Analyst Projections: Franklin U.S. Equity Index ETF Shows Potential Growth

ETF Channel’s analysis reveals that the Franklin U.S. Equity Index ETF (Symbol: USPX) is priced at $51.56, suggesting it has room to grow based on analysts’ target estimates.

Implied Target Prices Indicate Positive Upside

By evaluating the ETF’s underlying holdings, we determined that analysts forecast an average target price of $58.28 per unit for USPX. This anticipated target offers a potential upside of 13.03% compared to its current trading price.

Key Stocks with Significant Upside Potential

Several underlying holdings of USPX stand out for their projected growth relative to their recent market prices. Intel Corp (Symbol: INTC) currently trades at $19.30, but analysts expect its average target to reach $26.34, a notable 36.46% rise. Booz Allen Hamilton Holding Corp. (Symbol: BAH) is presently at $133.37, with an estimated target of $178.30, reflecting a potential gain of 33.69%. Meanwhile, CDW Corp (Symbol: CDW) is priced at $171.49, while forecasts project it could hit $227.64, indicating a 32.74% increase.

Performance Overview of Selected Stocks

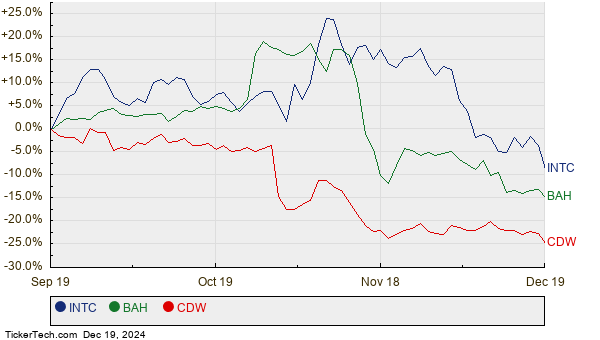

The following chart illustrates the recent price movements of INTC, BAH, and CDW:

Current Analyst Assessment Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Franklin U.S. Equity Index ETF | USPX | $51.56 | $58.28 | 13.03% |

| Intel Corp | INTC | $19.30 | $26.34 | 36.46% |

| Booz Allen Hamilton Holding Corp. | BAH | $133.37 | $178.30 | 33.69% |

| CDW Corp | CDW | $171.49 | $227.64 | 32.74% |

Evaluating Analyst Optimism

The questions arise: Are these targets supported by current market trends, or might they fall short in the light of recent developments? High price targets can indicate positive outlooks, but they may also lead to adjustments if they do not align with the evolving market landscape. Investors should delve deeply into these dynamics before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

– Cheap Growth Stocks

– IACC shares outstanding history

– Funds Holding ORGS

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.