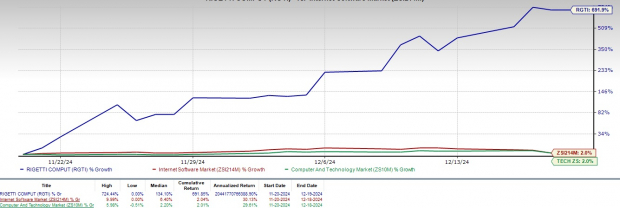

Rigetti Computing Reports Incredible 691.9% Surge in Share Prices

In the last month, Rigetti Computing (RGTI) shares have seen a remarkable increase of 691.9%. This performance dwarfs the Zacks Internet – Software industry, which only rose by 2%, along with the broader Zacks Computer & Technology sector, also at 2%.

RGTI has surpassed competitors International Business Machines (IBM) and Microsoft (MSFT), who have both seen smaller gains of 34.6% and 16.5%, respectively, over the same period.

The company’s recent success can be linked to its growing customer base and expanding presence in the quantum computing industry.

Year-to-Date Performance Update

Image Source: Zacks Investment Research

Strategic Partnerships Fuel Rigetti’s Growth

RGTI owes much of its success to strategic partnerships with Riverlane, NVIDIA (NVDA), and Quantum Machines. These collaborations have established Rigetti as a notable player in the rapidly advancing quantum computing field.

Recently, Rigetti announced a significant achievement through its partnership with Quantum Machines. They successfully applied artificial intelligence to automate the calibration of the 9-qubit Novera QPU. Utilizing NVIDIA’s DGX Quantum, the team secured high gate fidelities, marking a pivotal moment in quantum computing efficiency.

An important collaboration with Riverlane involves developing quantum error correction technology, essential for enhancing the reliability of quantum systems—one of the main challenges in scaling quantum computing.

In October, Rigetti and Riverlane showcased real-time, low-latency quantum error correction on Rigetti’s 84-qubit Ankaa-2 system. This success helped reduce decoding times, which is vital for maintaining fault tolerance in quantum computing.

Rigetti’s Pioneering Advancements in Quantum Computing

The company’s innovation in quantum technology is central to driving its recent success.

During the third quarter of 2024, RGTI made strides, particularly with its multi-chip architecture designed for scaling qubit systems. This advancement places Rigetti at the forefront of the quantum computing industry, strengthening its operational capabilities.

Continuing this upward trajectory, Rigetti successfully demonstrated 9-qubit chips with an impressive 99.4% median 2-qubit gate fidelity and has outlined plans to launch a 36-qubit system by mid-2025. Such hardware developments are crucial for the company’s future prospects.

In a significant step forward, Rigetti’s 24-qubit Ankaa system became operational at the recently inaugurated U.K. National Quantum Computing Centre. This facility is now open for testing and exploration, further expanding Rigetti’s role in the field.

As the landscape of quantum computing evolves, RGTI is in a favorable position to reap the rewards of market growth, with projections from Grand View Research estimating a 20.1% compound annual growth rate (CAGR) for the quantum computing sector from 2024 to 2030.

Challenges Facing Rigetti in the Quantum Market

Despite its advancements, Rigetti is encountering difficulties in the quantum computing marketplace.

The company reported a decrease in revenue to $2.4 million for the third quarter of 2024, down from $3.1 million a year earlier. This decline is largely attributed to inconsistencies in contract deliverables, especially involving government clients, which has led to fluctuating revenue streams.

Gross margins also took a hit, falling to 51% in the third quarter of 2024, down from 73% a year prior. This drop is partially due to a contract involving a 24-qubit quantum system, which had a different gross margin structure compared to other revenue sources.

Earnings Estimates for RGTI Indicate a Steady Trend

The Zacks Consensus Estimate for RGTI’s fourth-quarter revenues stands at $2.40 million, which reflects a decline of 28.99% year-over-year.

The consensus prediction indicates a loss of 8 cents per share, with no change in estimates over the past month.

Rigetti Computing, Inc. Price and Consensus

Rigetti Computing, Inc. price-consensus-chart | Rigetti Computing, Inc. Quote

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

Investment Outlook: Buy, Sell or Hold RGTI?

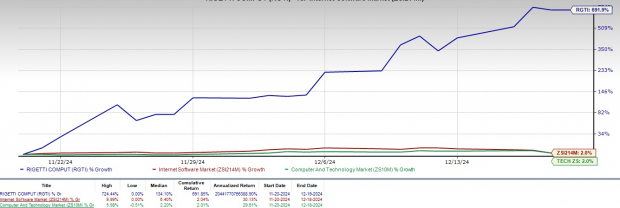

RGTI shares might not be a bargain, as indicated by their Value Score of F.

The forward 12-month Price/Sales ratio stands at 135.46X, significantly higher than the sector average of 6.35X.

Price/Sales (F12M) Comparison

Image Source: Zacks Investment Research

Currently, Rigetti holds a Zacks Rank #3 (Hold), which suggests that investors should consider waiting for a more attractive entry point. A complete list of today’s Zacks #1 Rank (Strong Buy) stocks can be found here.

Zacks Features Top 10 Stocks for 2025

Interested in insights on the top 10 stock picks for 2025?

Past performance indicates potential for exceptional returns.

Since 2012, under the guidance of Director of Research Sheraz Mian, the Zacks Top 10 Stocks portfolio has seen gains of +2,112.6%, outperforming the S&P 500’s +475.6%. Sheraz is currently analyzing 4,400 companies to identify the top 10 stocks to buy and hold for 2025. Don’t miss the opportunity to get in on these picks when they are unveiled on January 2.

Stay updated with the latest recommendations from Zacks Investment Research. Today, download the report on 5 Stocks Set to Double.

Microsoft Corporation (MSFT): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.