Rexford Industrial Realty: A Strong Dividend Play Amid Market Shifts

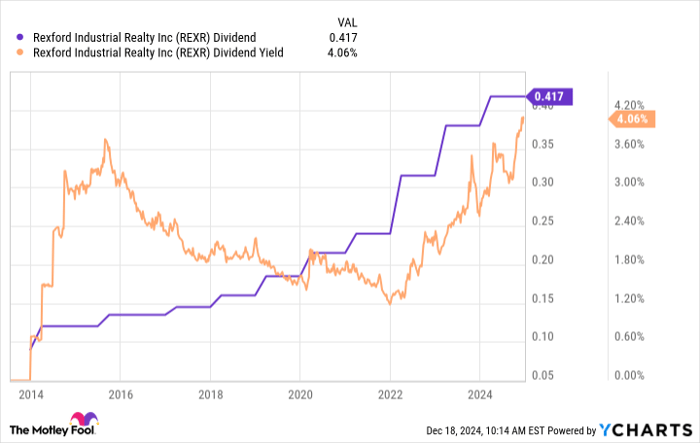

Shares of Rexford Industrial Realty (NYSE: REXR) experienced a significant upswing as the economy rebounded from the pandemic, driven by a surge in warehouse demand. However, with investor attention shifting to emerging stories like artificial intelligence (AI), the stock has depreciated by nearly 50% since its peak in 2022. Nonetheless, its current dividend yield stands at a tempting 4.1%.

Start Your Mornings Smarter! Receive Breakfast news in your inbox every market day. Sign Up For Free »

Let’s explore why Rexford should be a consideration for long-term income investors.

Understanding Rexford Industrial’s Business Model

Rexford operates as a real estate investment trust (REIT), focusing solely on purchasing and leasing out industrial properties. The company’s niche is particularly pronounced, as it concentrates exclusively on industrial assets within Southern California, distinguishing it from many peers who diversify their portfolios geographically.

This focused approach carries inherent risks; any downturn in Southern California’s industrial market could severely impact the company. Yet, it is balanced by several favorable conditions.

Southern California boasts the largest industrial market in the United States, acting as a primary entry point for goods from Asia. While vacancy rates have begun to climb since 2023, they remain below the national average for industrial properties. Factors that support the region’s strong market include tight supply due to land scarcity and the conversion of industrial spaces for other uses, particularly housing. Rexford’s expertise in property redevelopment makes it a competitive player in enhancing existing assets without increasing overall supply.

Image source: Getty Images.

Overall, Southern California continues to be a highly attractive market for industrial assets, promising stability in a fluctuating economy.

Current Performance of Rexford Industrial

Following the heightened demand for industrial properties post-COVID, Rexford experienced significant rent increases. Although demand has softened recently, leading to a slight decline in occupancy within Southern California, the sell-off of Rexford’s stock is not indicative of severe underlying problems.

In mid-November 2024, Rexford released key stats, revealing occupancy rates at 95.9%. This figure is robust, though lower than at the peak of demand. Furthermore, the average rental increases for new and renewed leases during the initial half of the fourth quarter saw rates 80% above expired leases, with annual rent increases averaging 3.9%. These metrics predict continued earnings growth.

REXR Dividend data by YCharts

Additionally, Rexford anticipates around $450 million in capital projects aimed at further enhancing existing properties, which will likely lead to additional rental increases over time. This redevelopment backlog is expected to sustain efforts through 2027.

Reasons to Consider Rexford Industrial Now

Rexford remains positioned as a solid industrial REIT, but the real draw is its 4.1% dividend yield, one of its highest ever. Despite being perceived as undervalued due to broader market concerns regarding industrial real estate, Rexford’s strong regional focus and performance are promising.

For income-focused investors with a long-term perspective, this REIT merits consideration.

Should You Invest $1,000 in Rexford Industrial Realty Now?

Before making any investments in Rexford Industrial Realty, it’s essential to weigh your options.

The Motley Fool Stock Advisor team has highlighted the 10 best stocks for investors to consider now, and surprisingly, Rexford was not included. Each of these top picks has the potential to deliver substantial returns in the coming years.

Just consider that when Nvidia was listed on April 15, 2005, a $1,000 investment would have grown to $800,876 today!*

Stock Advisor offers investors a straightforward roadmap to success, featuring portfolio-building guidance, continuous analyst updates, and two fresh stock recommendations each month. The service has more than quadrupled the S&P 500’s return since its inception in 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Rexford Industrial Realty. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.