Super Micro Computer: A Rollercoaster Ride in 2024 and Its Outlook for 2025

Super Micro Computer (NASDAQ: SMCI) started 2024 with astonishing growth, climbing over 300% by March. However, a series of setbacks including missed performance targets and allegations of accounting fraud led to a steep decline in the second half of the year. Thankfully for the company, investigations seem to have cleared it of these allegations, positioning Supermicro for potential gains in 2025.

Start Your Mornings Smarter! Wake up with Breakfast News in your inbox every market day. Sign Up For Free »

Solid Foundations: Supermicro’s Business Model Holds Strong

Let’s review Supermicro’s journey as it entered 2024. The company produces components for computing servers and assembles complete technology racks. Demand for their products surged alongside rising spending in artificial intelligence (AI). This upswing was reminiscent of the success seen by Nvidia (NASDAQ: NVDA).

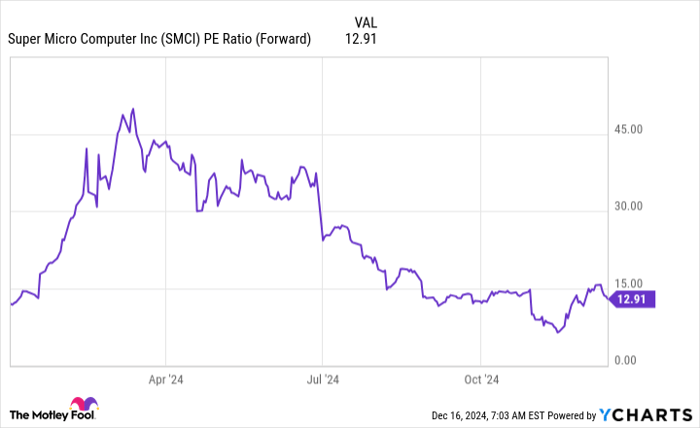

Entering 2024, Supermicro’s stock was attractively priced at just 12 times its forward earnings, allowing room for growth based on valuations alone. The company initially met growth expectations, which fueled a stock price surge. However, issues began to arise as profit margins shrank and investors grew wary of a high valuation.

Nonetheless, it was the accounting fraud allegations that really rattled investors.

When short-seller Hindenburg Research released a report accusing Supermicro of accounting fraud and the company postponed its year-end report, the stock plummeted. Compounding this situation, Supermicro’s auditor resigned, citing mistrust in the information provided by management.

Initially, many believed this indicated serious internal issues; however, a subsequent investigation by a special committee, assisted by a forensic accounting firm, found no wrongdoing. This investigation recommended changing the chief financial officer, which is underway. Following the positive news, Supermicro’s stock rebounded, regaining its footing as it heads into 2025.

Valuation Metrics Remain Steady as 2025 Approaches

Currently, Supermicro’s stock trades at 12.9 times forward earnings, nearly matching its valuation at the start of 2024.

SMCI PE Ratio (Forward) data by YCharts

The demand for AI computing servers continues to be a major factor driving interest in the company. Additionally, Supermicro’s liquid-cooled technology offers better efficiency than its competitors’ air-cooled systems, providing up to 40% energy savings and 80% reduction in space, thus cutting down server room costs significantly.

Wall Street predicts impressive growth for fiscal year 2025, with revenues expected to increase by almost 70%. Yet, will this be enough to draw back investors burned by past controversies? The short answer is unlikely.

Many investors, especially institutional players, often avoid companies implicated in accounting scandals for years, regardless of the outcomes of investigations. With numerous attractive investment alternatives available, it’s probable that Supermicro will face challenges in recreating its 2024 success during 2025.

Catch This Second Chance for a Potential Investment Opportunity

Have you ever wished you had been quicker to buy into successful stocks? This may be your moment.

Our team of expert analysts occasionally identifies “Double Down” stock recommendations for companies they believe are on the verge of significant growth. If you’re concerned about missing your chance, now might be the ideal time to invest before opportunities slip away. The track records are compelling:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you’d now have $334,266!*

- Apple: A $1,000 investment when we doubled down in 2008 would be worth $46,976!*

- Netflix: A $1,000 investment from our 2004 recommendation would have grown to $479,727!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and you may not have another chance like this soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.