New Options Open Up for Dave & Buster’s Investors

Investors in Dave & Busters Entertainment Inc (Symbol: PLAY) have new options to consider this week, with contracts expiring in February 2025. Stock Options Channel has analyzed the options chain and pinpointed one put and one call contract that stand out.

Put Option: Opportunity with a Discount

The put contract at a $27.00 strike price is currently bid at $2.30. By selling to open this put contract, an investor agrees to buy the stock at $27.00, but they also earn the premium, which effectively reduces their cost basis to $24.70 (excluding broker fees). For investors keen on acquiring shares of PLAY, this approach could be a more appealing choice compared to the current market price of $27.77 per share.

The $27.00 strike price offers about a 3% discount from the stock’s current trading level, meaning that it is slightly “out-of-the-money.” Analytical data indicates a 59% chance that this put contract could expire worthless. Stock Options Channel will monitor these odds over time and update them on their website. If the contract does expire worthless, the premium could yield an 8.52% return on the cash commitment, or 49.35% annualized—referred to as the YieldBoost.

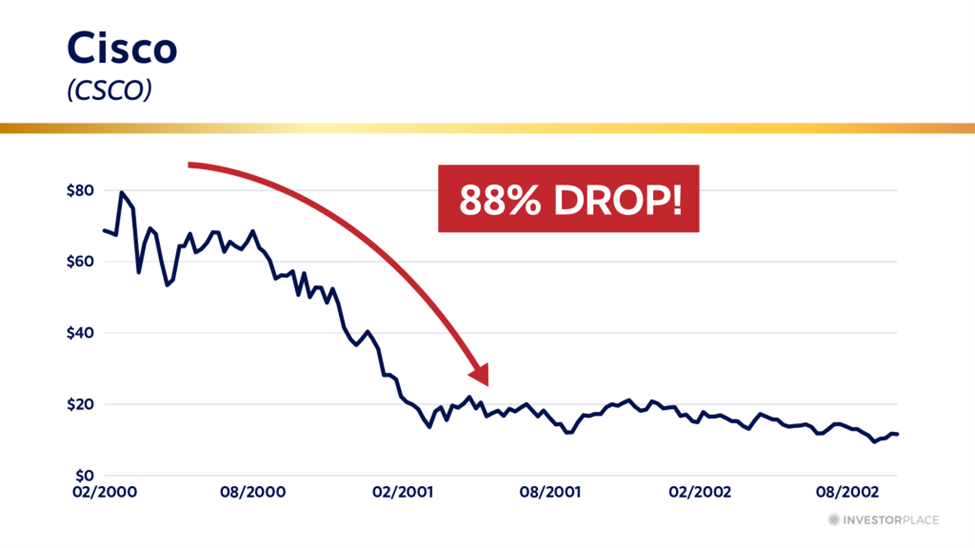

Below is a chart displaying the trailing twelve-month trading history for Dave & Buster’s, highlighting the position of the $27.00 strike:

Call Option: Potential for Gain

On the calls side, there’s also a contract at a $28.00 strike price with a current bid of $2.55. If an investor buys shares of PLAY at $27.77 and sells this call as a “covered call,” they commit to selling the stock at $28.00. Including the premium collected, this strategy offers a total return of 10.01% if the stock is called away at the February 2025 expiration (before broker fees). Investors should consider the potential upside if PLAY shares rise significantly, making it essential to review the trading history and business fundamentals.

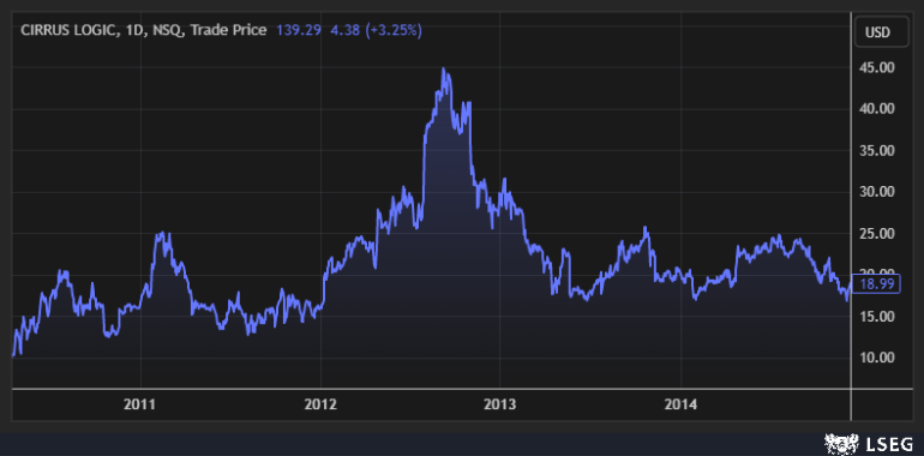

The chart below shows the trailing twelve-month trading history for Dave & Buster’s, with the $28.00 strike marked:

The $28.00 strike is approximately 1% above the current trading price, indicating it is also slightly “out-of-the-money.” There is a possibility that this covered call contract could expire worthless, allowing the investor to retain both the stock and the premium earned. Current data suggests a 47% chance of this occurrence. Stock Options Channel will also track this information over time on their website. Should the covered call end up worthless, the premium offers an additional 9.18% return, or 53.20% annualized—a YieldBoost opportunity.

The implied volatility for the put contract is 61%, while the call’s implied volatility stands at 63%. In comparison, the actual trailing twelve-month volatility, based on the last 251 trading day closing values and today’s price of $27.77, is 56%. For more ideas regarding put and call options contracts, visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also see:

- TALS market cap history

- TG Videos

- FFWM Split History

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.