Merck’s Stock Faces Challenges but Shows Potential for Recovery

Shares of Merck & Co., Inc. MRK are trading flat on Thursday, despite being in a downtrend.

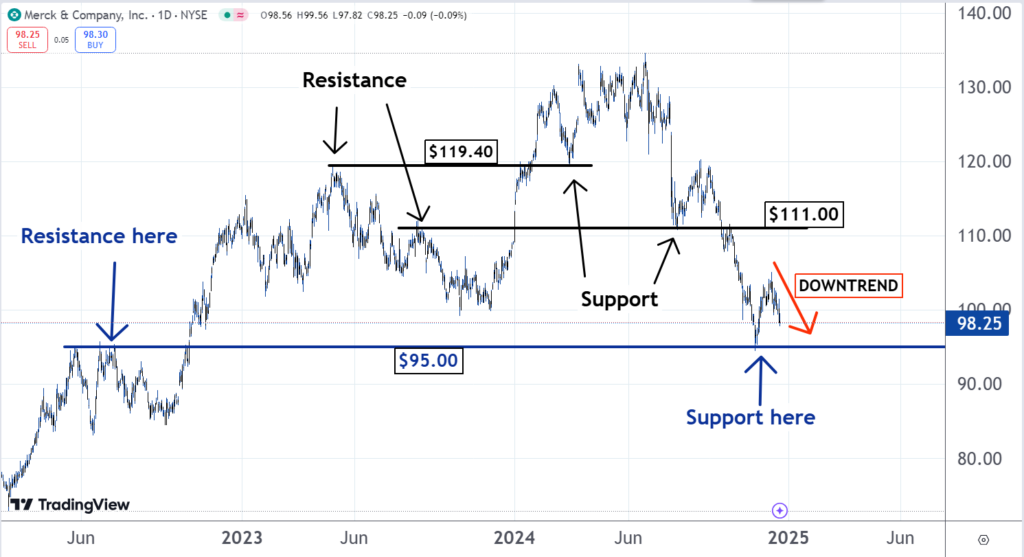

Price Levels and Stock Support

Should the stock price approach $95.00, analysts believe that a reversal is likely, potentially leading to a price increase. This pattern was evident in late November, when the stock rallied after hitting a similar price level. This compelling action has prompted the technical analysis team to designate Merck as the Stock of the Day.

Recent Developments at Merck

Merck has been making headlines recently. Notably, Personalis, Inc. PSNL announced a $50 million equity investment from Merck, which will secure a 16.5% ownership stake upon completion of the deal.

Additionally, Merck is venturing into the obesity market by licensing rights from Chinese biotech firm Hansoh Pharmaceutical Group Company Limited HNSPF for an investigational oral GLP-1 receptor product.

Understanding Resistance and Support in Stock Trading

Merck’s stock chart illustrates key concepts in technical analysis. Resistance levels can transform into support levels. When stocks decline to established support levels, they often experience rallies.

For example, $119.40 was a resistance level in May 2023. Investors who sold their shares at that time may have felt satisfied when the price dropped afterward, believing they had made a wise decision.

However, in January 2024, the stock broke through this resistance, moving higher, which led some investors to reconsider their choices and seek to repurchase shares at the price they previously sold.

When the stock returned to approximately $119.40 in March 2024, a significant number of buy orders emerged, establishing support at what was once a resistance level.

This behavior was mirrored at the $111.00 level, where the price acted as resistance in August 2023 and then shifted to support by August 2024.

Similarly, the $95.00 level previously served as resistance in July 2022, was converted to support last month, and could play the same role again if Merck reaches it.

Potential for a Price Rally

Historically, stocks often rally after bouncing off support levels. Buyers who helped create that support may fear being outbid. If another buyer offers a higher price, initial buyers will increase their bids as well.

This can create a momentum effect, raising stock prices even further, an outcome that may be on the horizon for Merck.

What’s Next for Merck?

Read Next:

Image: Courtesy of Merck.

Market News and Data brought to you by Benzinga APIs