Strong Earnings Growth Expected for S&P 500 in Q4 2024

Note: This excerpt is from this week’s Earnings Trends report. For a complete analysis, including detailed historical data and future estimates, click here>>>

Key Highlights:

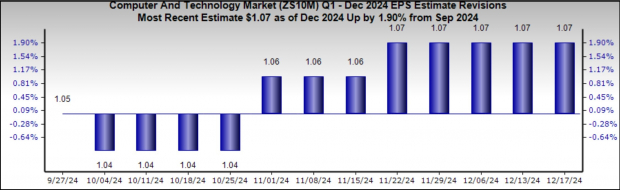

- For Q4 2024, total S&P 500 earnings are projected to rise by +7.4% compared to Q4 2023, driven by a +4.8% increase in revenues.

- Removing the Energy sector’s negative impact, earnings growth improves to +9.5%. However, without the substantial input from the Tech sector, the growth rate drops to +4.0%.

- Since the start of the quarter, earnings estimates have been revised down from +9.8% in early October to the current +7.4% growth rate.

- For the ‘Magnificent 7’ companies, Q4 earnings are expected to be up +20.7% year-over-year, with revenues also rising by +12.3%. Excluding these companies, the remaining index shows only a +3.4% earnings growth.

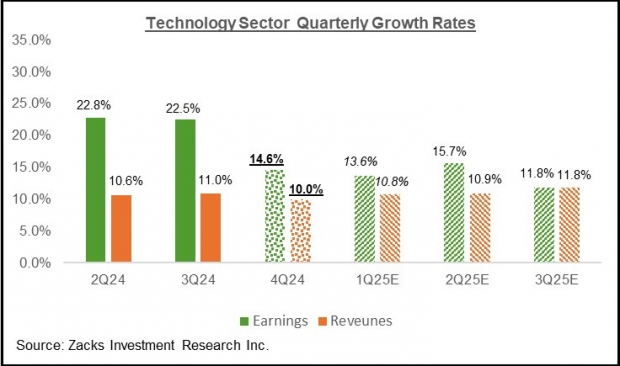

Technology Sector Leading the Charge

The Tech sector continues to be a vital force behind earnings growth, with expectations for Q4 reflecting a +14.6% increase from the prior year, along with a +10% revenue boost. This marks the sixth consecutive quarter of double-digit earnings growth for Tech companies.

This performance builds on the previous quarter’s impressive +22.5% earnings growth and +11% revenue rise in Q3 2024. The outlook suggests that Tech will maintain its upward trajectory in the upcoming quarters.

Image Source: Zacks Investment Research

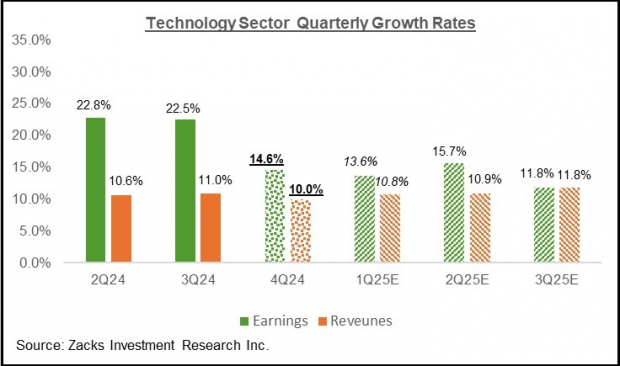

The Tech sector’s strong growth is complemented by an improving earnings outlook, reflected in ongoing positive revisions for both Q4 and the full year 2025. Significant players like Nvidia NVDA and Meta Platforms META have also seen upward adjustments in their earnings estimates. The current Zacks Consensus EPS estimate for Nvidia is 84 cents, up from 78 cents two months prior, while Meta’s estimate rose by +7.1% to $6.76 over the same period.

Image Source: Zacks Investment Research

The Overall Earnings Landscape

A closer look at the earnings projections for Q4 2024 reveals an evolution from previous quarters, showing both achievements and expectations for the next few quarters.

Image Source: Zacks Investment Research

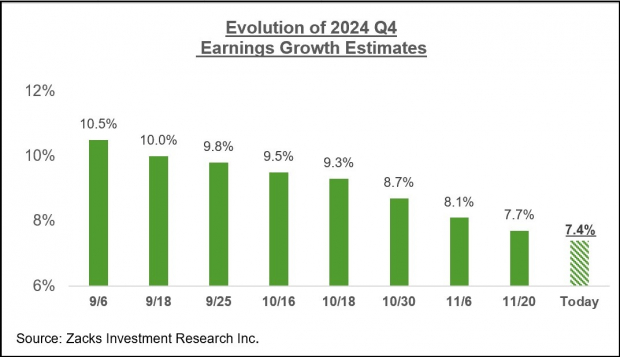

While estimates for Q4 2024 have been trimmed since the beginning of the quarter, the extent of these downward revisions is less severe than what was seen in the prior quarter. This trend is illustrated in the following charts tracking recent changes in Q4 estimates.

Image Source: Zacks Investment Research

On an annual basis, the outlook for earnings remains robust.

Image Source: Zacks Investment Research

Projected earnings indicate double-digit growth for the next two years, with a significant increase in the number of sectors expected to show strong performance. For context, Tech sector earnings are forecasted to grow by +17.4% in 2025, following a +19.8% growth rate in 2024. Excluding Tech, earnings for the S&P 500 are still set to rise by +12.3% in 2025, with nine out of 16 Zacks sectors anticipated to post double-digit growth.

Discover Profitable Opportunities in Nuclear Energy

Electricity demand is surging, while the world pivots away from fossil fuels like oil and gas. Nuclear energy stands out as a promising alternative.

A coalition of leaders from the US and 21 other countries recently pledged to triple global nuclear energy capacities, presenting substantial profit potential for nuclear-related stocks and early investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, sheds light on key players and technologies in this space, including three standout stocks poised for growth. Download it free today.

For the latest stock recommendations from Zacks Investment Research, you can also access the report on “5 Stocks Set to Double.” Sign up to receive this free report.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

For the full article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.