The AI Boom: A Look at Two Promising Semiconductor Stocks

In recent years, artificial intelligence (AI) has transformed into a significant growth industry. The global AI market, valued at $93 billion in 2020, is projected to reach $244 billion by 2025.

This rapid growth is spurring increased demand for semiconductors, the vital components that power AI systems. These chips ensure efficient energy consumption in data centers and provide the necessary processing power for AI tasks. Therefore, investing in semiconductor stocks represents a compelling way to benefit from the expanding AI landscape.

Start Your Mornings Smarter! Receive Breakfast news in your inbox every market day. Sign Up For Free »

Two notable semiconductor companies to consider are Wolfspeed (NYSE: WOLF) and Advanced Micro Devices (NASDAQ: AMD). Wolfspeed specializes in silicon carbide (SiC) products for power applications, while AMD focuses on advanced semiconductor chips designed for AI.

Despite facing share price declines this year as of December 16, both companies may present attractive buying opportunities. Below, we will analyze each company’s prospects as potential long-term AI investments.

Wolfspeed’s Innovations in AI Technology

Operating AI systems can cost millions, particularly in energy. This is where Wolfspeed’s silicon carbide (SiC) products come into play.

SiC technology provides increased efficiency, while reducing the size and weight compared to traditional silicon power devices. As the demand for AI continues to grow, the need for silicon carbide products is expected to rise sharply.

Wolfspeed forecasts that growth in the SiC market could generate $3 billion in annual sales, a significant increase from the $807.2 million reported for the 2024 fiscal year, ending June 30.

To meet the rising demand, Wolfspeed is expanding its SiC manufacturing capabilities, particularly at its newly developed facility in Mohawk Valley, New York. This facility, which opened in 2022, is already boosting the company’s revenue streams.

In the first quarter of fiscal 2025, which ended on September 29, the Mohawk Valley facility contributed $49 million out of a total revenue of $194.7 million. This marks a substantial increase from just $4 million from the prior year.

Nonetheless, increasing production has come at a high cost. In the first quarter, while generating $194.7 million in sales, Wolfspeed incurred a revenue cost of $230.9 million, resulting in a net loss of $282.2 million.

To counter these challenges, the company aims to reduce its capital expenditures (capex) in fiscal 2025 by 43%, compared to $2.1 billion in fiscal 2024. Additionally, the resignation of the CEO in November adds another layer of uncertainty.

AMD’s Strategic Positioning in the AI Sector

AMD anticipates significant sales growth, driven by what CEO Lisa Su describes as an “insatiable demand for more compute.” She references the increasing need for processing power in AI applications.

Focusing on accelerated computing, AMD uses specialized hardware to perform demanding tasks, including the extensive data analysis required for AI.

The company offers components like graphics processing units (GPUs) and accelerators, which support efficient AI functioning. Consequently, AMD has experienced remarkable growth in its data center revenue.

In its fiscal Q3, ending September 28, AMD saw data center revenue skyrocket by 122% year over year to a record $3.5 billion. This helped the company achieve total Q3 sales of $6.8 billion, an 18% increase from last year, while net income rose 158% to $771 million.

Conversely, sales in the once-prominent gaming segment fell 69% year over year to $462 million, offsetting some of AMD’s growth in its data center business.

Comparing Investment Potential of Wolfspeed and AMD

When deciding between investing in Wolfspeed or AMD, it’s crucial to consider the potential impact of U.S. government tariffs and export restrictions on semiconductor products. Such measures could influence sales across the semiconductor industry and exert downward pressure on stock prices.

Nonetheless, the technologies offered by Wolfspeed and AMD remain in high demand, positioning both companies for potential long-term growth as AI continues to advance. Their innovative offerings suggest that stock prices could rebound from recent declines.

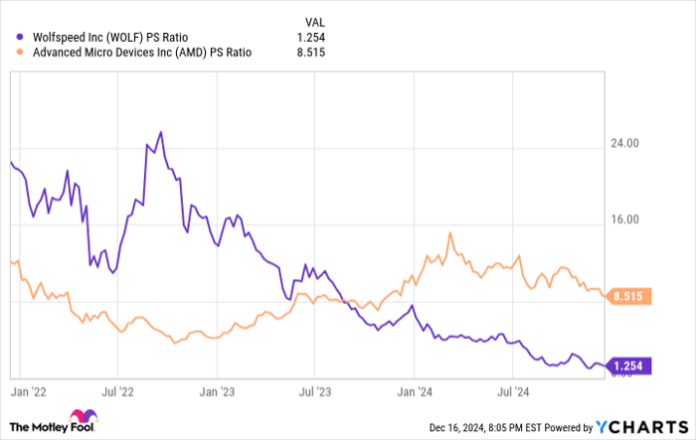

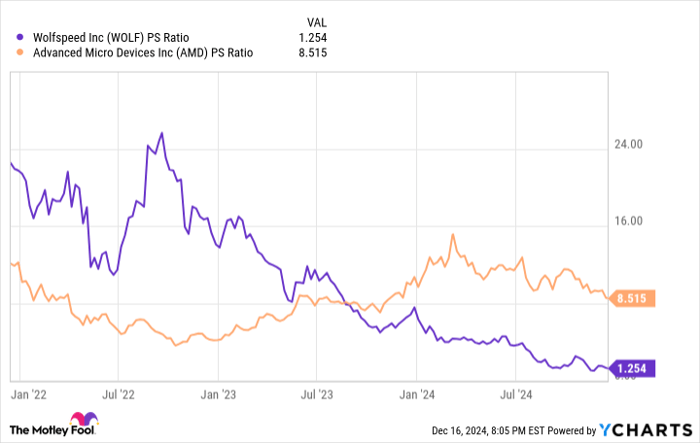

Stock valuation also plays a significant role in decision-making. Below is a comparison of the price-to-sales (P/S) ratio for both companies, which reflects how much investors are willing to pay for every dollar of sales.

Data by YCharts.

The chart indicates that Wolfspeed’s P/S ratio is lower than AMD’s and is at a low point not seen in years. This suggests that Wolfspeed’s stock may offer better value compared to AMD.

However, Wolfspeed faces considerable challenges, including substantial operating costs, ongoing losses, and management changes. Investors with a low risk tolerance might want to be cautious when considering Wolfspeed shares.

Given these factors, AMD emerges as the preferred long-term investment option among these two semiconductor leaders for exposure to the AI market.

Seizing a Potentially Lucrative Opportunity

Have you ever felt you missed out on purchasing high-performing stocks? If so, you might find this information compelling.

Occasionally, our team of expert analysts identifies “Double Down” stock recommendations for companies they believe are poised for significant growth. If you’re concerned about having missed your chance to invest, now could be the perfect time to take action before it’s too late. The numbers speak volumes:

- Nvidia: Investing $1,000 when we doubled down in 2009 would have grown to $338,855!*

- Apple: Investing $1,000 when we doubled down in 2008 would now be worth $47,306!*

- Netflix: A $1,000 investment made when we doubled down in 2004 would have reached $486,462!*

At this moment, “Double Down” alerts are being issued for three exceptional companies, and opportunities like these are rare.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Robert Izquierdo holds shares in Advanced Micro Devices. The Motley Fool has positions in and recommends Advanced Micro Devices and Wolfspeed. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.