Progress Software Sees Stock Surge with Promising Growth Prospects

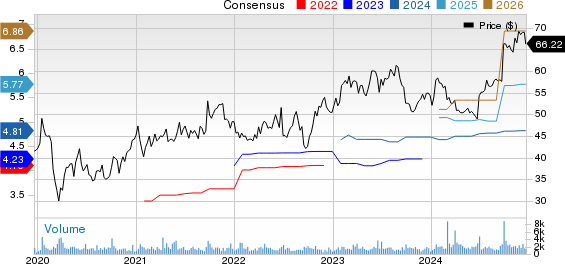

Progress Software’s shares (PRGS) have soared by 37.4% over the last six months, significantly outpacing the Zacks Computer & Technology sector’s modest increase of 4.7% and the Zacks Computer – Software industry’s growth of 3.5%.

During this period, PRGS has outperformed notable competitors such as ANSYS (ANSS), Cadence Design Systems (CDNS), and Microsoft (MSFT). While ANSYS saw a decline of 2.5%, Microsoft and Cadence Design Systems experienced losses of 1.9% and 5.4%, respectively.

The impressive stock performance is driven by a rising demand for its AI-powered infrastructure software and a commitment to high-value recurring revenue streams that bolster financial stability.

PRGS Shows Strong Market Position

Progress Software boasts a robust data platform featuring MarkLogic, Semaphore, and OpenEdge, which provide data management, analytics, and application solutions that foster growth across various sectors.

The company’s expansion is largely fueled by its key offerings, including DevTools, Sitefinity, LoadMaster, Flowmon, Telerik, and MOVEit. Increased adoption of these products has played a significant role in driving overall performance.

Recently, Progress Software launched the Q4 2024 release for Telerik and Kendo UI, which features advanced design-to-code tools and capability support for .NET 9 and Angular 19.

Also notable is the recent acquisition of ShareFile, an AI-driven platform designed for content collaboration and workflow automation, enhancing efficiency in document sharing.

Impressive Q3 Results Bolster Confidence in PRGS Stock

In its third quarter, Progress Software reported revenues of $179 million, surpassing its guidance of $174-$178 million. Earnings per share (EPS) stood at $1.26, exceeding the anticipated range of $1.11-$1.15.

The company demonstrated financial strength with a non-GAAP operating margin of 41%, which reflects a 200 basis point year-over-year increase. This improvement showcases effective expense management and operational efficiency.

Progress Software’s reduction in days sales outstanding from 49 to 45 days indicates enhanced efficiency in revenue collection and stronger cash flow management.

Additionally, the company achieved a net customer retention rate of 99% in the third quarter, indicating a solid ability to retain clients and maintain consistent value delivery, which is crucial for stability and growth.

Positive Outlook Ahead for Progress Software

Looking ahead to the fourth quarter of 2024, Progress Software anticipates non-GAAP revenues in the range of $207 million to $217 million.

The Zacks Consensus Estimate for Q4 2024 revenues is currently at $211.34 million, signaling a potential year-over-year growth of 19.05%.

The company projects non-GAAP earnings between $1.15 and $1.25 per share, with analysts estimating earnings of $1.21 per share, reflecting an 18.63% increase from last year.

For the full year of 2024, non-GAAP revenues are expected to fall between $745 million and $755 million, with the Zacks Consensus Estimate at $749.79 million, indicating a growth of 7.40% from the prior year.

PRGS expects non-GAAP earnings to range from $4.75 to $4.85 per share, aligning with the estimate of $4.81 per share from analysts, which reflects a year-over-year growth of 10.57%.

Current Zacks Ranking for PRGS

Currently, PRGS holds a Zacks Rank #3 (Hold), suggesting that investors may want to wait for a more opportunistic entry point into the stock.

For those interested, you can find the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Reveals Top 10 Stocks for 2025

Looking for early insights on our top 10 stock picks for 2025?

History indicates their performance could be exceptional.

Since 2012, under the leadership of Sheraz Mian, the Zacks Top 10 Stocks have returned +2,112.6%, outperforming the S&P 500’s +475.6%. Sheraz is now selecting the best 10 stocks to hold for 2025, with the release expected on January 2.

Don’t miss your chance to get in on these stocks!

For the latest recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double. Click to get this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Progress Software Corporation (PRGS): Free Stock Analysis Report

ANSYS, Inc. (ANSS): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.