Stocks Surge: Can the S&P 500 Keep the Momentum in 2025?

This year has been remarkable for stocks, as the S&P 500 confirmed a bull market back in January. Currently, all three major benchmarks are poised for double-digit annual gains. Specifically, the S&P 500 has risen 27% this year, while the Nasdaq surged 34% and the Dow Jones Industrial Average increased by 15%.

What fueled this performance? At the beginning of the year, investors were optimistic about potential interest rate cuts for the first time in four years, anticipating a stronger economy. Concurrently, excitement grew in the high-growth area of artificial intelligence (AI), prompting companies to invest heavily in AI initiatives. These factors significantly bolstered the stock market’s momentum in 2024.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy at this moment. See the 10 stocks »

However, even in a thriving market, conditions can change quickly. A significant occurrence has taken place only three times since the S&P 500 was established in the late 1950s. Could this new development hinder the S&P 500’s progress in 2025? Let’s explore.

Image source: Getty Images.

The Bull Market’s Resilience

It’s crucial to highlight that the current bull market is thriving, with the S&P 500 hitting record highs throughout the year. Growth stocks, especially, have thrived as they typically do well in a strong economy. AI stocks like Nvidia and Palantir Technologies have particularly stood out, garnering some of the highest performance in their respective indexes.

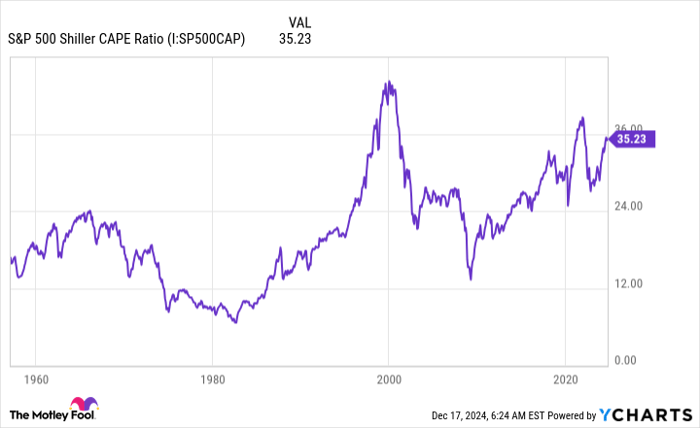

This positive momentum has pushed valuations to new heights. Notably, the S&P 500 Shiller CAPE ratio has exceeded 35 for only the third time in the past 67 years, indicating that stocks are becoming increasingly expensive. The Shiller CAPE ratio measures stock valuations using inflation-adjusted earnings-per-share over a decade.

S&P 500 Shiller CAPE Ratio data by YCharts

This ratio suggests S&P 500 stocks are at one of their highest valuation levels in history. To understand the potential implications on future gains, we can look back at prior peaks. Historically, whenever the Shiller CAPE ratio reached such heights, the S&P 500 typically experienced a downturn as valuations adjusted downward.

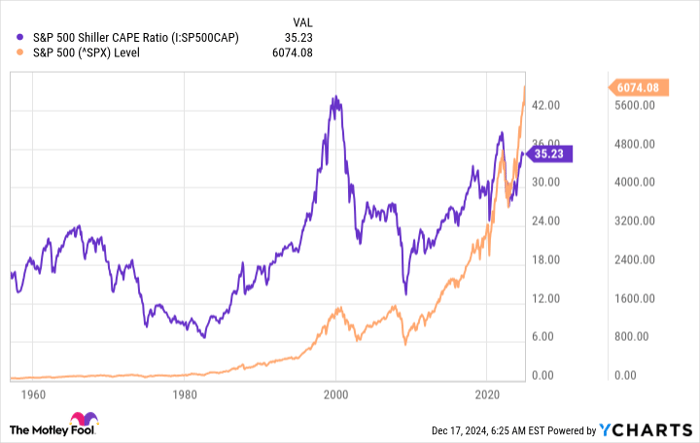

S&P 500 Shiller CAPE Ratio data by YCharts

Could the S&P 500 Decline Next Year?

Does this dynamic mean the S&P 500 is headed for a decline in 2025? Not necessarily. It’s difficult to predict the peak of valuations. They might have already peaked or could dip briefly before rising again, or they might keep climbing. Although stocks appear costly now, it doesn’t guarantee a significant drop for the S&P 500 next year. There’s still potential for substantial gains.

As an investor, it is essential to assess individual stock valuations before investing. This practice should be a routine, not just when the market seems overvalued. Regardless of the environment, bargains exist among stocks, making it a prime opportunity to invest wisely.

Identifying Reasonably Priced Stocks

For example, even within the rapidly growing AI sector, some stocks remain fairly priced. Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is currently trading at just 24 times its forward earnings estimates, with its cloud services division reporting robust growth. Additionally, Meta Platforms (NASDAQ: META) is also reasonably priced at 27 times forward earnings estimates.

While history suggests that there will eventually be a market correction, it doesn’t imply an imminent decline for the index next year. Not all stocks are overpriced, which presents a favorable environment to invest further. By focusing on quality investments at reasonable prices, an investor could see growth not just in 2025 but also over the long term.

Seize the Opportunity for Growth

If you’ve ever felt like you missed out on major growth stocks, now might be your chance.

Occasionally, our expert analysts recommend a “Double Down” stock – these companies are poised for significant rebounds. If you’re concerned about missing out, now is an ideal time to invest before opportunities vanish. The numbers reveal potential for impressive returns:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $338,103!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $48,005!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $495,679!*

Currently, we’re issuing “Double Down” alerts for three promising companies, and this could be a limited-time opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Randi Zuckerberg, a former market development director at Facebook and sister of its CEO, is also on The Motley Fool’s board. Adria Cimino has no investments in the mentioned stocks. The Motley Fool holds positions in and recommends Alphabet, Meta Platforms, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

The views expressed belong to the author and do not reflect those of Nasdaq, Inc.