amazon AMZN, Walmart’s dedicated investment in technology—spanning artificial intelligence (AI), augmented reality, and same-day delivery—has translated into record earnings and earned it the distinction of Yahoo Finance’s “Company of the Year” for 2024.

From December 2019 to December 2023, Walmart stock traded within a narrow range of $40 to $50 before climbing to $96 this year. Over the past five years, shares have soared over 133%, outperforming the Food/Drug-Retail/Wholesale Market industry.

Image Source: Zacks Investment Research

E-Commerce Expansion

Walmart has experienced significant growth in its online business. During the second quarter of fiscal 2025, global e-commerce sales increased by 21%, driven by store-fulfilled pickup and delivery options. In the U.S., e-commerce sales climbed 22%, while international sales rose 18%.

At Sam’s Club, U.S. e-commerce sales surged by 22%. The company is also broadening its third-party marketplace and investigating innovative delivery methods—like drone deliveries—to stay competitive against Amazon.

Attracting Wealthier Customers

Walmart has revamped its shopping experience, successfully appealing to higher-income shoppers and moving away from its traditional “no-frills” image. This strategy has helped increase market share and outperform competitors such as Target TGT.

Despite facing consumer headwinds and making significant tech investments, Walmart’s operating margins at Walmart U.S., Walmart International, and Sam’s Club have improved. CFO John David Rainey noted that Walmart anticipates average annual operating income growth of around 10% going forward.

Return to Shareholders

Strong cash flows have enabled Walmart to engage in shareholder-friendly initiatives. In the nine months ending October 31, Walmart spent $3 billion on stock buybacks—over three times the amount from the previous year.

Broker Opinions

Currently, Walmart has an average brokerage recommendation (ABR) of 1.25 on a scale of 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell), based on the insights of 38 brokerage firms. This compares to an ABR of 1.20 from a month ago.

Out of the 38 recommendations contributing to this ABR, 31 are categorized as Strong Buy, and four as Buy. Such ratings account for 81.58% and 10.53% of all recommendations, respectively. A month earlier, Strong Buy recommendations comprised 84.21% of the total.

Valuation Insights

Analyzing the price-to-earnings (P/E) ratio, Walmart appears to be slightly overvalued compared to the industry average. The stock is trading at a forward P/E ratio of 38.35X, above the industry’s forward P/E ratio of 27.77X.

Image Source: Zacks Investment Research

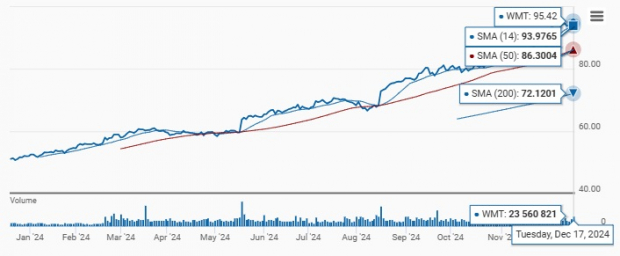

Technical Analysis of Walmart Stock

Walmart stock holds a Momentum Score of “B,” with moderate scores of “C” for Value and Growth. Price trends have shown steady growth from January to December 2024, characterized by a series of higher highs and higher lows—indicative of a classic uptrend. The upward movement of the 50-day SMA (86.3) and 200-day SMA (72.1) reinforces this positive trend.

Currently priced at $95.42, the stock remains above all key SMAs, suggesting a bullish outlook. Increased trading volumes reflect investor confidence.

The 50-day SMA (86.3) serves as a support level, where the stock price typically rebounds on pullbacks.

The current price of $95.42 could be seen as a resistance level temporarily halting upward movement. Investors may consider the stock overvalued at such prices, potentially leading to profit-taking. However, a breakout above this resistance—fueled by substantial volume—could signal a bullish trend continuation.

Image Source: Zacks Investment Research

Evaluating Walmart ETFs

Investors hesitant about Walmart’s slight overvaluation or potential price resistance may consider ETFs that focus on Walmart, such as Fidelity MSCI Consumer Staples Index ETF FSTA, Vanguard Consumer Staples ETF VDC, Consumer Staples Select Sector SPDR Fund XLP, VanEck Retail ETF RTH, and iShares U.S. Consumer Focused ETF IEDI. These ETFs can help mitigate risks tied to individual stocks.

Stay Updated on Key ETF Information

Zacks’ complimentary Fund Newsletter provides timely news and analysis, along with top-performing ETFs, each week.

Get it free >>

To receive Zacks Investment Research’s latest recommendations, you can download 5 Stocks Set to Double. Click here for the free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Consumer Staples Select Sector SPDR ETF (XLP): ETF Research Reports

VanEck Retail ETF (RTH): ETF Research Reports

Vanguard Consumer Staples ETF (VDC): ETF Research Reports

Fidelity MSCI Consumer Staples Index ETF (FSTA): ETF Research Reports

iShares U.S. Consumer Focused ETF (IEDI): ETF Research Reports

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.